This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

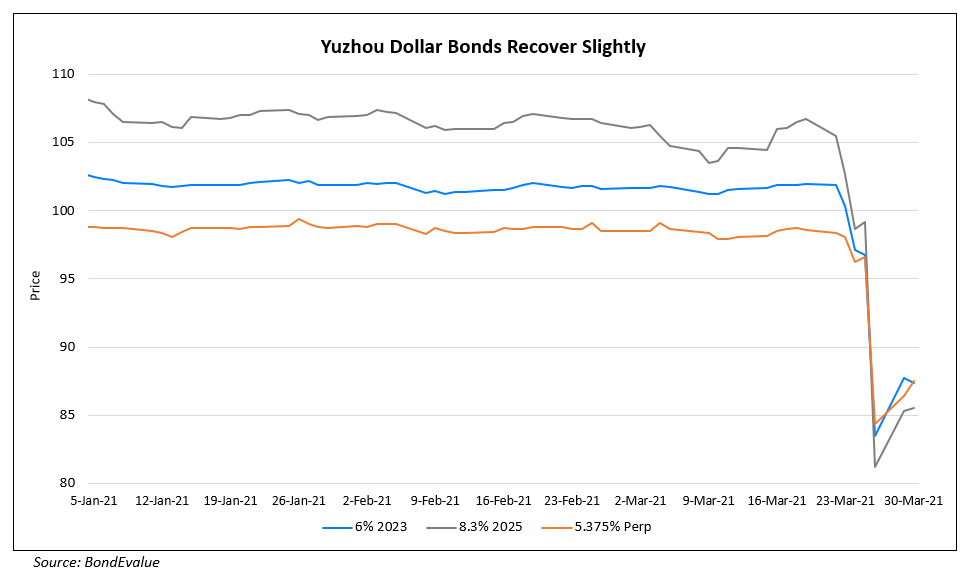

Yuzhou’s Bonds Recover Slightly

March 30, 2021

Dollar bonds from Chinese real estate developer Yuzhou Group recovered slightly after bond prices plummeted late last week following the release of its earnings guidance leading to a credit rating downgrade. The company will release its earnings later today. The company’s dollar bonds’ topped the gainers list today, with its 7.85% 2026s and 6.35% 2027s recovering by 7.5 and 6.5 points to 84.13 and 82.30 this morning, yielding 11.9% and 10.5% respectively. Despite the recovery, Yuzhou’s dollar bonds remain ~10 points below its price last week before the downgrade to B1 from Moody’s.

Go back to Latest bond Market News

Related Posts: