This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 22, 2022

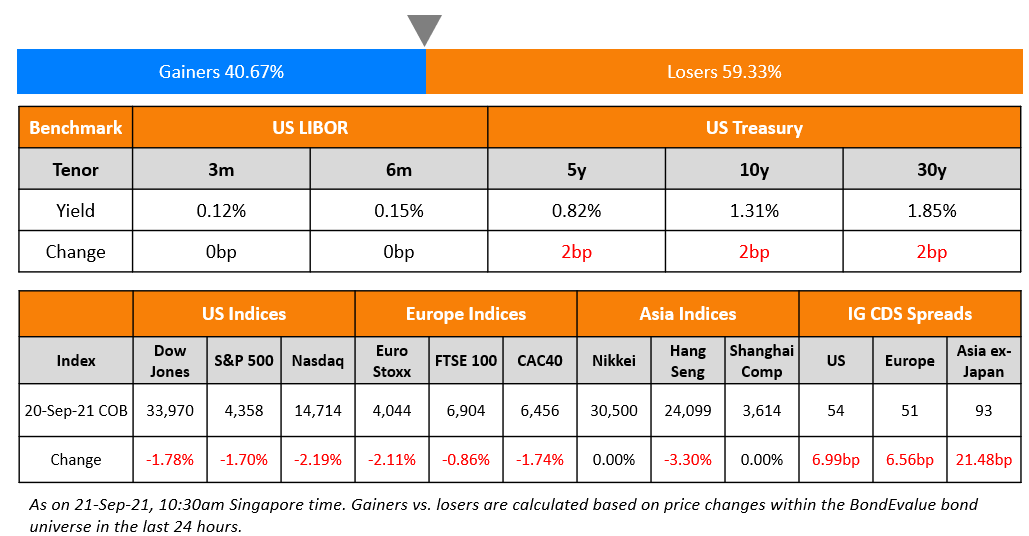

US Treasury yields were little changed across the curve yesterday. The peak Fed Funds rate was up 2bp to 5.08% for the June 2023 meeting. Federal Reserve’s Loretta Mester said that she does not have a problem with slowing down rate hikes from 75bp to 50bp in December. Meanwhile, another Fed governor Mary Daly said that she believes the impact of Fed hikes are likely bigger than what target rate implies, noting that financial markets are acting like the fed rate is ~6%. Probabilities of a 50bp hike at the FOMC’s December meeting currently stands at 76%. US IG CDS spreads tightened 0.3bp and HY spreads saw a 0.6bp tightening. US equity markets ended lower with the S&P and Nasdaq down 0.4% and 1.1%.

European equity markets were also higher. EU Main CDS spreads widened 0.3bp and Crossover spreads widened 4.5bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads widened by 8bp.

New Bond Issues

- BoCom HK $ 3Y at T+100bp area; 2Y Dim Sum at 3.5% area

- Shangrao Investment $ 3Y at 8% area

ArcelorMittal raised $2.2bn via a two-tranche deal. It raised:

- $1.2bn via a 5Y bond at a yield of 6.572%, 20bp inside initial guidance of T+275bp area. The new bonds are priced 55.2bp wider vs. its existing 4.25% 2029s that yield 6.02%, despite the shorter tenor.

- $1bn via a 10Y bond at a yield of 6.888%, 20bp inside initial guidance of T+325bp area.

The senior unsecured bonds have expected ratings of Baa3/BBB-. Proceeds will be used for general corporate purposes and to repay commitments under the $2.2bn bridge term facility agreement related to the financing of the intended acquisition of Companhia Siderúrgica do Pecém.

Credit Agricole raised €2.25bn via a two-tranche deal. It raised

- €1.1bn via a long 4Y bond at a yield of 3.426%, 25bp inside initial guidance of MS+100bp area. The bonds received orders over €1.4bn, 1.3x issue size.

- €1.25bn via a 12Y bond at a yield of 3.94%, 25bp inside initial guidance of MS+150bp area. The bonds received orders over €2.6bn, 2.1x issue size.

The senior preferred bonds have expected ratings of Aa3/A+/AA-.

Deutsche Bank raised €750mn via a 5Y bond at a yield of 4.025%, 35bp inside initial guidance of MS+170bp area. The senior preferred bonds have expected ratings of A1/A-/A-, and received orders over €3bn, 4x issue size.

ASB Bank raised $650mn via a 5Y bond at a yield of 5.398%, 20bp inside initial guidance of T+160bp area. Proceeds from the unrated senior unsecured bonds will be used for general corporate purposes.

Jinan Rail Transit Group raised $200mn via a 1Y green bond at a yield of 6.75%, 45bp inside initial guidance of 7.2% area. The senior unsecured bonds are rated A- by Fitch.

New Bonds Pipeline

- Rakuten Group hires for $500mn 2Y bond

- Korea Investment & Securities hires for $ Green bond

- Zhongrong International Trust hires for $ 367 mn Short 1Y bond

Rating Changes

- Axis Bank Upgraded To ‘BBB-/A-3’ On Improving Asset Quality; Outlook Stable

- Delhi International Airport Ltd. Outlook Revised To Positive On Stronger Traffic; ‘B’ Ratings Affirmed

- Moody’s changes Carvana’s outlook to negative, Caa1 CFR affirmed

Term of the Day

Standby Letter of Credit

Standby Letter of Credit (SBLC) is a note issued by the buyer’s bank to the seller’s bank, where the former guarantees to pay a sum of money to the latter if the buyer defaults on the agreement. Particularly in the shipping of goods, SBLCs are used to reduce risks associated with the transaction on unforeseen events leading to a default. Bonds backed by the above structure are called SBLC-Backed Bonds. Unlike guarantees, which are direct obligations of a bank to cover the timely payment of related bonds, SBLCs require trustees of the bonds to provide demand notices to the banks in the event that issuers fail to make bond payments. Thus as Moody’s says, more analysis is required on whether the language of SBLCs and transaction mechanisms support timely payments.

Jinan Industry Development last week raised $114mn via a 364-day bond at a yield of 7.5%, where Bank of Qingdao Jinan branch was providing a standby letter of credit.

Talking Heads

On High-Yield Party Returning to Emerging Markets Being Too Cheap to Ignore

Ben Luk, a senior multi-asset strategist at State Street Global Markets

“Cheaper high-yield emerging-market bonds do look more attractive relative to investment grade”… recent rebound in commodity prices, especially oil, could also “generate greater cash flow and lower the chance of any sovereign default in the near term.”

Tellimer’s Stuart Culverhouse and Patrick Curran

“The easing in risk sentiment has opened up a window of opportunity for outperformance in selected emerging-market assets, particularly those that sold off by more than fundamentals would warrant”

Guido Chamorro, co-head of EM hard-currency debt at Pictet Asset Management

“There are very attractive yields, especially if one can look through short-term volatility periods that we think will still happen from time to time”

On Supporting A Smaller Rate Hike in December – Cleveland Fed President Loretta Mester

“I think we can slow down from the 75 at the next meeting. I don’t have a problem with that, I do think that’s very appropriate. But I do think we’re going to have to let the economy tell us going forward what pace we have to be at… Right now my forecast is that we’re going to see some real, good progress on inflation next year. We won’t be back to 2%, but we’ll see some meaningful progress next year”

“The level of financial tightening in the economy is much higher than what the (federal) funds rate tells us… financial markets are acting like it is around 6%… it will be important to remain conscious of this gap between the federal funds rate and the tightening in financial markets. Ignoring it raises the chances of tightening too much”

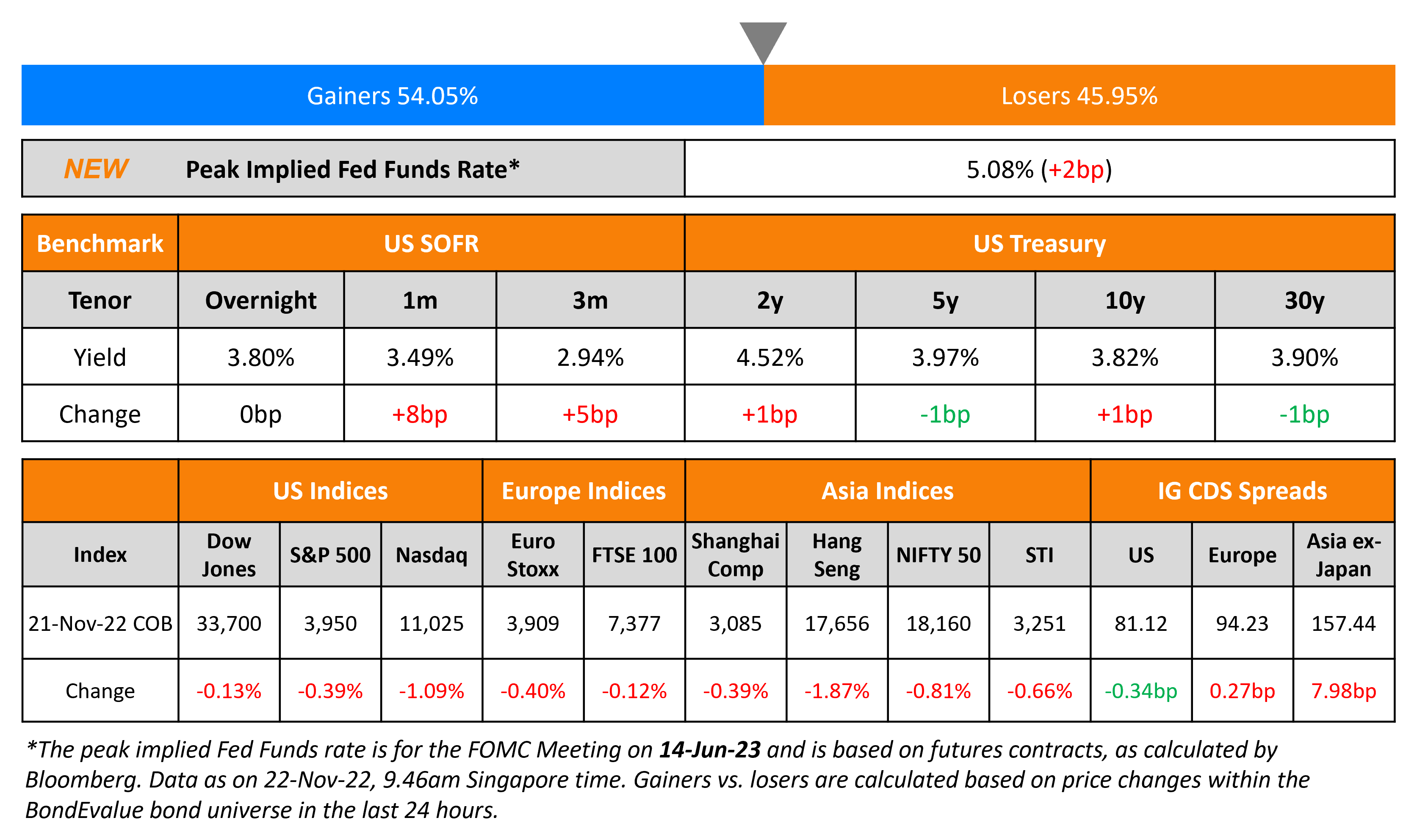

Top Gainers & Losers – 22-November-22*

Go back to Latest bond Market News

Related Posts:%20x%20311px%20(h).jpg?upscale=true&width=1400&upscale=true&name=Tablet%20banner%20661px%20(w)%20x%20311px%20(h).jpg)