This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 21, 2021

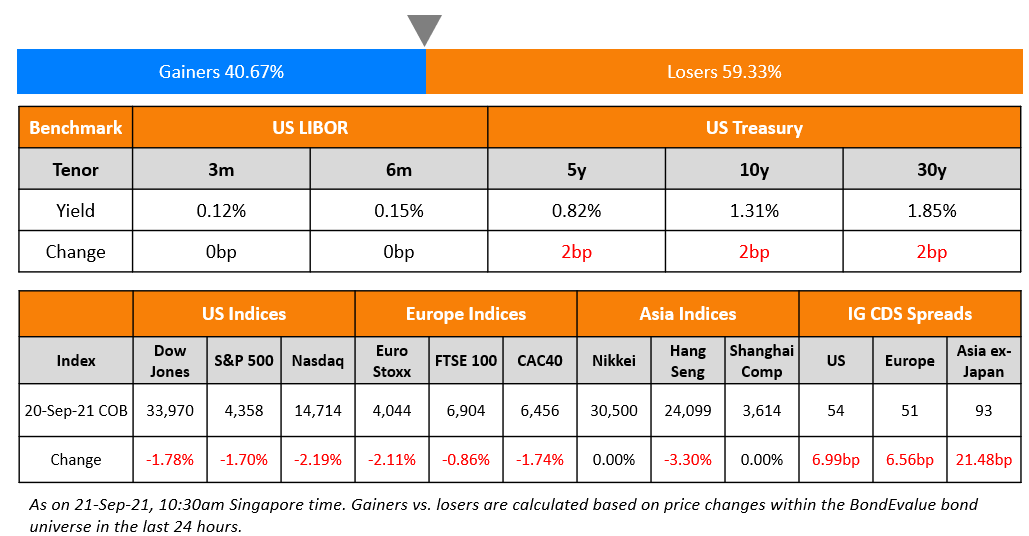

US markets witnessed a sharp sell-off making it the worst trading session since May. Market volatility remained high as investors watch for the impact of economic disruptions in China, particularly in the real estate space and the upcoming Fed Meeting – the tech heavy Nasdaq fell 2.2% while S&P dropped 1.7%. Sectors across were deep in the red led by Energy tanking 3% followed by Consumer Discretionary and Financials losing more than 2.2%. European stocks had a similar story – DAX fell another 2.3%, CAC 1.7% and FTSE 0.9% with banks falling as much as 4.1%. Brazil’s Bovespa plunged another 2.3% adding to the 2.1% loss witnessed on Friday. In the Middle East, UAE’s ADX and Saudi TASI lost 0.8% and 0.6% respectively. Shanghai remains closed for the mid-autumn festival holiday while most of the other Asian equity indices followed the West – HSI has added another 1% to yesterday’s losses of ~3% in early trading and Nikkei was down 2% while Singapore’s STI was slightly up 0.1%. Hong Kong’s CPI YoY for Aug came softer at 1.6% vs. 3.7% last year expectations of 1.8%. US 10Y Treasury yields widened 2bp to 1.31%.

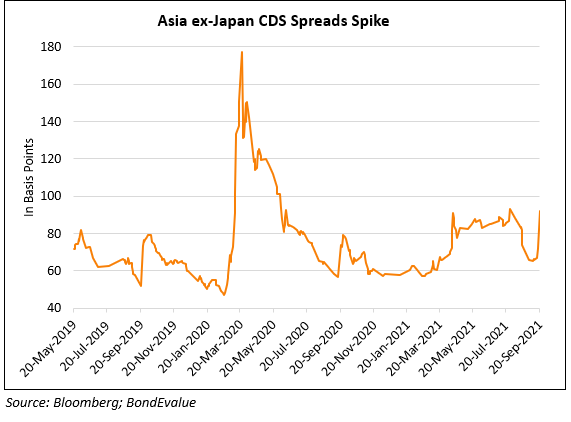

The credit risk sentiment impact was seen across CDS (Term of the Day, explained below) markets – US IG and HY CDX spreads widened 7bp and 8bp respectively. EU Main CDS spreads were 6.6bp wider and Crossover CDS spreads widened 25.8bp. Asia ex-Japan CDS spreads widened a massive 21.5bp (chart below) as contagion fears in China’s real estate sector grow as Evergrande stares at a possible default.

One Week To Go | Register for The Upcoming Bond Masterclass at a 25% Discount

Sign up for the upcoming 8-module course designed & curated to help develop a comprehensive understanding of bonds along with practical and actionable insights on how to trade and advise on bonds better. The course will be conducted via Zoom over 8 modules on 27-30 September and 4-7 October (Monday-Thursday) at 5pm Singapore / 1pm Dubai / 10am London.

The modules will cover bond valuation and risk, portfolio and leverage, AT1 bonds, high yield bonds, ESG bonds and more.

All attendees will receive a 1-month complimentary Premium subscription to the BondEvalue App, a certificate, presentations materials as well as 14-days access to video recordings to re-watch the sessions.

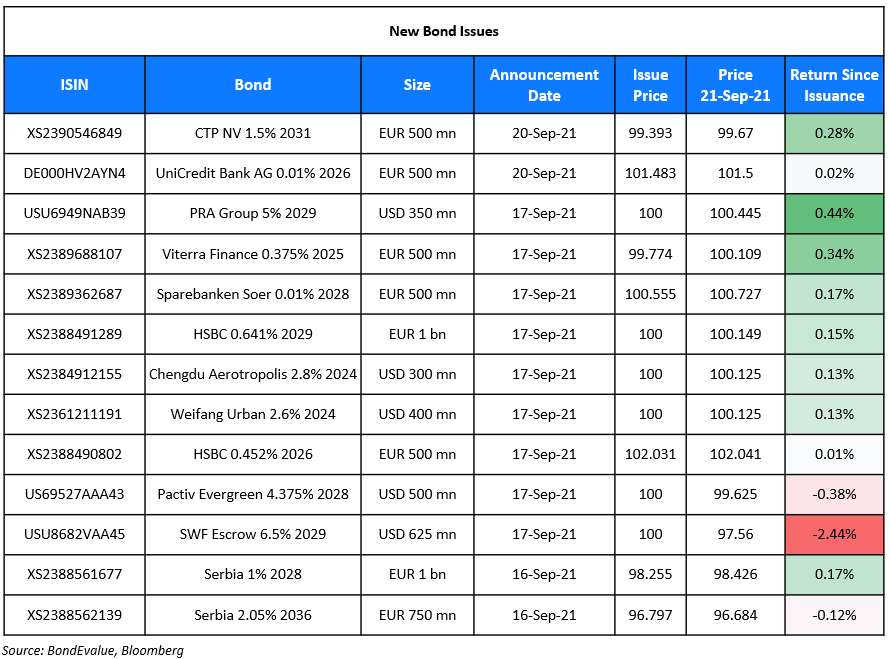

New Bond Issues

- KWG $158mn tap of 7.4% 2024s

CK Asset raised S$300mn ($222.8mn) via a fixed-for-life Perpetual non-call 3Y (PerpNC3) bond at a yield of 3.38%, 24.5bp inside initial guidance of 3.625% area. The bonds have expected ratings of A2 (Moody’s) and are issued by Panther Ventures, while CK Asset, formerly known as Cheung Kong Property Holdings, will be the guarantor. Private banks will receive a 20-cent rebate. The bonds have no coupon reset or step-up while the coupon is deferrable on a cumulative and compounding basis. Proceeds will be used for general corporate requirements. The deal is only the second fixed-for-life SGD-denominated Perp in after Mapletree Investments’ S$600mn ($443mn) PerpNC3 in August that priced at a yield of 3.7%. The bonds were priced 24bp wider to Mapletree’s 3.7% fixed-for-life Perp (unrated) that currently yield 3.14%. Proceeds will be used for general corporate requirements.

Zhongliang Holdings raised $200mn via a 1 year 7 month green bond at a yield of 12%. The bonds are rated B+ (Fitch). Proceeds will be used for debt refinancing and in accordance with the company’s sustainable finance framework.

New Bonds Pipeline

- Oxley Holdings hires for S$ tap of 6.9% 2024s bond

- Maldives’ HDC hires for $ 3Y sustainability bond

- Clover Aviation Capital hires for $ bond

- Apicorp hires for $ 5Y green bond

- Dat Xanh Group hires for $ debut bond

Rating Changes

- Moody’s upgrades the four largest Greek banks with positive outlook

- Fitch Revises LeasePlan’s Outlook to Stable; Affirms at ‘BBB+’

- Big River Steel LLC Upgraded To ‘B’, Outlook Positive On Improving Financial Position

- Fitch Upgrades Dell Technologies to ‘BBB-‘; Maintains Watch Positive; Removes UCO

- United States Steel Corp. Upgraded To ‘B’ On Debt Reduction And Windfall Cash Flow; Outlook Positive

- China SCE Group Holdings Outlook Revised To Stable On Steady Operations And Funding Access; ‘B+’ Ratings Affirmed

Term of the Day

Credit Default Swap (CDS)

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On China Property Fear Spreading Beyond Evergrande

Brian Quartarolo, portfolio manager at Pilgrim Partners Asia

“The price action across several asset classes in Asia today is horrendous due to rising fears over Evergrande and a few other issues, but it could be an overreaction due to all of the market closures”

Phoenix Kalen, head of emerging-market strategy in London

“The repercussions from Evergrande’s prospective collapse will likely contribute to China’s ongoing economic deceleration, which in turn anchors global growth and inflation, and casts a pall over commodity prices”

Hao Hong, chief strategist at Bocom International

“This is a paradigm shift…People need to keep a close look.”

On China Concerns Not Delaying Fed Signaling Taper Move – Former NY Fed President William Dudley

“They’re not going to react to small market moves and defer the tapering on that basis. They have to change their economic forecast. At this point it’s really premature to reach that conclusion. If inflation expectations truly become unanchored that’s a problem for actual inflation and I would think they’d have to react. On the other hand, if more officials project a rate increase next year “that may reduce the concerns about the Fed being late”

On Europe Facing Worst Corporate Credit Supply Squeeze Since 2005

James Vokins, head of investment-grade credit at Aviva Investors

“It’s getting to a situation where the credit market will be almost broken… It won’t be functioning with the liquidity it needs and that could be a concern for next year if the trend continues”

Thomas Neuhold, a portfolio manager at Gutmann Kapitalanlage AG

“The situation currently in the new issuance market makes it difficult to get paper for a reasonable premium. You’re trying to set spread limits and effectively end up sitting in cash.”

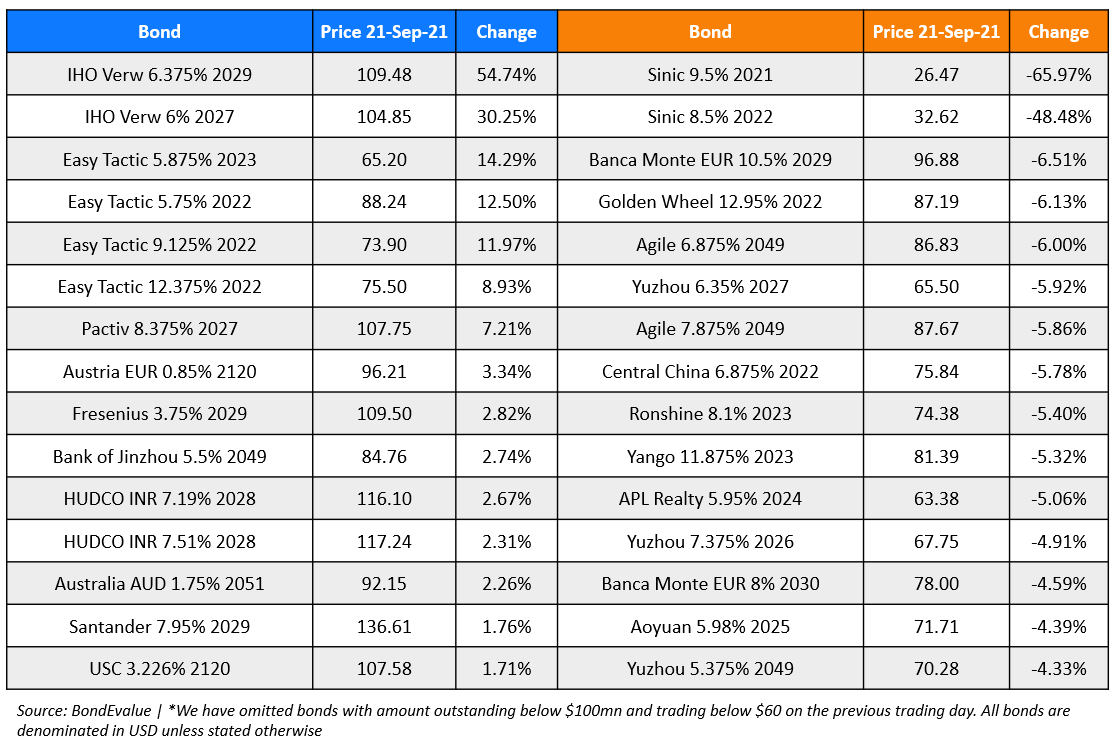

Top Gainers & Losers – 21-Sep-21*

Other Stories

Go back to Latest bond Market News

Related Posts:.png)