This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

October 18, 2022

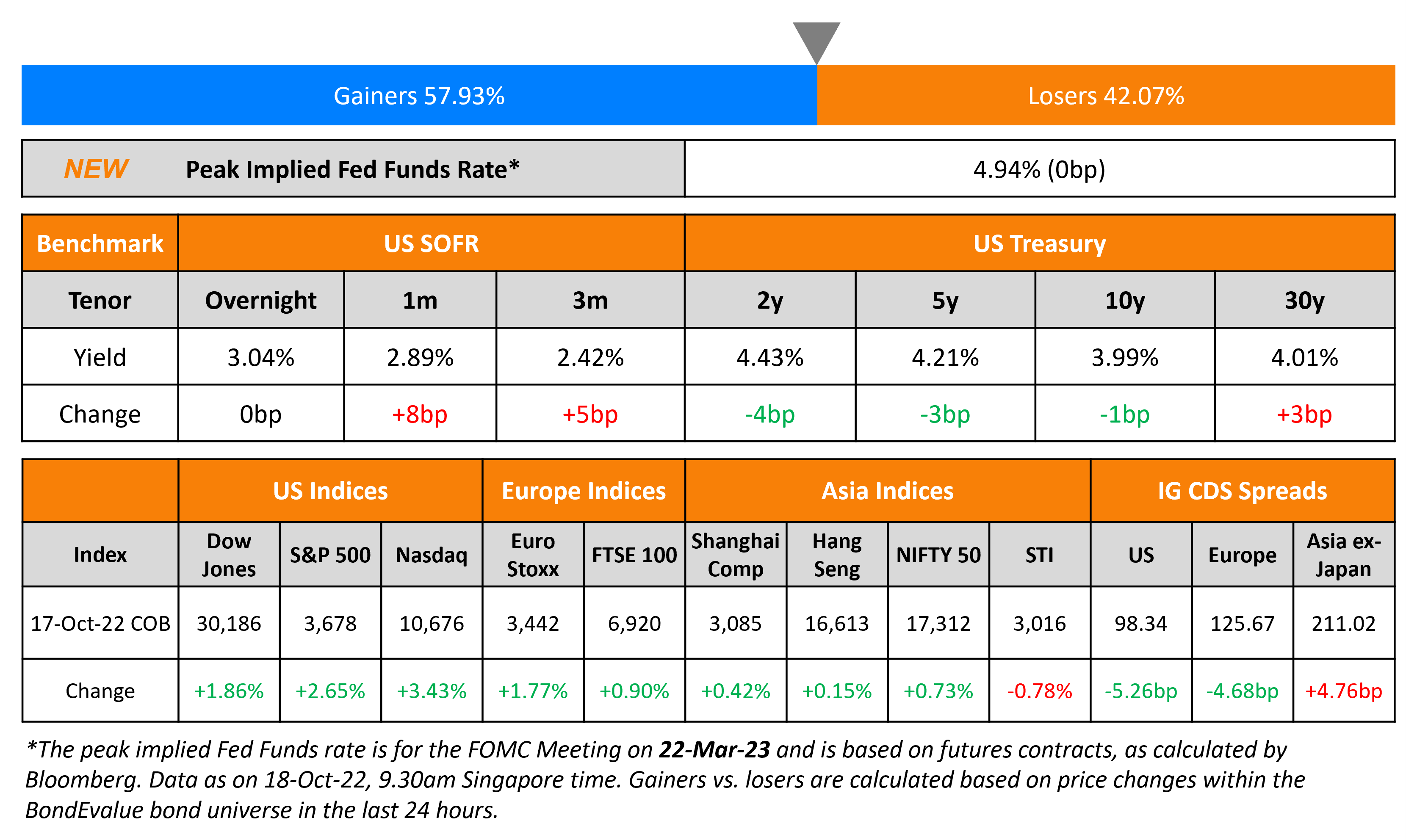

US Treasury yields eased slightly with the 2Y and 10Y yields down 3bp and 1bp. The peak Fed Funds Rate was unchanged at 4.94% for the FOMC’s March 2023 meeting. In the credit markets, US IG CDS spreads tightened 5.3bp and HY CDS spreads saw a 33bp tightening. US equity markets saw a sharp bounce on Monday, reversing Friday’s losses with the S&P and Nasdaq up 2.7% and 3.4% respectively. JP Morgan has said that they have cut down their overweight position in equities and have trimmed their underweight position in bonds due to increased risk that central banks will make a hawkish policy error, as per Reuters.

European equity markets also saw gains of over 1% with CDS spreads tightening across the board – EU Main and Crossover CDS spreads tightened by 4.7bp and 21bp respectively. Asian equity markets have echoed the move in global equity markets, having opened ~1% higher today. However, Asia ex-Japan CDS widened 4.8bp wider. China announced that it was delaying the release of its GDP numbers indefinitely, in a surprise announcement.

New Bond Issues

- AIA Group $ 5Y at T+175bp area

- Industrial Bank of Korea $ 2Y at T+85bp area

Bank of Nova Scotia raised $750mn via a 60NC5 bond at a yield of 8.625%, 12.5bp inside initial guidance of 8.75% area. The junior subordinated bonds have expected ratings of Baa3/BBB-. Proceeds will be used for general corporate purposes. If not redeemed by the call date of 27 October 2027, the coupon rate resets to the 5Y US Treasury yield plus a spread of 438.9bp. The new bonds are priced at a new issue premium of 21.5bp vs. its existing 3.625% 2081s that yield currently 8.41%.

New Bonds Pipeline

- Chiyu Bank hires for $ Perp NC5 AT1 bond

- Export Finance Australia hires for $ 5Y bond

- Aozora Bank hires for $ 3Y Green bond

Rating Changes

Term of the Day

Green Hushing

‘Green Hushing’ is a term that refers to a company deliberately underreporting/not publicizing their sustainable practices in fear of being accused of not doing enough. This is in contrast to ‘Greenwashing’ which a marketing practice where companies vastly overstate environmentally-friendly initiatives.

As per a study by South Pole, there is an increasing number of companies and businesses setting net-zero targets but many are choosing not to publicize their work. South Pole says that one in four companies setting science-based targets (SBTs) on climate change are not making them public which they cite is possibly because of “media scrutiny, NGO critique and the threat of lawsuits”.

Talking Heads

On J.P. Morgan trimming equity positions, adding to bonds

“While EPS revisions have been incredibly resilient so far, earnings are finally likely to see some weakness in Q3… intermediate yields look vulnerable given volatility and a dearth of buyers”

On Momentum Building for Creating a Treasury Bond Buyback Program

Lou Crandall, Economist at Wrightson ICAP

“When we warned last week that Treasury buybacks might begin to enter the debt management conversation, we didn’t expect them to jump so abruptly into the limelight… September’s liquidity strains may have sharpened the Treasury’s interest in buybacks, but this is not just a knee-jerk response to recent market developments”

Deborah Cunningham, CIO of Global Liquidity Markets and Senior PM at Federated Hermes

“You can drive a truck through the bid-ask spread” for some securities”

Chamath De Silva, Senior PM at BetaShares Holdings

“That does have actual implications for liquidity at a market structure level, and if there’s elevated rate volatility dealers have less capacity to warehouse risk across government bonds as well as spread products”

On Credit Markets Getting a Wake-Up Call With Balance-Sheet Cash Dropping

David Knutson, head of US fixed income product management at Schroders

“The withdrawal of liquidity is something that is going to have a profound impact… Eventually something will crack, something will be exposed”

Joe Boyle, fixed income product manager at Hartford Funds

“You have to look at every company and you have to look at the starting point coming into this year – balance sheets were very robust”

On Seeing More Stress in Leveraged Markets Post-UK – BlackRock’s Bob Miller

“When you tighten financial conditions this aggressively, this abruptly, things are going to break… Where do they break first? Almost always, it’s in the levered strategy… The push toward a much more aggressive fiscal policy kicked off more pressure in an already-deteriorating market… But the proximate cause of the real stress was the levered LDI business model. If you have to borrow to sustain your strategy and you have to pay higher margin costs to maintain your leverage, you’re in a really difficult spot right now.”

Top Gainers & Losers – 18-October-22*

Go back to Latest bond Market News

Related Posts:.png)