This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

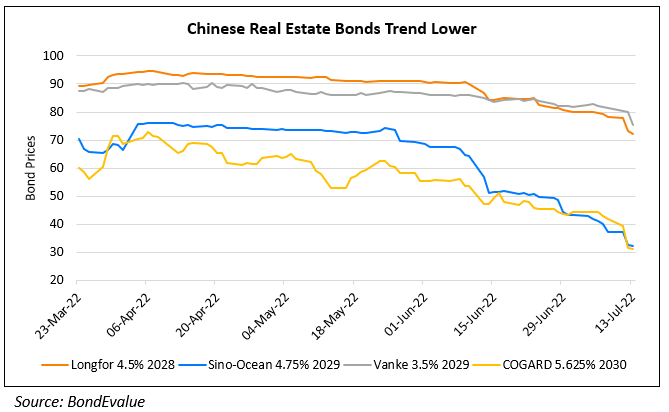

Dollar Bonds of Vanke, Longfor Continue to Drop

September 11, 2024

Dollar bonds of China Vanke and Longfor Group continued to trend lower across their curve. This comes after continued pressures from declines in property sales and worries about liquidity across Chinese developers. For instance, Vanke’s contracted sales fell 24% YoY in August, as compared to a 13% YoY drop in July. With this Vanke reported its first half-yearly loss in more than two decades. S&P recently downgraded Vanke by two notches to BB- from BB+, citing poor sales and weakened liquidity, expecting contracted sales to decline by 35% and 18% in 2024 and 2025 respectively. Some analysts have noted that investor sentiment is not positive as more policy support towards the sector has not come out, disappointing their hopes.

Vanke’s 3.975% 2027s are down 3.6 points to 47.4. Longfor’s 4.5% 2028s are down 1.6 points to 70.8, yielding 16.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts: