This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS, Lippo, COGO Launch $ Bonds; Macro; Rating Changes; New Bond Issues; Talking Heads; Top Gainers & Losers

February 2, 2021

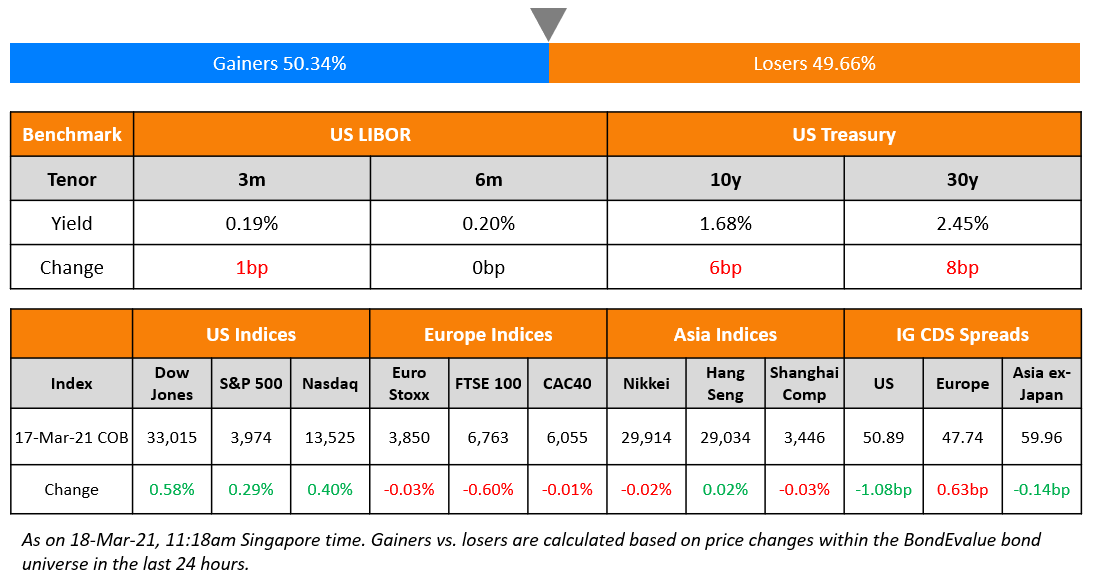

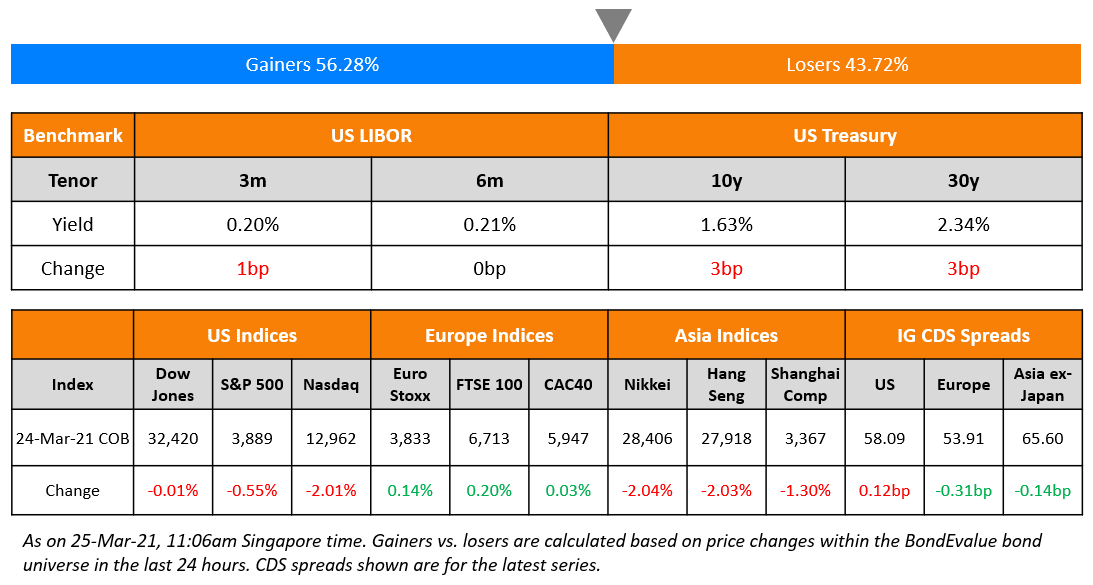

S&P was 1.6% higher while Nasdaq rallied 2.6% as tech stocks outperformed. Amazon and Microsoft were among the large-cap gainers, up 4.3% and 3.3% besides Tesla moving higher by 5.8%. Mining stocks were also in demand after the Gamestop saga with the focus now on silver, which soared to eight-year highs. US 10Y Treasury yields inched up 1bp. A possible smaller fiscal package, ISM manufacturing index printing at 58.7 for January vs. 60.5 in the month before and the US Treasury reducing Q1 borrowing due to higher cash balance made the headlines in the US. There is speculation that former ECB president Draghi could become the next Italian prime minister. FTSE, DAX and CAC also rose 0.9%, 1.4% and 1.2% respectively. US IG CDS spreads were 1.1bp tighter and HY was 7.1bp tighter. EU main CDS spreads tightened 0.5bp and crossover spreads tightened 1bp. Asia ex-Japan CDS spreads are 0.1bp tighter while Asian equities are ~1.2% higher today.

Bond Traders’ Masterclass

Sign up for the upcoming sessions on Understanding New Bond Issues & Credit Ratings today, February 2 and Using Excel to Understand Bond Calculations tomorrow, February 3. This session is part of the Bond Traders’ Masterclass across four sessions specially curated for private bond investors and wealth managers to develop a strong fundamental understanding of bonds. The sessions will be conducted by debt capital market bankers with over 40 years of collective experience at premier global banks. Click on the image below to register.

New Bond Issues

- UBS Group TLAC 11NC10 at T+125/130bp; UBS AG 3Y at T+50bp area and 3Y floater at SOFR + equivalent

- LMIRT $ 5NC3 at 8.125% area

- China Overseas Grand Oceans $ 5Y at T+250bp area; books $2.5bn

- Continuum Energy $560mn green bond at 4.875% area; books $1bn

- JY Grandmark $ 364-day at 7.75% area alongside exchange offer

- China Industrial Securities International $300mn 3Y at 2.5% area

Hyundai Capital raised $600mn via a 5Y green bond at a yield of 1.343%, or T+92.5bp, 37.5bp inside initial guidance of T+130bp area. The bonds have expected ratings of Baa1/BBB+ and received orders over $4.75bn, 7.9x issue size. Asia took 54%, EMEA 14% and the US 32%. Fund managers and asset managers bought 66%, insurers, pension funds and sovereigns, supranationals and agencies 20%, bank treasuries 10% and private banks, corporates and others 4%. Proceeds will be used for eligible projects in accordance with the issuer’s sustainable financing framework.

Mongolian Mortgage Corp (MMC) raised $250mn via a 3Y bond at a yield of 9.125%. The bonds have expected ratings of B3/B. The bonds have a guarantee from parent company MIK Holding as well as a letter of support from the Mongolian central bank. The letter of support is not a guarantee, but states, among other things, that the BoM will maintain its seat on the board of MIK Holding. The issuer had marketed a three-year bond on January 21 at final guidance of 9.125%, but postponed the deal when Prime Minister Khurelsukh Ukhnaa resigned that day following protests about the government’s handling of the Covid-19 pandemic. MMC had launched a tender offer for its $280.68mn 9.75% 2022s guaranteed by MIK Holding, which is dependent on the new deal going ahead. The tender offer will be at $1,020 per $1,000 in principal before the deadline of February 16.

New Bond Pipeline

- IRFC $ bond

- Southwest Securities $ bond

- AVIC $ bond

- CABEI $ 5Y social bond

- Liberty Mutual Group

- Zhejiang Xinchang Investment

- KEXIM $ bond

- Jinchuan Group $ bond

- Buma $ 5NC2 bond

Rating Changes

- Fitch Downgrades Pan Brothers to ‘C’/’C(idn)’ as Company Enters Standstill Agreement

- Diversified Healthcare Trust Downgraded To ‘BB-‘ From ‘BB’ By S&P On Slow Senior Housing Recovery, Outlook Negative

- Moody’s downgrades Diversified Healthcare’s corporate family rating to Ba3, outlook negative

- Fitch Affirms Volcan at ‘BB’; Revises Outlook to Positive

- L Brands Inc. Outlook Revised To Positive From Stable By S&P On Resilience Through The Holiday Season; Ratings Affirmed

- Fitch Affirms IGH’s IDR at ‘BB+’; Off RWN; Outlook Negative

- PT Saka Energi Indonesia ‘B’ Ratings Withdrawn By S&P At The Company’s Request

- Fitch Affirms Zoomlion at ‘B+’; Withdraws Ratings

Term of the Day

Uridashi Bonds

Uridashi bonds are non-JPY denominated bonds sold directly to Japanese individual investors. Institutions like the World Bank, ADB etc. have issued such bonds. These are typically issued in a currency with a higher yield vs. the Japanese Yen. These are different from Samurai bonds that are yen-denominated bonds issued by foreign entities in Japan.

Talking Heads

On no need for monetary policy response to trading frenzy in GameStop Corp. and other hot stocks

Neel Kashkari, Federal Reserve Bank of Minneapolis President

“I’m not at all thinking about modifying my views on monetary policy because of speculators in these individual stocks.” “The key now is for the Federal Reserve to keep our foot on the monetary policy gas until we really have achieved maximum employment,” Kashkari said

Mary Daly, San Francisco Fed President

She didn’t favor tightening up monetary policy, which would potentially slow the economic recovery, “simply to ensure that some people who already have stock market wealth don’t get more.”

Robert Kaplan, Dallas Fed President

“Non-bank financials I’m watching very carefully — potential instability funding risks that might occur,” Kaplan said. “And I’m conscious of the fact that we’ve had to make these extraordinary moves that we’ve had at the Fed with interest rates and bond buying.”

“We are still in the teeth of this pandemic – and we are not out of the woods yet,” Kaplan said. “We need to be aggressive in our fiscal and monetary policy actions, and I am hopeful that by doing that we will ultimately get beyond this pandemic and can then get to a more normalized environment in the months and years ahead.”

On the delay to US-China investment ban leaving US investors in limbo

Paul Lukaszewski, head of corporate debt for Asia Pacific at Aberdeen Standard Investments

“We have now entered wait-and-see mode until we get clarity as to what the new administration will do,” said Lukaszewski. “China’s debt market is one of the world’s largest. Chinese credit spreads are attractive compared to U.S. credit spreads and investors benefit from diversification when they allocate across more markets and geographies,” Lukaszewski said, adding U.S. investors were in a “difficult position.”

Shamaila Khan, head of emerging market debt strategies at AllianceBernstein

“If you put sanctions on the ability of investors to hold debt, you’re not hurting the company that issued the debt -you’re hurting the investors that bought it,” said Khan. “When you sanction a company for future issuance of debt, then you hurt the company more than the investors of the debt. So there are nuances.”

Jeremy Schwartz, global head of research at WisdomTree Asset Management

“The Global investment community wants more access to Chinese assets,” said Schwartz. “The bigger picture stepping back is that there is a lot of global interest in adding China currency reserves and Chinese bonds to portfolios.”

“You’ve got investors that are awash with cash, investors that have no reason to delay as there are no expectations for significant interest rises and finally the back-up of the central banks,” said Blandin. “That was a pretty good recipe for highly successful transactions and that’s why we’ve seen massive order books for most of the very large transactions.”

On Brazil traders piling into rarest of bets in zero-rates world

Roberto Campos Neto, Brazil Central Bank President

“There was a consensus that we should wait for a series of inflation and activity data before normalizing rates,” Campos Neto said

Gustavo Pessoa, a partner at hedge fund Legacy Capital

“Our balance of fiscal risks is worse than our peers,” said Pessoa who forecasts a half-point hike in March. “This has weighed on our currency and has contributed to rising inflation.”

Brendan McKenna, a strategist at Wells Fargo

“Given the way inflation numbers have moved and the guidance from the central bank, we brought those forward,” he said. “We are looking for average inflation this year of around 4%.”

Top Gainers & Losers – 2-Feb-21*

Go back to Latest bond Market News

Related Posts: