This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shriram Launches $ 3.5Y at 6.5%a

September 24, 2024

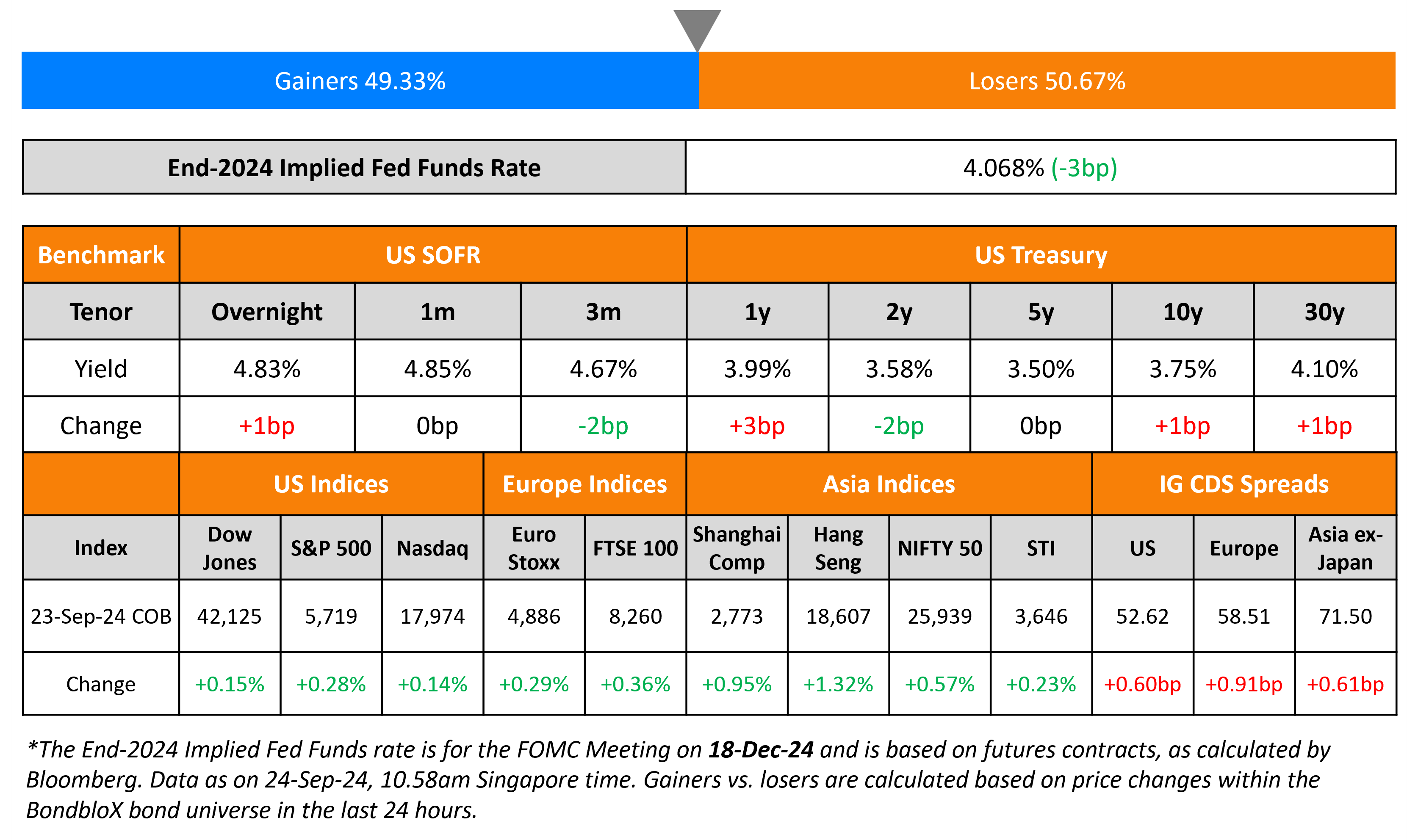

US Treasuries continued to bull steepen with the 2s10s now at 14bp. S&P Manufacturing PMI for the month of September came in weaker at 47.0, compared to estimates of 48.5. However, the Services PMI came in at 55.4, inline with estimates of 55.3. A number of Fed chiefs spoke at various events yesterday, supporting last week’s rate cut. Chicago Fed President Austin Goolsbee commented that he was comfortable with a starting move of 50bp rate cut and that if a soft landing is required, then the Fed can’t be behind the curve. Atlanta Fed President Raphael Bostic said that he felt the economy was closing in on its “normal” level faster than he expected, and that monetary policy should adjust as well from the current tight credit stance. Minneapolis Fed President Neel Kashkari said that he agreed to the half-point cut, adding that two more quarter point cuts were likely warranted by year’s end because “the balance of risks has shifted away from higher inflation and toward the risk of a further weakening of the labor market.” US IG and HY CDS widened by 0.6bp and 4.4bp respectively. US equity markets closed higher with S&P and Nasdaq up by 0.3% and 0.1% respectively.

European equity markets also ended higher. Looking at European CDS spreads, the iTraxx Main widened by 0.9bp and Crossover widened by 1.4bp. Asian equity indices have opened broadly mixed today. Asia ex-Japan IG CDS spreads widened by 0.6bp.

New Bond Issues

-

Shriram $ 3.5Y at 6.5% area

-

Meituan $ 3.5Y/5Y at T+145/160bp area

AIA raised $1.25bn via a two-trancher. It raised $500mn via a 10.5Y at a yield of 4.995%, 25bps inside revised initial guidance of T+150bp area. It raised $750mn via a 30Y at a yield of 5.437%, 30bps inside revised initial guidance of T+165bp area. The subordinated bonds are expected to be rated A2/A-/A. Proceeds will be used for general corporate purposes. The 10.5Y bond was priced in line with its existing AIA 5.375% 2034s which currently yields 4.95%.

REC raised $500mn via a 5Y Green bond at a yield of 4.809%, 32.5bp inside initial guidance of T+160bp area. The senior unsecured bond is expected to be rated Baa3/BBB- (Moody’s/Fitch). The bond has a change of control put at 100%, if the Government of India ceases to own, directly or indirectly >50% of voting rights of company. Proceeds will be used to finance, in whole or in part, eligible green projects, in each case in accordance with REC Ltd. green finance framework and approvals granted by RBI from time to time and in accordance with external commercial borrowings (ECB) regulations and guidelines of India. The bond was priced at a new issue premium of 10bp compared to REC 5.625% 2028, which currently yields 4.7%.

ANZ raised $2.5bn via a three-part deal. It raised:

- $750mn via a 3Y at a yield of 3.919%, 20bps inside initial guidance of T+65bp area. The senior unsecured bond is expected to be rated Aa2/AA-/AA-.

- $500mn via a 3Y FRN at an equivalent yield of SOFR plus 65bp, compared to initial guidance of SOFR Equivalent area. The senior unsecured bond is expected to be rated Aa2/AA-/AA-.

- $1.25bn via a 11NC10Y at a yield of 5.204%, 28bps inside initial guidance of T+175bp area. The subordinated bond is expected to be rated A3/A-/A-

Proceeds will be used for general corporate purposes.

Hyundai Capital America raised $2.75bn via a four-part issuance. It raised:

The senior unsecured bonds are expected to be rated A3/A-/A-. Proceeds will be used for general corporate purposes.

T-Mobile USA Inc. raised $2.5bn via a three-part offering. It raised:

- $700mn via a 5Y bond at a yield of 4.246%, 30bp inside initial guidance of T+105bp area.

- $900mn via a 10Y bond at a yield of 4.719%, 32bp inside initial guidance of T+130bp area.

- $900mn via a 30Y bond at a yield of 5.265%, 32bp inside initial guidance of T+150bp area.

The senior unsecured bonds are expected to be rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes, including among other things, share repurchases, any dividends declared by the T-Mobile US, and refinancing of existing indebtedness on an ongoing basis.

Bank of China/Sydney raised $500mn via a 3Y FRN at SOFR + 59bp, 45bp inside initial guidance of SOFR+105bp area. The senior unsecured bond is expected to be rated A1/A/A (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- QIIB hires for $ PerpNC5.5 bond

- Saudi Aramco hires for $ 5Y/10Y bond

Rating Changes

- Moody’s Ratings upgrades Blackstone Private Credit Fund’s senior unsecured rating to Baa2 with a stable outlook

- Moody’s Ratings upgrades Ares Capital’s senior unsecured rating to Baa2; outlook stable

- Moody’s Ratings upgrades long-term deposit ratings of certain Costa Rican banks to Ba3; outlooks positive

- Hudson Pacific Properties Inc. Downgraded To ‘BB-‘ On Elevated Leverage; Outlook Negative

- Moody’s Ratings affirms CSN’s Ba2 ratings; outlook changed to negative

Term of the Day

Trigger Event

Triggers, or trigger events are an important feature of contingent convertible (CoCo) or additional tier 1 (AT1) bonds and define when the loss absorption mechanism is activated. Triggers can either be mechanical or discretionary. Mechanical triggers are numerically defined and most commonly refer to the bank’s capital ratio level. Discretionary triggers, also known as point of non-viability (PONV) triggers are based on supervisors’ judgement of the bank’s solvency position. On occurrence of a trigger event, an AT1’s loss absorption mechanism kicks in, which may include a conversion to equity and/or a principal write-down, both of which boost the bank’s capital position.

Talking Heads

On Fed Cut Raising Odds of Melt-Up in Stocks

Ed Yardeni, founder of Yardeni Research Inc.

“If they overheat the economy and create a bubble in the stock market, they’re creating some issues. Fed is ignoring the upcoming US presidential election, in which both candidates are proposing policies that could trigger inflation.”

On US Companies Raising Debt After Fed Rate Cut

David Schiffman, lead portfolio manager at Aquila Investment Management

“With the uncertainty of the Fed’s decision out of the way and investors still having liquidity to be deployed, it appears issuers are eager to get their deals done. Companies do not want to be shut out of the market as liquidity becomes more difficult as we approach the election.”

On Money Market Funds Shying Away from Longer Term T-Bills

Teresa Ho, strategist at JPMorgan Chase & Co.

“There remains the lack of clarity on how the easing cycle will unfold and the inverted yield curves. These curves remain deeply inverted, challenging liquidity investor’s willingness to add duration.”

Top Gainers & Losers 24-September-24*

Go back to Latest bond Market News

Related Posts: