This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pakistan Reaches $3bn Staff-Level Agreement with IMF

July 3, 2023

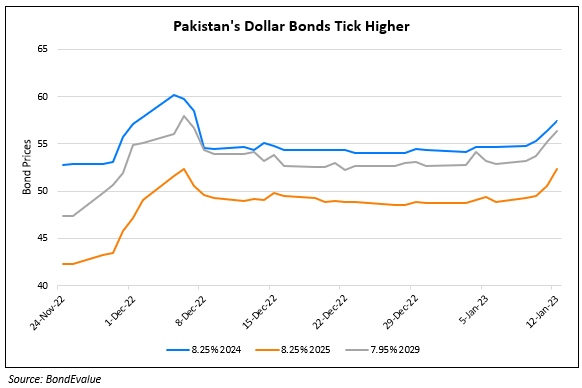

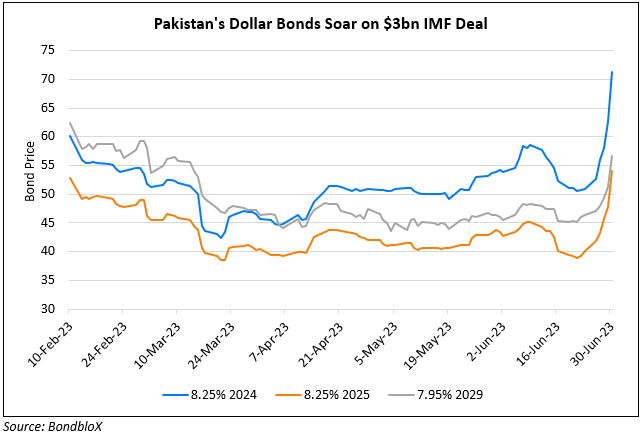

Pakistan’s dollar bonds soared over 10% after the nation reached a staff-level agreement with the IMF on a $3bn standby arrangement which will be spread out over 9 months. The magnitude of the funding is higher than expected, as the country was said to be in discussions with the IMF for a $2.5bn standby facility. This comes after its $6.5bn Extended Fund Facility (EFF) programme by the IMF was stalled for eight months and expired on Friday. The deal brings good news to Pakistan as the country is struggling against a backdrop of a shortage of foreign currency reserves, which were barely enough to cover one month’s imports. However, the agreement is still subject to approval by the IMF board in July. Last week, Pakistan’s parliament approved a revised budget after the IMF criticized its initial budget earlier. The latest review of Pakistan’s EFF is IMF’s ninth review and came just in time before its Friday deal expiration.

For more information, click here.

Go back to Latest bond Market News

Related Posts: