This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Suntec REIT, Yango, NagaCorp Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

June 7, 2021

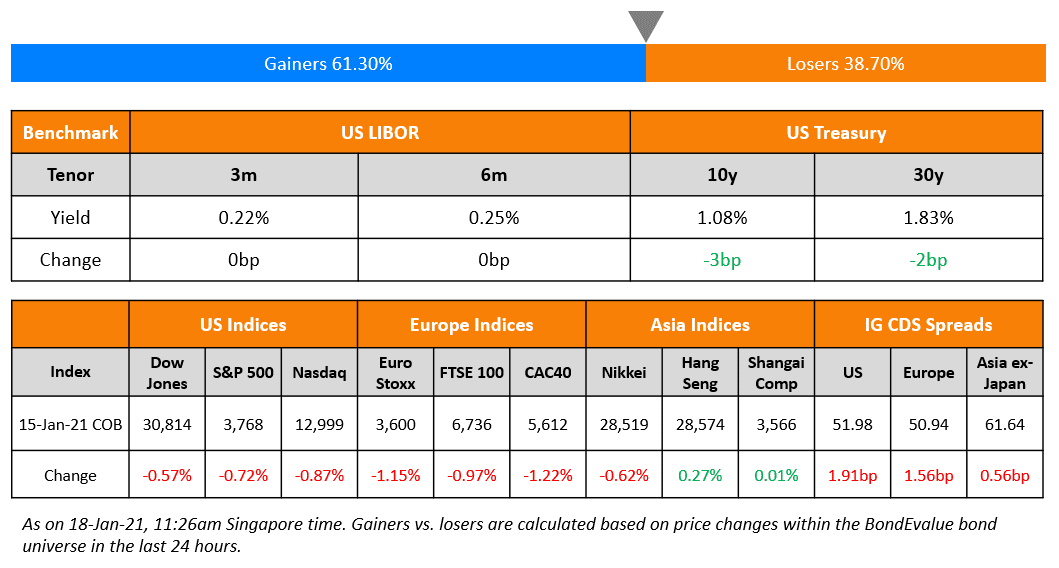

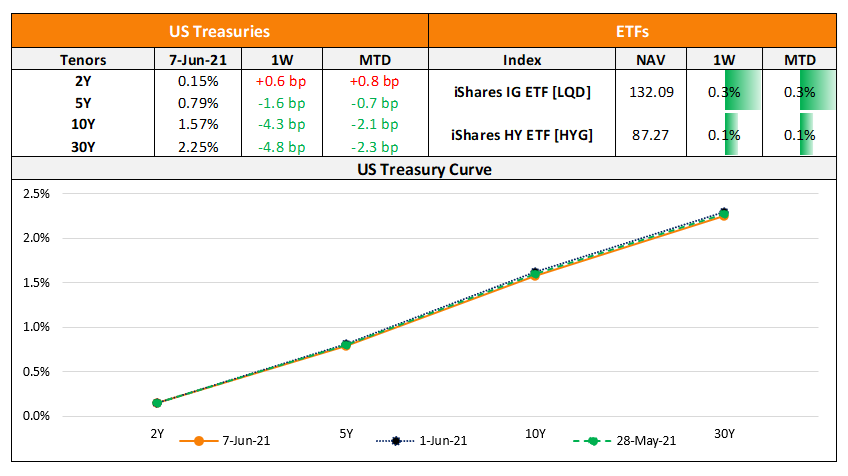

US stock markets ended the week in the green after the Non-Farm Payrolls report for May, where 559k jobs were added vs. 278k in April. The number was lower than the expectation of 671k. S&P was up 0.9% and the tech heavy Nasdaq was up 1.5% on Friday. The unemployment rate dropped to 5.8% from 6.1%, better than the expectation of 5.9%. US 10Y Treasury yields were 7bp lower to 1.56%. In Europe, DAX led the gains, higher by 0.4% while FTSE and CAC were up ~0.1% each. US IG and HY CDS spreads tightened 0.7bp and 4.5bp respectively. EU main and crossover CDS spreads tightened 0.6bp and 2.9bp respectively. Asian markets are flat with Asia ex-Japan CDS spreads tightening 2.5bp.

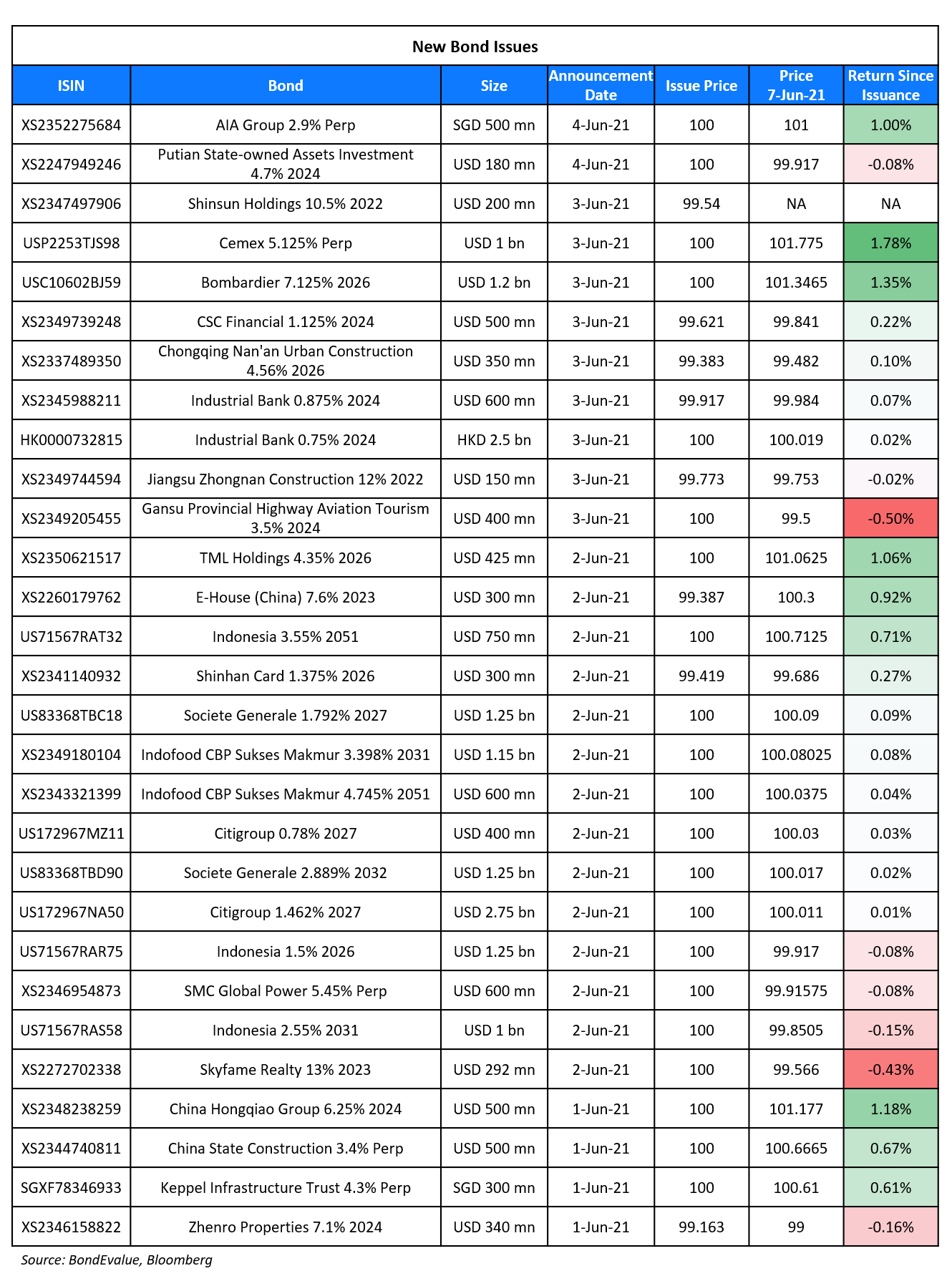

New Bond Issues

- NagaCorp tap of $ 7.95% 2024s IPG 6.875% area

- Suntec REIT S$ sub perpNC5 IPG at 4.45% area

- Fujian Yango Group US$ 3yr credit-enhanced bond FPG 4%

AIA Group raised S$500mn via a Perpetual non-call 10Y (PerpNC10) tier 2 bond at a yield of 2.9%. The bonds were rated A2. If not called on the first call date of June 11, 2031, the coupon resets to the prevailing SOR + initial credit spread of 133bp. There is no step-up. The coupon is deferrable and cumulative on a compounded basis. Bankers said the deal had been quietly offered to a limited group of investors, suggesting that it was either a private placement or a result of reverse enquiries (Term of the day, explained below). Proceeds will be used for general corporate purposes.

Putian State-owned Assets Investment raised $85mn via a tap of 4.7% 2024s at a yield of 4.7%. The bonds were rated BB+. The issuer is owned by the government of the Putian municipality in China’s Fujian province. Proceeds will be used for investments in domestic project construction and working capital purposes. The company had priced its debut $180mn 3Y bond at 4.7% earlier this year on April 20.

New Bond Pipeline

- Pacific Century Premium Developments hires banks bond issue

- SMBC Aviation hires banks for investor calls today

- Saudi Aramco hires for debut $ multi-tranche sukuk offering

- China Everbright Bank HK branch hires banks for $ bond issue

- Bayfront Infrastructure Capital II hires for $ multi-trancher backed by project finance portfolio

Rating Changes

- Moody’s upgrades Lionbridge Capital’s CFR to Ba3; changes outlook to stable

- Hong Kong And China Gas Co. Ltd. Downgraded To ‘A-‘ By S&P On Weaker Financials; Outlook Stable

- Australia Outlook Revised To Stable By S&P On Swift Economic Recovery; ‘AAA/A-1+’ Ratings Affirmed

- Uzbekistan Outlook Revised To Stable From Negative On By S&P Reduced Near-Term Fiscal And External Risks; ‘BB-/B’ Affirmed

- Papua New Guinea ‘B-/B’ Ratings Affirmed And Removed From CreditWatch Negative By S&P; Outlook Negative

- SMBC Aviation Capital Ltd. Outlook Revised To Stable From Negative By S&P On Expected Improved Metrics; ‘A-‘ Rating Affirmed

- Moody’s changes Gap Inc.’s outlook to stable; affirms Ba2 CFR

- Moody’s revises Lenovo’s outlook to positive; affirms Baa3 rating

- Moody’s withdraws Tahoe’s ratings due to insufficient information

The Week That Was

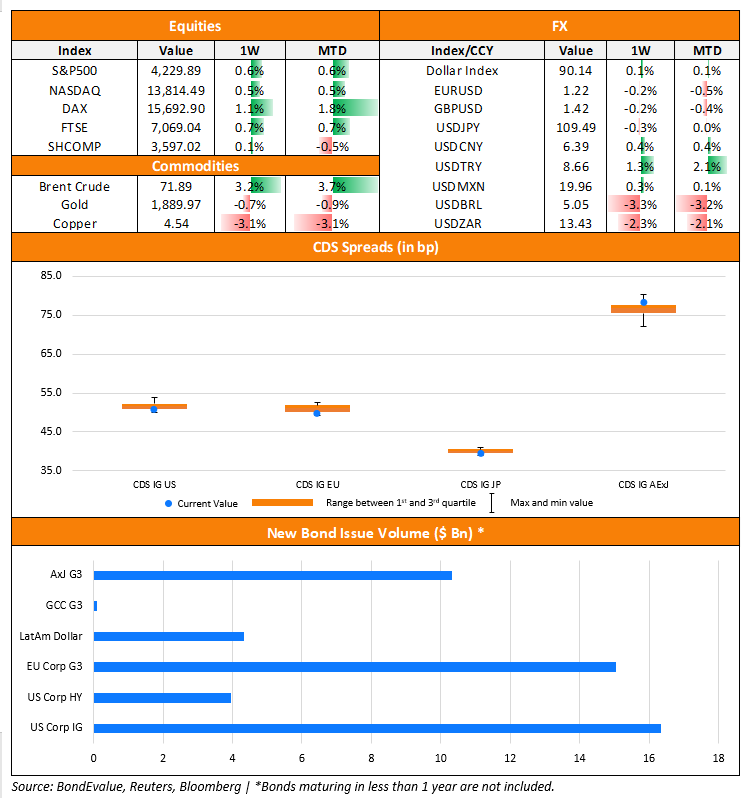

US primary market issuances dipped to $21.3bn, down 22% vs. $27.4bn in the week prior led by HY. IG issuances were lower last week at $16.4bn vs. $15bn in the prior week while HY issuances were down to $3.97bn vs. $12bn in the prior week. The largest deals in the IG space were led by Citigroup’s $3.15 two-trancher and Truist Financial’s $2bn deals. In the HY space, Lume Tech’s $1bn and Energy Transfer’s $900mn bond deals led the table. In North America, there were a total of 43 upgrades and 22 downgrades combined across the three major rating agencies last week. LatAm saw $4.3bn in issuances after two straight quiet weeks. The issuances were led by Petrobras’ $1.5bn 30Y to buyback bonds and Cemex’s 5.125% PerpNC5.25 deals. EU Corporate G3 issuances saw a sharp drop last week to $15bn vs. $37.4bn in the week prior – the table was led by Nestle’s €3.15bn ($3.8bn) four-trancher, SocGen’s $2.5bn dual-trancher and Vodafone’s $1.95bn two-trancher. Across the European region, there were 27 upgrades and 14 downgrades across the three major rating agencies. GCC and Sukuk G3 issuances were muted last week vs. $5bn in the week prior. Across the Middle East/Africa region, there were no upgrades and 3 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances were flat at $11.2bn vs. $11.3bn in the prior week. Indonesia’s $3bn three-trancher led the issuances followed by Indofood’s $1.75bn two-trancher, Worley US’s €500mn ($611mn) and Industrial Bank HK’s and $600mn deals. In the Asia ex-Japan region, there were 6 upgrades and 15 downgrades combined across the three major rating agencies last week.

Term of the Day

Reverse Enquiry

A reverse enquiry is an inquiry made by a potential investor to an issuer about purchasing a particular debt security in a one-off transaction. Here, the banker to the transaction acts as an agent to the institutional investor and tailors the issuance to meet the investor’s needs.

AIA Group raised S$500mn via a PerpNC10 tier 2 bond with bankers saying it was either a private placement or a result of reverse enquiries. Unlike typical bond issues which are launched with an initial guidance and priced later in the day or in the following day, AIA’s bonds came to the market at a final price guidance of 2.9%.

Talking Heads

“If we ended up with a slightly higher interest-rate environment it would actually be a plus for society’s point of view and the Fed’s point of view.” “We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade,” she said. “We want them to go back to” a normal environment, “and if this helps a little bit to alleviate things then that’s not a bad thing — that’s a good thing.”

“In the past I saw many risks related to deflation” but now “it’s clear that we need to be very careful about inflation, as we have been careful about deflation,” he said. “I am sure we will be successful in keeping inflation in check if it comes.”

Thomas Simons, economist at Jefferies

“Certainly, this is not the ‘million jobs per month’ that looked like the base-case expectation for the late spring ahead of the April payrolls data, but it isn’t a disaster either.”

Alicia Levine, chief strategist at BNY Mellon Investment Management

“The Fed is making greater progress on its inflation goals than it is on its employment goals.”

Willem Sels, chief investment officer for private banking and wealth management at HSBC

“There are pockets of wage pressure where there are labour shortages, but these seem limited in scope, and with oil price base effects fading in coming months, we think we should also see aggregate [consumer price] inflation start to stabilise in coming months,” Sels said.

“There are pockets of wage pressure where there are labour shortages, but these seem limited in scope, and with oil price base effects fading in coming months, we think we should also see aggregate [consumer price] inflation start to stabilise in coming months,” Sels said.

Luca Paolini, chief strategist at Pictet Asset Management

“As long as the US economy remains strong and the dollar quite weak it’s difficult to see oil prices going down from here.”

“As long as the US economy remains strong and the dollar quite weak it’s difficult to see oil prices going down from here.”

Randy Kroszner, an economics professor at the University of Chicago Booth School of Business and former member of the Fed’s Board of Governors

“A taper tantrum that leads to a spike in U.S. rates would start attracting investors out of most other asset classes, including emerging-market assets, into the US.” “That would be a time of flight to relative quality. That would be time when people move into relatively safer emerging-market assets and pull out of relatively riskier ones.”

Eugenia Victorino, head of Asia strategy at Skandinaviska Enskilda Banken AB

“The emerging-market space will have to navigate around Fed communication on tapering.” “Foreign positioning is also important. If there is a build-up in foreign positioning, the risk of a reversal in flows would have a more dramatic impact than if positioning had been light.”

Alan Wilson, portfolio manager at Eurizon SLJ Capital

“Ongoing U.S. exceptionalism is highly likely to result in further market tests of the accommodative stance of the Federal Reserve,” Wilson said.

“[The Fed] cannot tolerate the catastrophic consequences of bond origination and secondary trading snapping shut.” “To truly exit from the bond market, the Fed has signaled it will need to address its concerns with a major market player: mutual funds.”

Sahap Kavcioglu, Turkish central bank governor

“Expectations for an early easing of policy, which aren’t based on a just reasoning, need to disappear,”

Viktor Szabo, a fixed-income fund manager at Aberdeen Asset Management

“The risk of policy mistakes has increased so much that it overrides any other investment rationale.”

“Investors are requiring higher risk premium for the escalating social conflict in Colombia and the possible sizable change in economic policy stance that could take place if a radical candidate won the 2022 presidential election.” “Brazil’s social backdrop looks much calmer by comparison.”

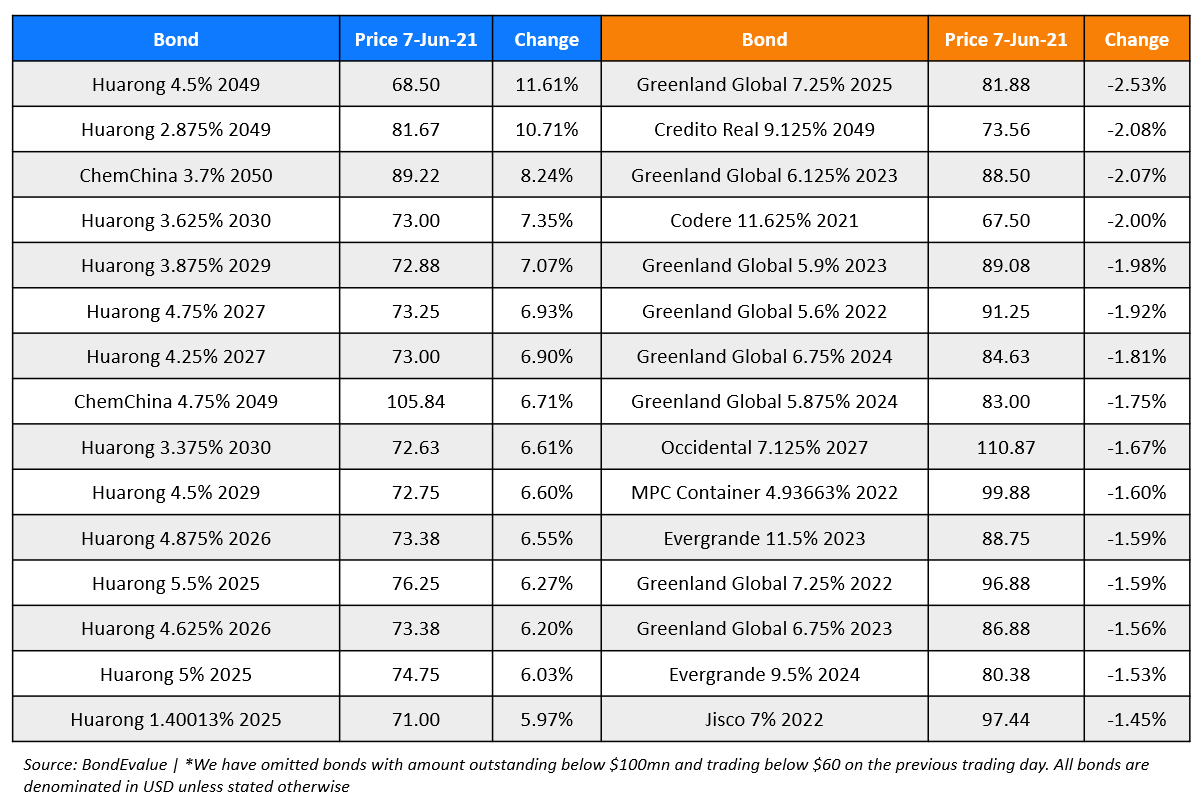

Top Gainers & Losers

Other Stories

Go back to Latest bond Market News

Related Posts: