This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Rakuten, AES Prices $ Bonds; ISM Services Softer than Expected

December 5, 2024

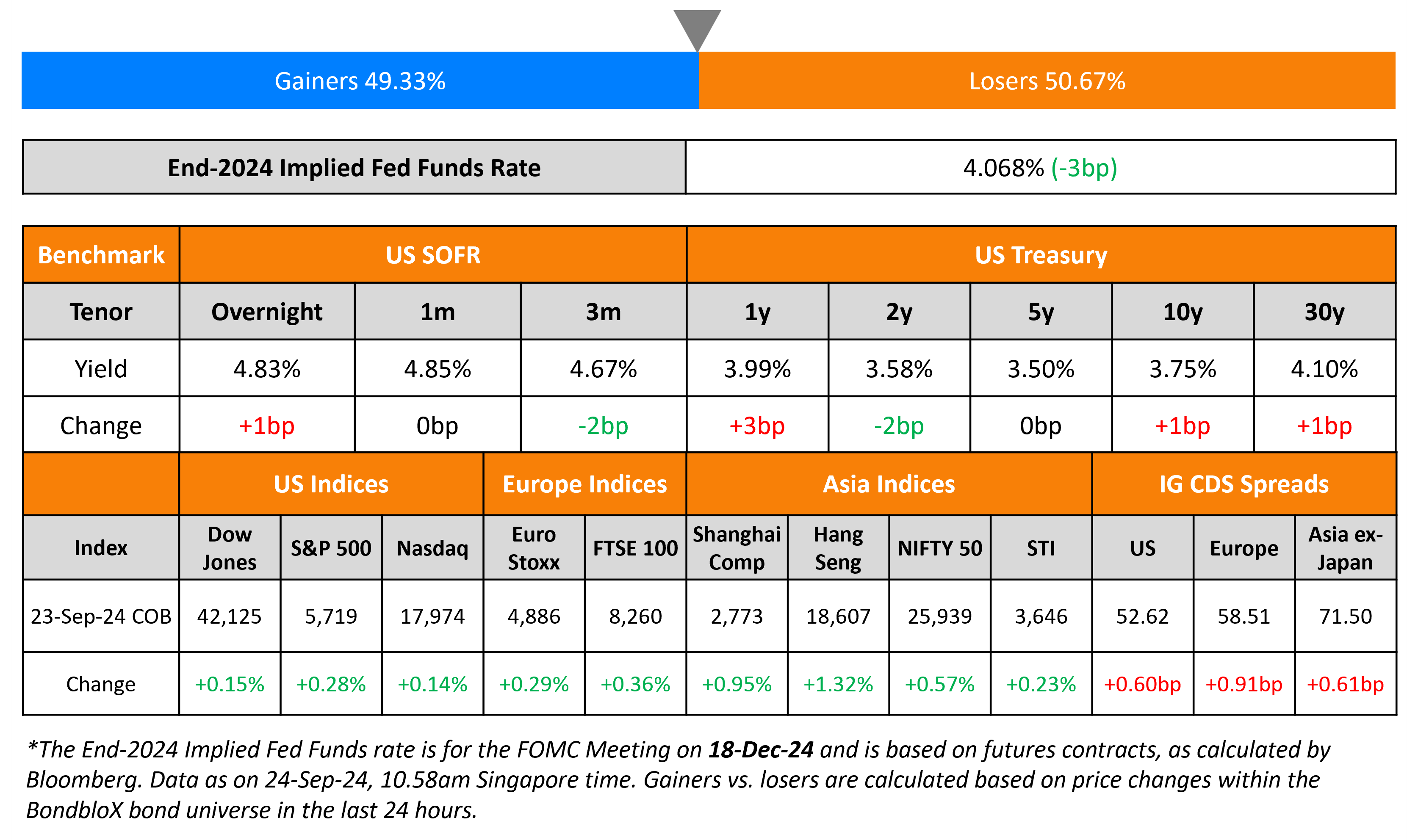

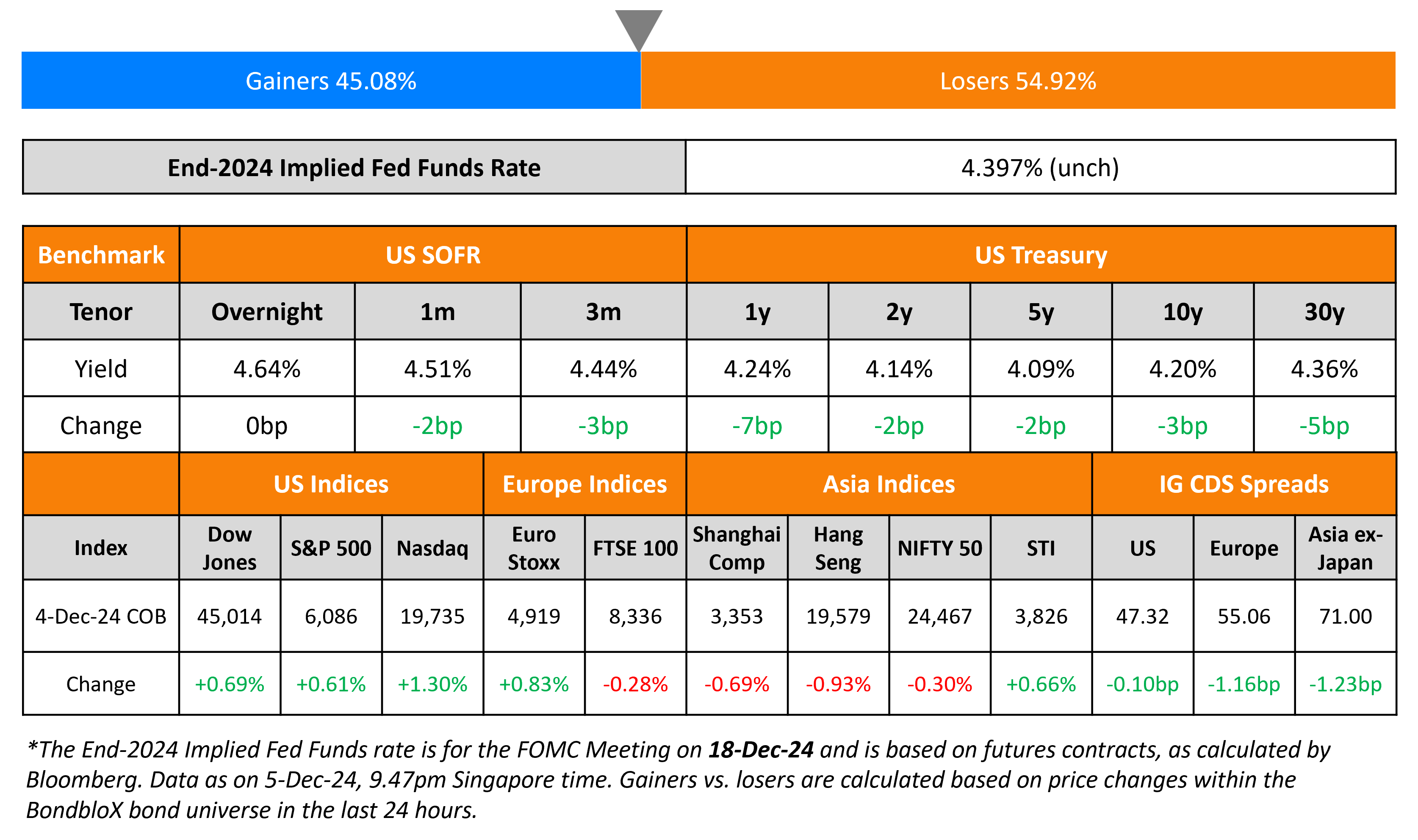

US Treasury yields ticked lower by 2-3bp across the curve yesterday. The ISM Services reading for November came-in at 52.1, worse than expectations of 55.7 (and the prior month’s 56). While the reading continued to show expansion in the services sector, it however also showed a deceleration from the prior two months. Separately, the Fed’s Mary Daly and Jerome Powell indicated that there was no urgency to lower interest rates and that the Fed could be more cautious in approaching the neutral rate. Powell noted that the 50bp rate cut in September was meant to be “a strong signal” that they were going to support the labor market if it continued to weaken. However since then, he said that data revisions “strongly suggests that the economy is even stronger” than the Fed initially thought.

US IG and HY CDS spreads tightened by 0.1bp and 1.2bp respectively. Looking at US equity markets, the S&P was higher by 0.6% and the Nasdaq rallied 1.3%. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.2bp and 5.1bp respectively. Asian equities have opened broadly lower this morning. Asia ex-Japan CDS spreads were 1.2bp tighter.

New Bond Issues

Rakuten raised $550m via a PerpNC5 bond at a yield of 8.125%, 25bp inside initial guidance of 8.375% area. The subordinated notes are rated B by S&P. If not called by 15 December 2029, the coupon will reset to the US 5Y yield plus 400bp. Additionally, the bonds have a coupon step-up of 25bp on the above reset date and another 75bp step-up in year 20 (December 2044) if an IG-rating is not obtained. Proceeds will be used to redeem/buyback ¥50bn in aggregate principal amount of its 1.81% 2055s and ¥26bn 2.61% 2055s. Any remaining proceeds will be used for general corporate purposes, including to repurchase/redeem Rakuten Group’s outstanding senior notes. This was Rakuten’s lowest yielding issuance since 2021 when it lost its IG-status at S&P.

AES raised $500mn via a 30.25NC5.25 bond at a yield of 6.95%, 42.5bp inside initial guidance of 7.375% area. The subordinated notes are rated Ba1/BB/BB. Proceeds will be used to repay existing debt, including borrowings under its revolving senior credit facility, and for general corporate purposes.

Rating Changes

-

Fitch Upgrades CaixaBank to ‘A-‘; Outlook Stable

-

Quad/Graphics Inc. Upgraded To ‘BB-‘ On Improved Leverage, Outlook Stable

-

Nitrogenmuvek Ratings Lowered To ‘CCC-‘ From ‘CCC’ On Near-Term Debt Maturities; Outlook Negative

-

Sonoco Products Co. Downgraded To ‘BBB-‘ On Debt-Financed Acquisition Of Eviosys; Outlook Stable

-

Fitch Revises Outlook on Beijing Capital Development Holding to Negative; Affirms at ‘BBB-‘

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day

Diaspora Bonds

Diaspora bonds are sovereign bonds that target investors that have emigrated to other countries. The reasons for emigration range from political unrest to better opportunities. For issuing countries, it is considered to be a possible stable source of finance particularly in bad times and can support the sovereign’s credit rating. For investors, it is believed to be a semblance of patriotism for the country of origin whilst also serving to manage risk since debt is serviced in local currency.

Kenya is said to be working with to raise as much as 500bn shillings ($3.86bn) by issuing a diaspora bond.

Talking Heads

On BOJ Rate Hike Bets for This Month Tumble, Pressuring Yen Lower

Yusuke Matsuo, Mizuho Securities

“If the information was released with intention by the BOJ, it may be trying to prevent the misunderstanding that it has already decided to raise interest rates at the December meeting”

Yujiro Goto, Nomura Securities

“The speech by the dovish board member is today”

On ECB Shouldn’t Cut Interest Rates Below Neutral – ECB GC member, Joachim Nagel

“Interest rates should converge slowly and at a measured pace toward neutral … I do not see a significant risk of inflation undershooting that would warrant the Eurosystem becoming expansionary in the near future… no objections if we were to continue to reduce our policy rates”

On Yield-Curve Control at ECB a Possibility to Cap Surge – ING’s Carsten Brzeski

“Central banks monetarizing debt could really be on the cards in the next few years… I could see as a bold call the ECB having to stabilize the yield curve… As a central bank, you want to go lower”

Top Gainers and Losers- 05-December-24*

Go back to Latest bond Market News

Related Posts: