This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pakistan Required to Cut expenditures, Development Funds to Revive IMF Programme

April 21, 2022

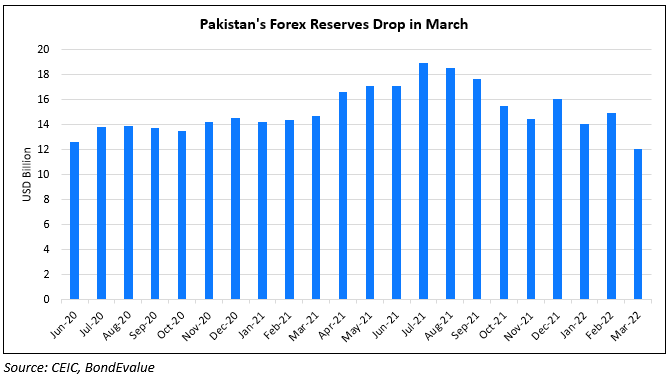

Pakistan’s finance minister Miftah Ismail said that Pakistan will need to cut expenditures and public sector development funds in order to be able to revive an IMF programme. Reuters notes that Pakistan is currently waiting for the IMF to resume talks on its seventh review of the $6bn rescue package agreed in July 2019. If the review is approved, the IMF is set to release over $900mn in funds and let Pakistan avail other external funding. Pakistan’s current account deficit is set to exceed 10% by June for the current financial year and hence the path of talks and funding remain uncertain.

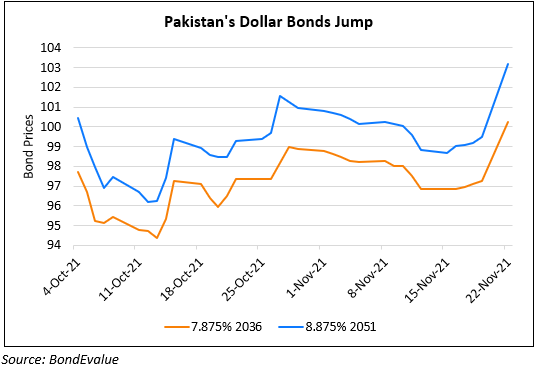

Pakistan’s dollar bonds were weaker, with its 6% 2026s down 0.5 points to 77.91, yielding 13.4%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: