This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Yuzhou’s Dollar Bonds Take Another Beating With Some Losing As Much As 20%

March 29, 2021

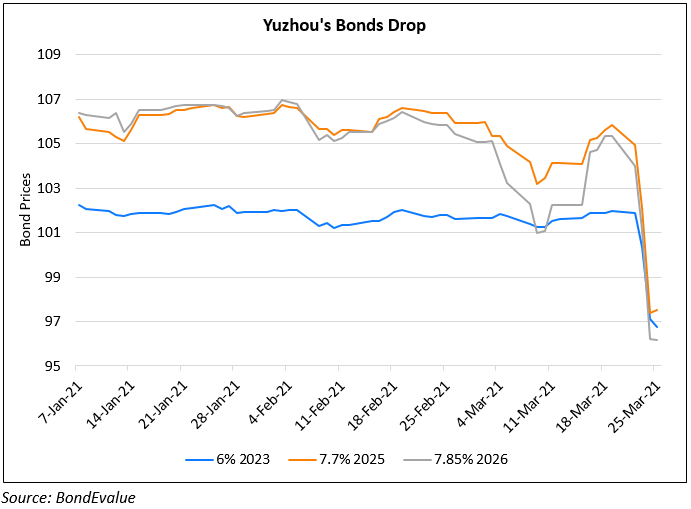

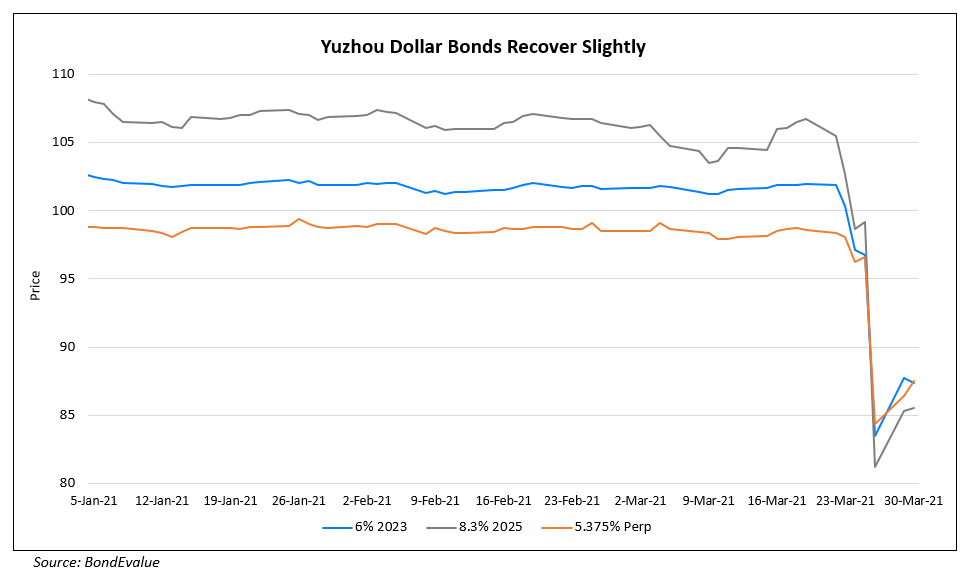

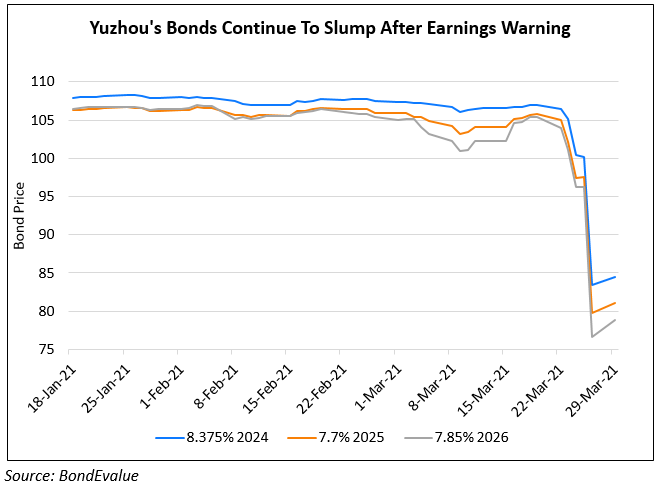

Chinese real estate developer Yuzhou Group gave further details on its profit decline in an earnings guidance investor call on Friday. They said net income in 2020 would be about CNY 117mn ($18mn), vs. CNY 3.61bn ($550mn) in 2019, a drop of almost 96%. Further, earnings would drop “significantly” on the back of lower margins from regulatory control measures and delays for some projects due to the pandemic. People who attended the investors’ call noted the management saying that as of December, the company had not breached thresholds on net debt/equity and cash/short-term borrowing under the “three red lines” framework. Yuzhou’s net debt/equity as of June 2020 was at 94% and cash reserves cover short-term debt about 1.6 times as compared to thresholds of 100% and a minimum of 1x respectively. They added that Yuzhou was ready to take measures to boost investor confidence like share buybacks if necessary. The company will release its results on Tuesday. Yuzhou’s bonds fell late last week after Moody’s downgraded the company to B1 from Ba3 with a negative outlook. The company’s dollar bonds topped the losers list on Friday with its 7.85% 2026s and 7.375% 2026 falling the most, as much as 20% to 76.7 and 76.8 respectively.

Go back to Latest bond Market News

Related Posts: