This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Q3 2023: ‘Higher for Longer’ Theme and Sharp Rise in Treasury Yields Lead to Drop in 71% of Dollar Bonds

October 2, 2023

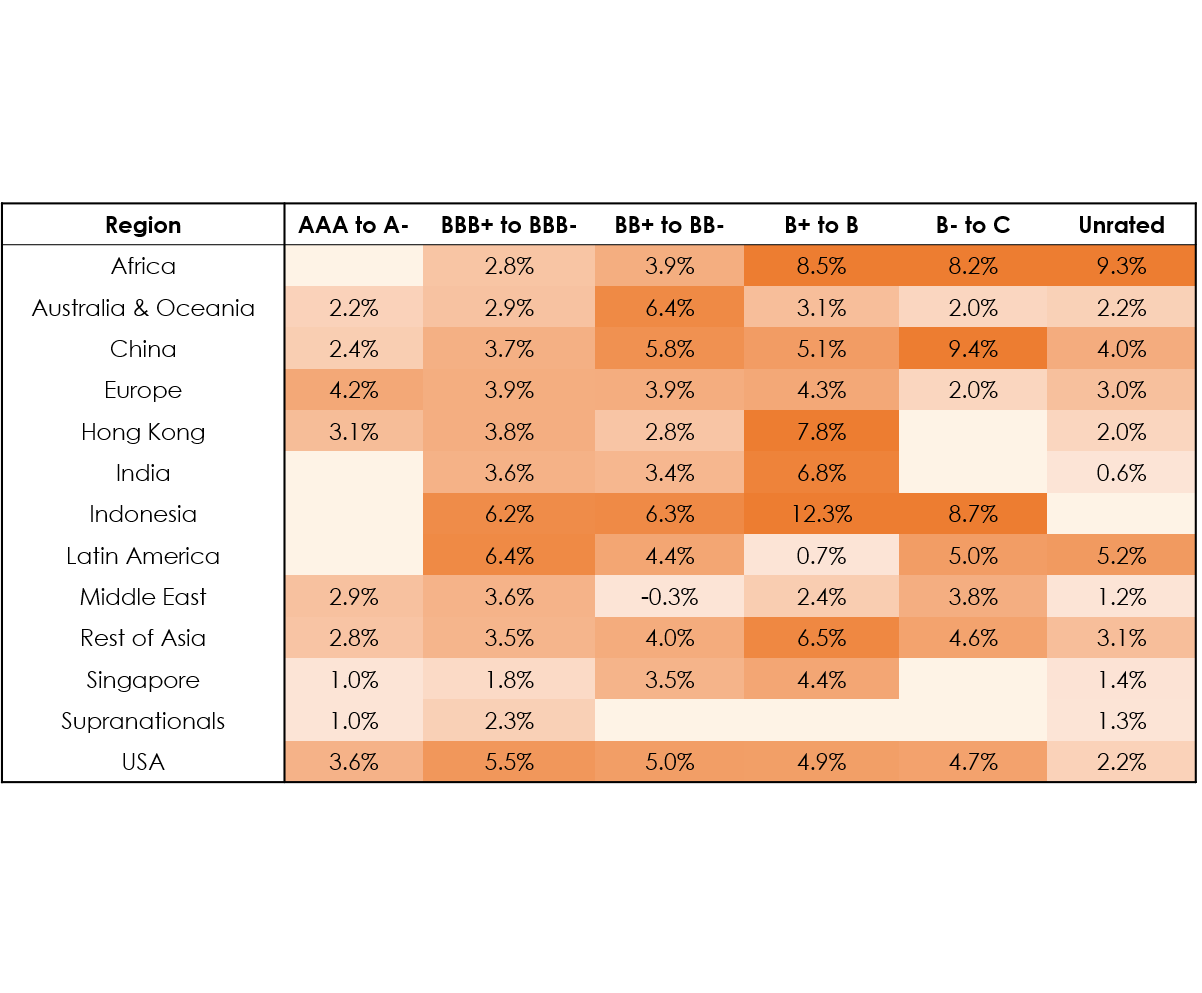

The third quarter of 2023 was a poor one as 71% of dollar bonds in our universe delivered a negative price return (ex-coupon). This compares to a broadly cheerful Q1 when 75% of dollar bonds delivered a positive return and a mixed Q2 where 54% of these bonds were lower. Within our dollar bond universe, Investment Grade (IG) bonds underperformed High Yield (HY) bonds – 76% of IG dollar bonds ended the quarter in the red vs. 57% of HY bonds that were in the red. Looking at the performance of bond indices, most regional indices dropped in Q3 2023. The Asian HY space saw the biggest drop, down by over 3.9% followed by the GCC dollar bond index that fell 3.4%. This was followed by the LatAm Index that fell 3.3% and US IG Index that dropped 3.1%. On the other hand the US HY Index was up 0.5%, the only gainer among the global bond indices.

US economic data showed resilience through the quarter despite market analysts initially expecting a slowdown, that transitioned into a 'soft landing' theme. Non-farm Payrolls (NFP) continued to stay firm at ~185k and wage inflation kept steady at ~4.4%. Besides, US CPI also trended slightly higher towards 3.7% and worries about inflation have weighed on markets also stemming from the rise in crude oil prices. Additionally, hard data points including GDP, retail sales and durable goods orders continued to indicate a resilient economy, thereby raising prospects of a 'higher for longer' view on rates by the US Federal Reserve. At the beginning of the quarter, the Fed hiked rates by 25bp in July, the only rate hike during the quarter with a guidance for a possible additional increase to end the year dependent on data.

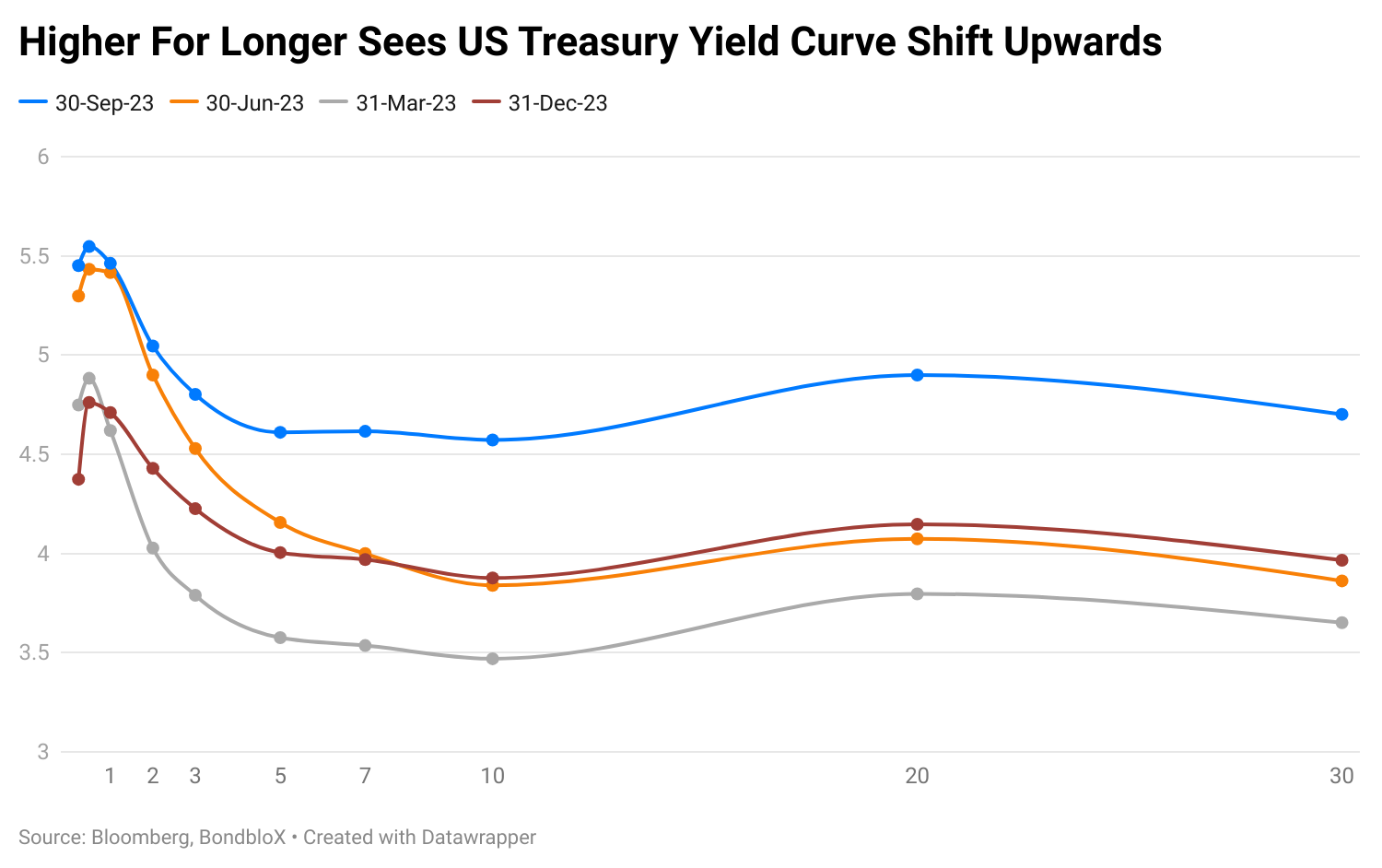

Given the continued inflationary backdrop, the US Treasury yield curve shifted significantly higher during the quarter, particularly on the long-end. While the 2Y yield was up by 15bp during the quarter, the 10Y and 30Y yields soared by a massive 73bp and 84bp respectively. The duration sensitive IG sector thus significantly underperformed the HY segment. Among the IG names, the large rise in yields saw not many noteworthy gainers during the third quarter. However, the losers list saw several long-dated, high duration issuers' bonds drop by 10-15% owing to the sharp rise in long-end treasury yields as mentioned earlier. This included names like Manulife, Microsoft, Tencent, Apple amongst others. (Click on the animated chart to view the interactive version)

Besides, dollar bonds IG-rated Chinese developers like Longfor and Vanke dropped over 25% after weak sales and the property market's worries weighed on them especially following COGARD's liquidity risks.

In the HY space, the largest gainer was China Grand Auto's 9.109% Perp that rallied ~80% after news that it will redeem all of the outstanding notes on October 30, its next call date. Pakistan's dollar bonds also rallied through the quarter, up by over 70-80% after it reached a staff-level agreement with the IMF on a $3bn standby arrangement. Several other Russian issuers also made it to the gainers, up over 20% during the quarter. El Salvador's dollar bonds rallied over 20% having consistently risen during this period, further benefitted by Google Cloud's plans to establish an office in the country spurring possible FDI flows into the economy. The largest loser was Country Garden's dollar bonds that fell over 75-80% to deeply distressed levels of 7-8 cents on the dollar. This came after it cited dire conditions and liquidity risks whilst almost defaulting on its dollar bonds by nearly missing coupon payments at the end of the grace period. Hong Kong companies tied to the property market also dropped with Shui On, NWD and Lai Sun's dollar bonds down over 20% after seeing a larger than expected drop in their average sell-through rate of homes. WeWork's dollar bonds also collapsed by 80% after warning of a bankruptcy.

Below is a violin chart of returns across the IG and HY spectrum. Hovering over the dots shows specific bonds and their returns across the rating categories.

Issuance Volumes

In Q3 2023, global corporate dollar bond issuances stood at $554bn, 7% lower than the prior quarter which was at $593bn. In comparison to Q3 2022, issuance volumes were 20% higher. Issuance volumes were primarily helped by May, which saw $227bn in new bond deals.

Asia ex-Japan & Middle East G3 issuances in Q3 2023 stood at just under $50bn, 2% lower than that of Q2 2023, but 71% higher than that of Q3 2022. 76% of the volumes came from IG issuers while HY contributed to 18% of deal volumes similar to the previous quarter and the remainder was taken up by unrated issuers.

Largest Deals

The largest deal globally in Q3 were led by big banks - Wells Fargo and BofA raised $8.5bn each, followed by Morgan Stanley’s $6.75bn four-part deal, UBS’s and Barclays' $4.5bn multi-tranchers each. Besides, other large bank issuances included Citibank's $4bn three-trancher, HSBC’s $3bn two-trancher, ING Groep’s €2.5bn and $2.5bn separate deals, SocGen and BNP’s €1.5bn issuances and others. Other large issuances included Columbia Pipelines’ $5.6bn seven-trancher, ONEOK’s $5.25bn five-trancher, Intuit Inc’s $4bn four-trancher and similar such large issuance by other corporates.

In the APAC & Middle East region, the largest deals were led by Pacific issuers like BHP's $3.6bn four-trancher, CBA’s $2.65bn two-trancher and ANZ NZ’s $1bn issuance. Other large deals included Korean issuers like KEXIM’s $2bn three-trancher, KEPCO’s $1bn deal, Korea Housing Finance’s €1bn deal and LG Energy’s $1bn two-trancher. Gulf issuers also contributed to the dollar bond primary markets with UAE's $1.5bn issuance, DP World’s $1.5bn deal and Energy Development Oman (EDO) $1bn.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019