This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

7-Eleven, Genting, Kaisa Among 7 New Deals; Macro; Rating Changes; New Issuances; Talking Heads; Top Gainers & Losers

January 27, 2021

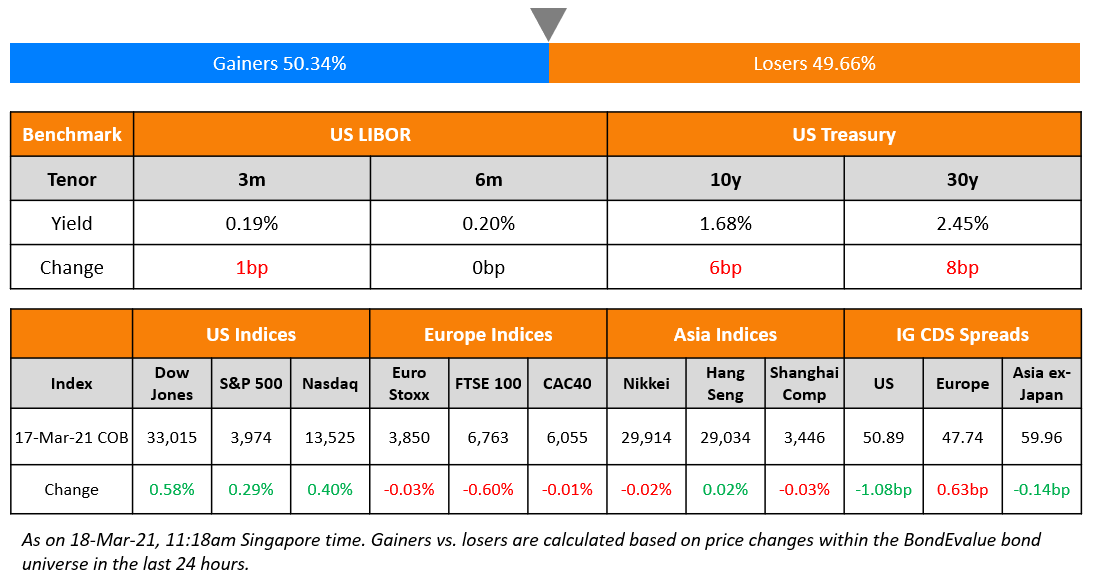

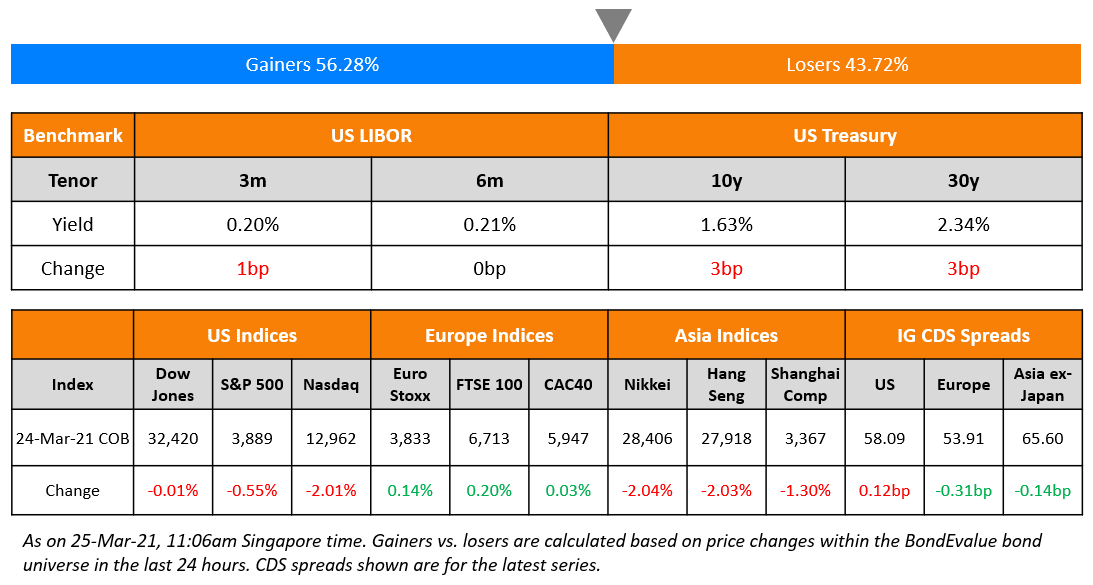

S&P and Nasdaq ended marginally lower by ~0.1% each. Microsoft shares hit a new high as they exceeded earnings expectations with a boost from work-from-home revenues. US 10Y Treasury yields were stable at roughly 1.04% with US Senate Majority Leader Schumer saying that he and fellow Democrats may try to pass much of Biden’s $1.9tn Covid relief bill bypassing filibuster and with a majority vote. Mike Chang, a strategist at Citi said “We think ultimately it’s going to be smaller than the $1.9tn… We have penciled in around $600bn-$1tn. Timing is another issue, not just the size, how long it will take to get the whole thing through”. The IMF lifted its global growth forecast for 2021 to 5.5% – US at 5.1%, China at 8.1% and India at 11.5%. Auto and industrial stocks led the DAX 1.66% higher, while FTSE MIB was up 1.15% on hopes that Italian PM Conte will be able to form a new coalition government after resigning yesterday. The first EU SURE bonds of 2021 raised €14bn through 7Y and 30Y tenors with orders of €83bn, 5.9x issue size. US IG CDS spreads were 0.9bp wider and HY was 3bp wider. EU main CDS spreads tightened 0.9bp and crossover spreads tightened 3.3bp. Momentum in the Asian primary markets continue with 7 new bond issues today. Asia ex-Japan CDS spreads are 0.6bp wider while Asian equities are ~0.1% lower today.

Bond Traders’ Masterclass – Today 6pm Singapore | 2pm Dubai | 10am London

Sign up for the upcoming sessions on Bond Portfolio Optimization & Risk in Perpetual Bonds today, January 27. This session is part of the Bond Traders’ Masterclass across four sessions specially curated for private bond investors and wealth managers to develop a strong fundamental understanding of bonds. The sessions will be conducted by debt capital market bankers with over 40 years of collective experience at premier global banks. Click on the image below to register.

Register today to avail a 25% discount on the Masterclass package

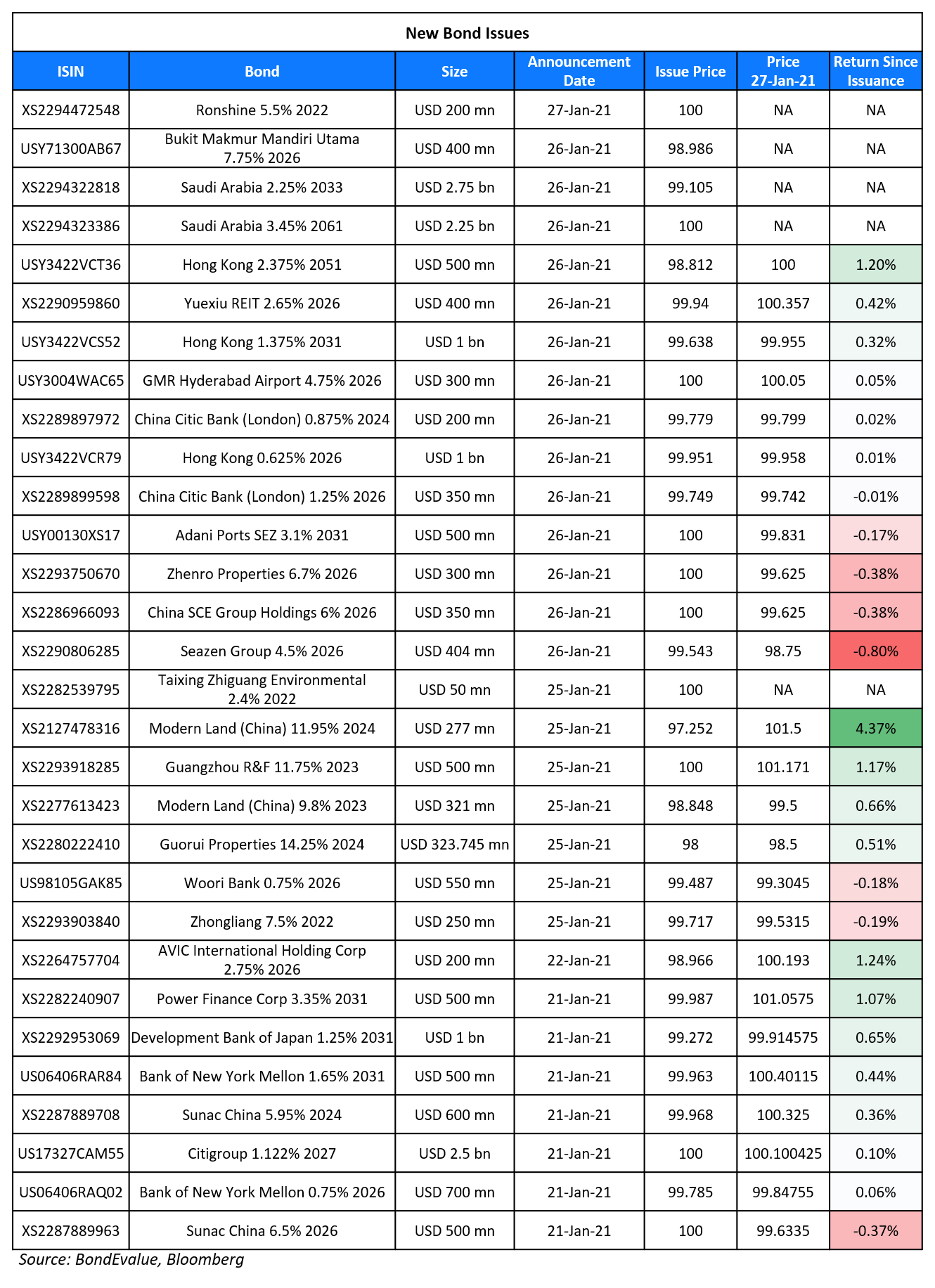

New Bond Issues

- 7-Eleven $10.95bn across floater 1.5Y6M at 3mL+70bp area, 2YNC1 at T+80bp area, 3NC1 at T+90bp area, 5Y at T+90bp area, 7Y at T+100bp area, 10Y at T+110bp area, 20Y at T+135bp area and 30Y at T+135bp area

- Genting NY $400mn at T+300bp area

- Kaisa tap of $ 9.95% 2025s at 11.2% area

- Longjtaihe Property tap of $ 12.5% 2022s at 12.5%

- Taizhou Hailing City Dvlpt $ 364-day at 2.4% area

- Hainan State Farms Investment $ 3Y at 3.5% area

- Taizhou Huaxin Pharmaceutical $ 3Y credit-enhanced bond at 2.7% area

Hong Kong SAR raised $2.5bn via a three trancher. It raised:

- $1bn via a 5Y bond at a yield of 0.635%, or T+25bp, 25bp inside initial guidance of T+50bp area

- $1bn via a 10Y bond at a yield of 1.414%, or T+40bp, 20bp inside initial guidance of T+60bp area

- $500mn via a 30Y green bond at a yield of 2.431%, or T+65bp, 25bp inside initial guidance of T+90bp area

The bonds have expected ratings of AA+/AA- in line with the issuer and received orders of over $15bn, 7x issue size. Proceeds will be used to finance and/or refinance projects eligible under HKSAR’s green bond framework – to provide environmental benefits and support the sustainable development of Hong Kong. Credit Agricole and HSBC were joint green structuring advisers, joint global coordinators and joint lead managers.

Adani Ports SEZ raised $500mn via 10Y bonds at a yield of 3.1%, 40bp inside initial guidance of 3.5% area. The bonds have an expected rating of Baa3/BBB-/BBB- and received orders of over $1.5bn, 3x issue size. EMEA took 36%, US 34% and Asia 30%. Fund managers booked 79%, insurers/agencies 11%, banks 8%, and private banks and others 2%. Proceeds will fund a tender offer for its older $500mn 3.95% 2022s. The company is offering to pay $1,032.3 per US$1,000 in principal and the offer ends on February 2. If the tender offer does not go ahead, proceeds will be used to pay down debt, subject to approval from the Reserve Bank of India. The 3.95% 2022s currently trade at $102.95 in the secondary market.

GMR Hyderabad Airport raised $300mn via a 5Y bond at a yield of 4.75%, 25bp inside initial guidance of 5% area. The bonds have expected ratings of Ba2/BB+ in line with the issuer and received orders over $1.1bn, 3.7x issue size. Asia took 79%, EMEA 12% and the US 9%. Fund/asset managers bought 86%, banks and private banks 11% and corporates, pension funds and others 3%. The bonds, which are secured against certain immovable assets, receivables and other collateral, have a change of control put at 101 if it leads to a downgrade. As per IFR, the Indian airport’s existing 5.375% 2024s were seen at a bid yield of around 4.7%, meaning the new bonds paid a negative new issue concession of around 10bp after factoring in the longer duration, according to a banker on the deal.

Zhenro Properties raised $300mn via a 5.5Y non-call 3.5Y (5.5NC3.5) green bond at a yield of 6.7%, 50bp inside initial guidance of 7.2% area. The bonds have expected ratings of B2/B+ and received orders over $3bn, 10x issue size. Asia bought 80% of the bonds and EMEA 20%. Fund managers, banks, financial institutions and sovereign wealth funds received a combined 88%, and private banks 12%. Proceeds will be used for debt refinancing and in accordance with the issuer’s green bond framework.

Seazen Properties raised $404mn via a 5.25Y non-call 3.25Y (5.25NC3.25) green bond at a yield of 4.6%, 40bp inside initial guidance of 5% area. The bonds have expected ratings of Ba2/BB+ and received orders of over $2.5bn, 6.2x issue size. The property developer plans to use proceeds primarily for debt refinancing, including to fund the concurrent tender offer for its outstanding $363.503mn 6.5% 2021s and $237.996mn 7.125% 2021s. For every $1,000 in principal, the purchase price is $1,010 for the 6.5% 2021s and $1,015 for the 7.125% 2021s, plus accrued and unpaid interest with the deadline on February 4. The 6.5% 2021s and 7.125% 2021s currently trade at 100.82 and 101.25 respectively.

Trafigura raised €400mn ($486mn) via a 5Y bond at a yield of 3.875%, ~40bp inside initial guidance of 4.125%-4.25% area. The bonds received orders over €750mn ($912mn). The bonds have a change of control put at par and proceeds will be used for general corporate purposes.

Ronshine China raised $200mn via a 364-day note at a yield of 5.5%. The bonds were unrated and proceeds will be used for refinancing purposes.

Yuexiu REIT raised $400mn via a 5Y bond at a yield of 2.663%, or T+225bp, 50bp inside initial guidance of T+275bp area. The bond has an expected rating of Baa3 and received orders over $3.2bn, 8x issue size. The bonds will be issued off Yuexiu REIT’s $1.5bn guaranteed medium-term note (MTN) programme.

China SCE Group Holdings raised $350mn via a 5Y non-call 3Y (5NC3) bond at a yield of 6%, 30bp inside initial guidance of 6.3% area. The bond has an expected rating of B2 and received orders over $2.2bn, 6.3x issue size. Proceeds will be used for debt refinancing.

China Citic Bank London branch raised $550mn via a dual tranche offering. It raised $200mn via a 3Y bond at a yield of 0.95%, or T+77bp, 43bp inside initial guidance of T+120bp area. It also raised $350mn via a 5Y bond at a yield of 1.302%, or T+89bp, 41bp inside initial guidance T+130bp area. The bonds have expected ratings of BBB+ and received orders over $7bn, 12.7x issue size. Proceeds will be used for working capital and general corporate purposes.

Bukit Makmur Mandiri Utama raised $400mn via a 5Y non-call 2Y (5NC2) bond at a yield of 8%, 50bp inside initial guidance of 8.5% area. The bonds have expected ratings Ba3/BB- and received orders over $1.15bn, 2.9x issue size. Asia took 64% of the 144A/Reg S bonds, EMEA 20%, and the US 16%. Asset managers and fund managers booked 88%, private banks 6%, financial institutions and banks 3%, and insurers 3%. The deal is the first Indonesian high-yield offering of the year, after textile Sri Rejeki Isman (Sritex) planned but did not proceed with an offering.

Laos pulled its dollar bond deal once again after investors raised concerns about undisclosed breaches in its borrowings. As per IFR, documentation for the planned offering in 2019 stated that Laos was in breach of covenants on certain financing agreements, after it created security over royalties from concessional power projects and shares of power project companies without obtaining permission from the lenders. The sovereign had planned to use the proceeds of the bond deal to pre-pay the loan facilities, but warned that the non-compliance with the loans could be considered a breach of covenants and result in cross-defaults on its other debt. The sovereign is expected to add the relevant disclosures to its bond documents before relaunching the deal for the third time.

New Bond Pipeline

- Hong Kong Airport Authority $ 10Y/30Y

- BOC HK Branch $ Yulan bond

- Liberty Mutual Group

- Zhejiang Xinchang Investment

- KEXIM $ bond

- Jinchuan Group $ bond

- Buma $ 5NC2 bond

- Dubai Aerospace Enterprise $ bond

- Zurich Insurance $ 30.25NC10.25

- REC $ bond

Rating Changes

- Netflix Inc. Upgraded To ‘BB+’ By S&P On Strong Streaming Video Trends And Free Cash Flow Improvement; Outlook Positive

- U.K.-Based TalkTalk Downgraded To ‘B+’ By S&P On Leveraged Acquisition By Tosca IOM; Outlook Stable

- SoftBank Group Outlook Revised To Stable On Sound Management; ‘BB+’ Ratings Affirmed

- HudBay Minerals Inc. Outlook Revised To Stable From Negative By S&P On Expected Credit Metrics Improvement;’B’ Rating Affirmed

- Correction: Fitch Revises GIB’s and GIBUK’s Outlook to Negative

Term of the Day

Extraordinary Redemption

This refers to a provision that allows a bond issuer the right to call their bonds before maturity if certain specified events occur as specified in the offering statement. These events could range from natural disasters or catastrophes, cancelled projects, to other unusual one-time occurrences.

Talking Heads

On Companies raise $400bn over three weeks in blistering start to 2021

John McClain, portfolio manager at Diamond Hill Capital Management

“The only thing that matters to markets is global fiscal and monetary policy. Markets are priced as though coronavirus doesn’t matter any more.”

Jeff Thomas, head of western US listings and capital markets at Nasdaq

“When you put all that capital into the system, it’s got to go somewhere,” he said. Rapidly rising stock market valuations have enticed companies to pivot from private to public markets much sooner”

On foreign interest in Malaysia’s bond market to remain strong despite likely future rate cut – UOB

“We are now in an environment where global interest rates are at very low levels, and there are trillions of bonds with negative yields out there. There is a lot of liquidity out there looking for a home, and even if the yield does come off, the yield pickup in Malaysia would still be attractive enough”

On aiming for Pre-Covid ‘Normal’ Is Misguided – Bridgewater CEO David McCormick

“There were some really significant underlying problems with normal. Our ability to respond to the economic challenges we have with monetary policy alone is much more limited because of the enormity of what’s already been done”

On Turkey’s Long-Unloved Debt Is Starting to Win Over Investors

Pramol Dhawan, Pimco’s head of emerging markets

“We think now it is a good time to invest in Turkey. The policies we have seen were in the right direction, and as long as Turkey follows through these policies, it can be a beneficiary of the favorable external environment for emerging markets”

Hakan Aksoy, Amundi’s senior fund manager for emerging-market sovereigns

“Turkey has started to do the right things recently. It has a beaten-up currency and a very high carry. At a time when yields are negative globally in many nations, the central bank is hiking interest rates, promises reforms and this makes us excited about the Turkish market”

Gustavo Medeiros, deputy head of research at Ashmore Group Plc.

“We are not constructive yet. So much damage has been done in terms of central-bank credibility, foreign investor confidence and valuation of the currency in recent years. We need more consistency in monetary and fiscal policy to regain confidence in the market.”

Top Gainers & Losers – 27-Jan-21*

Other Stories

Slovenia Rushes Back to Market With East Europe’s Longest Bonds

Go back to Latest bond Market News

Related Posts: