This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 30, 2021

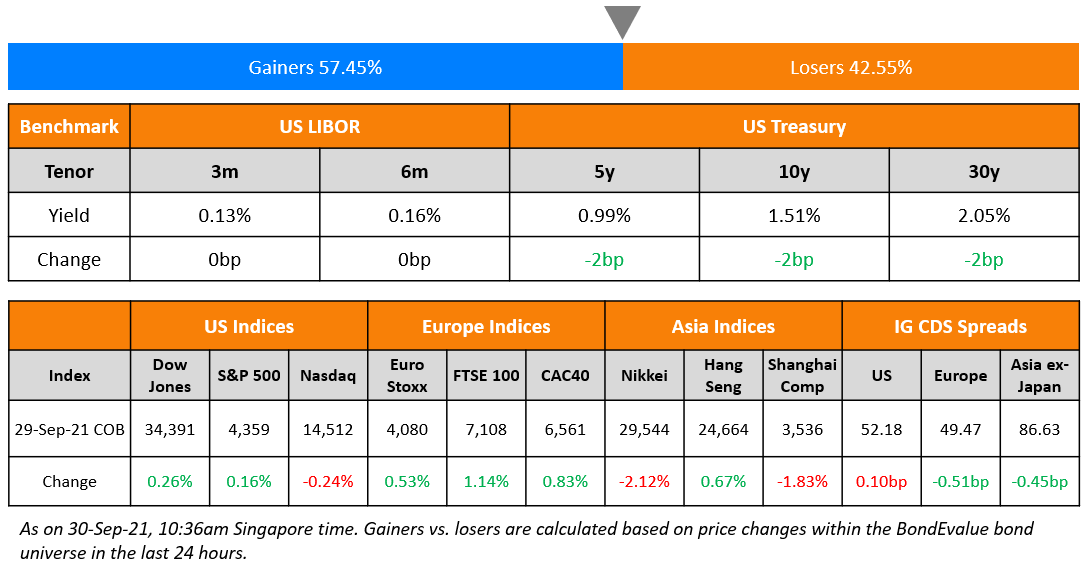

US markets ended mixed after selling-off sharply a day earlier as the S&P climbed 0.2% while the Nasdaq Composite slipped 0.2%. US 10Y Treasury yields eased 2bp to 1.51% after a sharp rise over the last week. Utilities and Consumer Staples led the gains while Materials and Communication Services led the losers. European stocks on the other hand jumped with the DAX and CAC up 0.8% each and FTSE up 1.1%. Brazil’s Bovespa also rose 0.9%. In the Middle East, UAE’s ADX ended 0.3% lower while Saudi TASI ended flat. Asia Pacific markets are mixed with Shanghai up 0.5%, HSI down 1%, STI up 0.6% and Nikkei down 0.3%. US IG CDS spreads were 0.1bp wider while HY CDX spreads tightened 1.3bp. EU Main CDS spreads were 0.5bp tighter and Crossover CDS spreads tightened 6.9bp. Asia ex-Japan CDS spreads widened 0.2bp.

EU consumer confidence for September improved from the prior month’s -5.3 but still stood at -4. Spanish HICP inflation came at 4%, higher than forecasts of 3.7%. Weekly US Crude inventories saw an increase of 4.58mn, after seven straight weeks of decline with the EIA saying that production rebounded after recent storms.

Bond Portfolio Optimization & Discussion on Leverage | Today at 5pm SGT

Last call for today’s masterclass on New Bond Issues & Credit Ratings, designed and curated for bond investors and professionals to learn about the new bond issue process, terminology, timelines and analysis. The session will also cover understanding and interpreting credit ratings. The masterclass will be conducted live via Zoom by Dr. Rahul Banerjee, Founder & CEO of BondEvalue and ex-debt capital market banker with two decades of experience across premier banks such as Standard Chartered, Credit Suisse and Citi. Click on the image below to reserve your seat.

Attendees on a trial plan will receive a 1-month complimentary Premium subscription to the BondEvalue App and attendees with a current subscription will receive a 1-month free one-tier plan upgrade. All attendees will also receive a certificate, presentations materials and 14-days access to video recordings to re-watch the sessions.

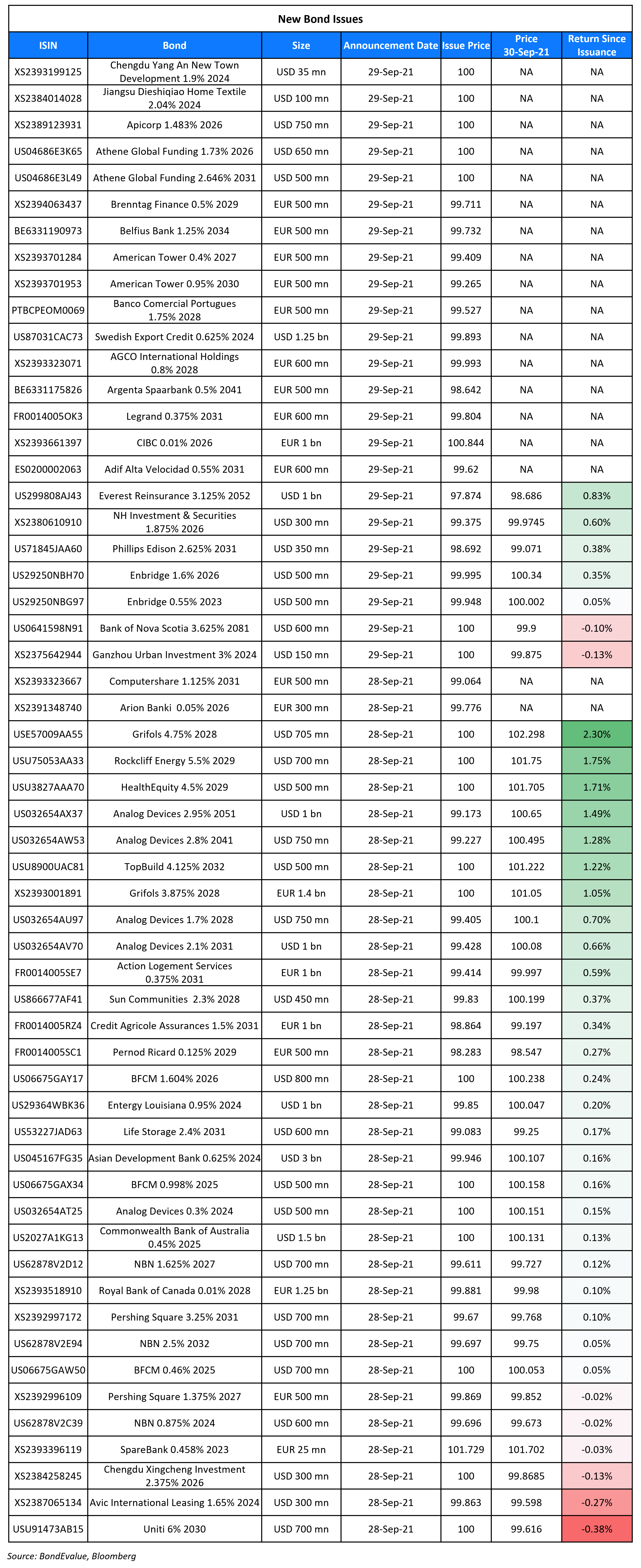

New Bond Issues

- Yanan New Area Investment Development 364-day $ notes at 5.2% area

Bank of Nova Scotia raised $600mn via a 60NC5 bond at a yield of 3.625%, 37.5bp inside initial guidance of 4% area. The bonds have expected ratings of Baa3/BBB-. The bonds are callable first in 5Y on 27 October 2026 and every quarter thereafter. If not called, the coupon will reset on 27 October 2026 to the prevailing US 5Y Treasury + 261.3bp.

Arab Petroleum Investments Corp (Apicorp) raised $750mn via a 5Y green bond at a yield of 1.1483%, 10bp inside initial guidance of MS+50bp area. The bonds have expected ratings of Aa2/AA (Moody’s/Fitch), and received orders over $2.1bn, 2.8x issue size. The bonds will be used to finance, refinance or invest in projects linked to Apicorp’s green finance framework, including green buildings, renewable energy and pollution prevention and control. The new bonds are priced 11.2bp tighter to its existing 1.26% non-green 2026s that yield 1.26%.

Sembcorp Industries raised S$675 via a 10.5Y sustainability-linked bond (SLB) at a yield of 2.66%, inline with initial guidance of 2.66%. The bonds are unrated, and received orders over S$700mn, 1.07x issue size. The bonds will be issued by Sembcorp Financial Services and guaranteed by Sembcorp Industries. There is a one-time 25bp per annum coupon step-up effective from the first interest payment date on or after April 1 2026 if the energy and urban developer fails to meet the sustainability performance target of achieving GHG emissions intensity at 0.40 tonnes of carbon dioxide per megawatt hour produced (tCO2e/MWh) or lower as of December 31, 2025. This is Singapore’s second sustainability-linked bond offering, following Surbana Jurong’s S$250mn 2031s issued in February. The new bonds are priced 3bp tighter to its existing 2.45% green 2031s that yield 2.69%.

NH Investment & Securities raised $300mn via a 5Y bond at a yield of 2.007%, 25bp inside initial guidance of T+125bp area. The bonds have expected ratings of A3/A– (Moody’s/S&P), in line with the issuer, and received orders over $1.2bn, 4x issue size. This is the firm’s debut offshore bond. Asia bought 96% while EMEA took 4%. Banks and financial institutions bought 50%, fund/asset managers 48%, and insurance 2%.

Ganzhou Urban Investment Holding Group raised $150mn via a 3Y bond at a yield of 3%, 50bp inside the initial guidance of 3.5% area. The bonds have expected ratings of BBB– (Fitch). The issuer is the primary infrastructure investment entity of Ganzhou city in China’s Jiangxi province and has businesses in infrastructure construction and property development.

Jiangsu Dieshiqiao Home Textile raised $100mn via a 3Y bond at a yield of 2.04%, unchanged from initial guidance. The bonds are unrated and are supported by a letter of credit from Bank of Shanghai Nanjing branch. The issuer is an SOE in the Haimen district, Jiangsu province.

Chengdu Yang An New Town Development raised $35mn via a 3Y bond at a yield of 1.9%, inline with initial guidance. The bonds have expected ratings of A+ by local rating agency Pengyuan, and are supported by a letter of credit from ICBC, Sichuan branch. The issuer is one of the major SOEs for investment, financing, operation and management of city infrastructure construction in Qionglai city, China’s Sichuan province.

New Bonds Pipeline

- Saigon-Hanoi Bank hires for $ bond

- Burgan Bank hires for $ 500mn 6NC5 bond

- Kexim hires for $/€ bond

- Clover Aviation Capital hires for $ bond

- Dat Xanh Group hires for $ debut bond

- Helenbergh China hires for $ 270 mn 2Y green bond

- GD-HKGBA Holdings hires for $ 2Y bond

Rating Changes

-

Fitch Downgrades Evergrande and Subsidiaries, Hengda and Tianji, to ‘C’

- Moody’s upgrades Bayan Resources to Ba2; outlook stable

- Erste Group Outlook Revised To Positive On Effective Resolution Strategy And Loss-Absorption Buffers; ‘A/A-1’ Affirmed

- Dell Technologies Inc. Upgraded To ‘BBB’; Outlook Stable On Improved Financial Profile Following Expected Spin-Off Of VM

- Fitch Revises Braskem Idesa Rating Watch to Positive

- Moody’s places IBM’s A2 senior unsecured rating on review for downgrade

Term of the Day

Average Inflation Targeting (AIT)

Average Inflation Targeting (AIT) is a type of strategy by the Fed where 2% is average inflation over time. In essence, an inflation rate of 2% is not a cap and hence the Fed may let inflation exceed 2% modestly and temporarily to make up for past low inflation. The key aim of this policy shift is anchoring inflation expectations especially since their earlier inflation policy was seen with as a flexible inflation targeting with the Fed being symmetric in responding towards inflation overshooting or undershooting of the target. For example, the latest September 2021 FOMC statement, ‘the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time”, showing that the Fed is not symmetric in its approach to inflation and rather uses AIT.

Talking Heads

“It is a problem for China, problem for its housing market. A problem for the whole segment that relies on this. There’s a lot of jobs related to this and a lot of commerce related to this.” “The default rate has dropped below 2%, and what you’re going to see is about 1%. I wouldn’t worry too much at this stage about defaults,” he said.

On bond yield surge testing investor confidence in Big Tech companies

Shawn Snyder, head of investment strategy at Citi US Consumer Wealth Management

“A lot of them have not wanted to retreat from their positioning.” For tech stocks, “the valuations remain elevated and they remain at risk when yields take these sharp jumps up.” “There’s a lot of caution about exactly where things go from here.”

Leslie Thompson, managing member at Spectrum Management Group

“Everything gets thrown out, so that’s why we’re seeing some of the declines in tech across the board.”

“I may have mentioned at some other occasion that we have brought Mr. Simon Wilson, who is the substantive financial secretary, back in the office and we are now looking and assessing our debt arrangement to determine how we best approach and how we do avoid any default,” he said. “We intend to live up to our obligations and where we are unable to, we intend to renegotiate terms, so as not to be in default.”

“The question is whether there will be broader spillover effects on the Chinese economy,” said Wong. “That — we are monitoring closely but overall our assessment remains that China’s economy will still grow strongly this year.”

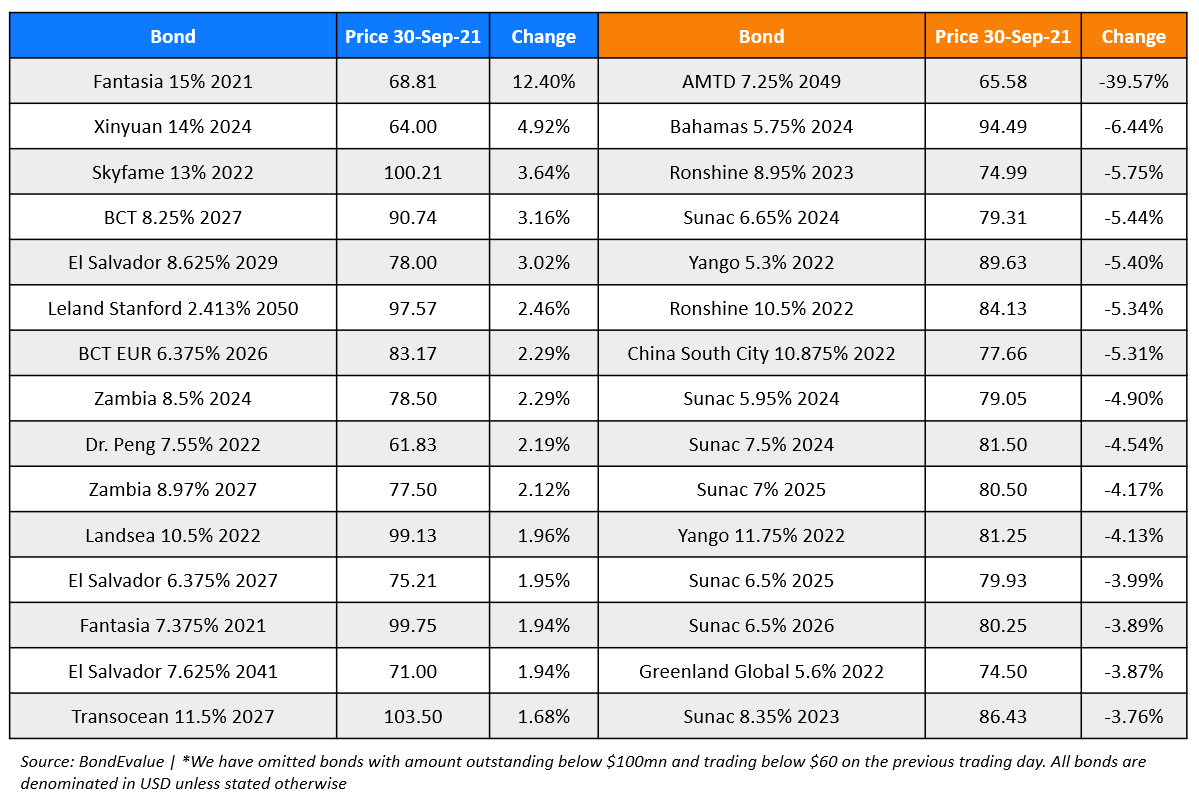

Top Gainers & Losers – 30-Sep-21*

Go back to Latest bond Market News

Related Posts:.png)