This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vanke Downgraded Two Notches to BB- by S&P

September 9, 2024

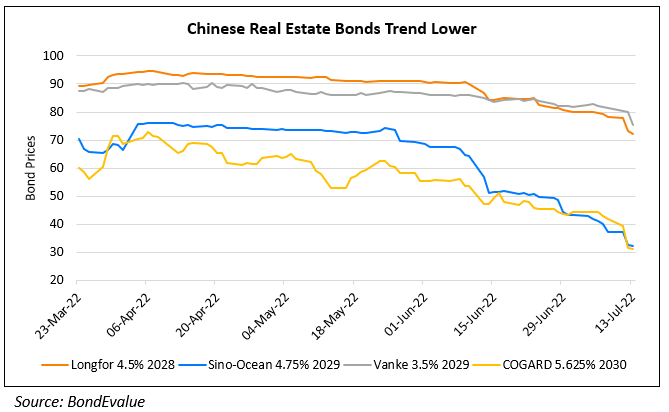

China Vanke was downgraded by two notches to BB- from BB by S&P due to its weakening sales and margins. The rating agency expects Vanke’s contracted sales to decline by 35% and 18% in 2024 and 2025 respectively, given a weak property market sentiment in China. Also, due to high-cost projects acquired before 2022 Vanke’s margins are set to remain under pressure in 2024-25. Due to a decreasing EBITDA, S&P expects the developer’s financial metrics to deteriorate with leverage jumping to 8.5-9.2x in 2024-2026 (vs. 4.2x in 2023), and EBITDA interest coverage weakening to 2.3-2.4x (vs. 4.6x in 2023). It also noted that weakening contracted sales would lead to falling funds from operations that will undermine Vanke’s liquidity. Besides, S&P assesses Vanke’s liquidity to be less than adequate.

Vanke’s dollar bonds were trading stable with its 2027s and 2029s at 50-52 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Vanke Unit to Raise ~$790mn via Hong Kong IPO

September 19, 2022