This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

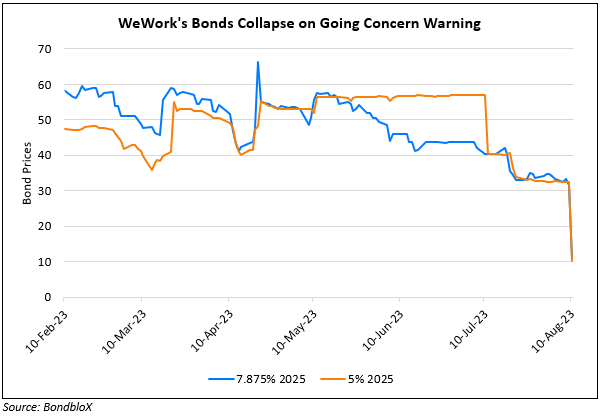

WeWork’s Bonds Collapse to 10 Cents on the Dollar after Bankruptcy Warning

August 10, 2023

WeWork’s dollar bonds have plunged by ~20 points to trade at just 10 cents on the dollar after it announced that there is “substantial doubt” about its ability to continue operating, citing sustained losses and cancelled memberships. WeWork continued to report losses with a Q2 net loss of $397mn and an occupancy rate of 72%. Once one of America’s most valuable startups, WeWork started its decline after launching a failed IPO in 2019 that necessitated a takeover from its largest investor SoftBank. Later, it was badly hit by the pandemic when its offices were vacated as workers transitioned to remote working. Despite a pickup in office occupancy over the last year, analysts note the recovery appeared to be unsustainable. It also suffered an exodus of executives with three of its board members departing just this week alone. In March this year, the company struck a deal with SoftBank and other major creditors to reduce its debt load by roughly $1.5bn and extend its other maturities. The company has said that it will remain committed to reducing rental costs, negotiating more favorable leases, increasing revenue, and raising capital over the next 12 months.

For more information, click here

Go back to Latest bond Market News

Related Posts: