This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

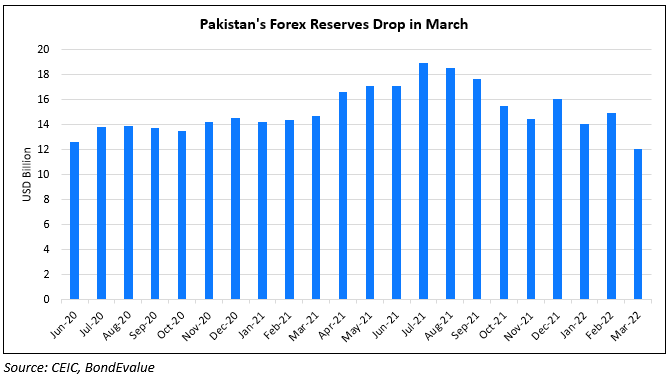

Pakistan’s Forex Reserves Fall to Lowest Since Mid 2020

April 1, 2022

Pakistan’s liquid reserves held by the Pakistan central bank, State Bank of Pakistan (SBP) fell by 19.5% weekly to $12.04bn, as of March 25, as per central bank data release. The SBP’s reserves are at its lowest since mid-2020. Overall, the nation’s liquid foreign exchange reserves dropped to $18.56bn as of March 2022, down 13% on a weekly basis. The country’s total foreign exchange reserves decreased by $5.4bn to $18.55bn in Q1 22 against $24bn as of end-December 2021. This decline is attributed to the repayment of external debt as a syndicated loan facility from China. SBP now expects the loan to get rolled over as negotiations are in progress.

Pakistan’s current account deficit for February improved sharply, down 78% to $545mn, against $2.53bn in January 2022. This was helped primarily by a drop in imports and also a tick higher in exports of goods and services. News wires note that the government is making efforts to maintain the reserves at a sustainable level by rescheduling the foreign debts, increasing remittances and exports.

Pakistan’s dollar bonds were higher – its 6.875% 2027 were up 2.7 points to 78.88 and yielding 12.13%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: