This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Yuzhou Downgraded To B1 From Ba3 With Negative Outlook; Dollar Bond Slip

March 24, 2021

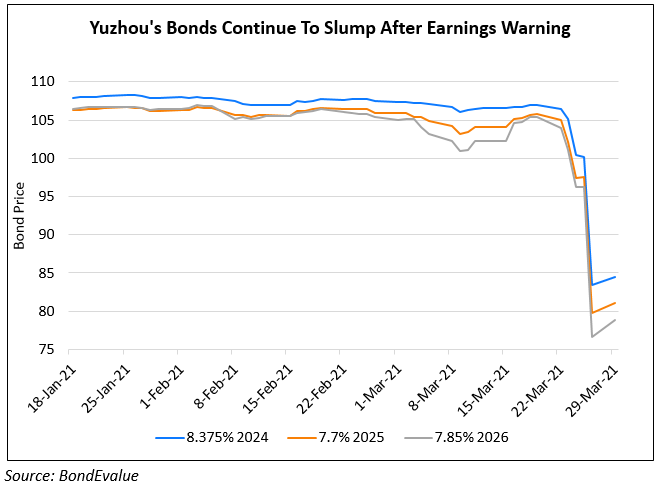

Chinese property developer Yuzhou Group’s corporate family rating was downgraded by Moody’s to B1 from Ba3 and its senior unsecured rating was downgraded to B2 from B1 with a change in outlook to negative from stable. Moody’s cited Yuzhou’s recent profit warning and the rating agency’s expectations that its revenue recognition would be weak due to the delivery of presold projects. Moody’s cited weak credit metrics and high reliance on sales from JVs and associates, which constrain corporate transparency. Moody’s expects leverage (revenue/adjusted debt) to stay weak at 35-40% in the next 1-1.5 years similar to the 35% in the previous year ending June 2020 – this goes contrary to Moody’s original expectation of an improvement. EBIT/interest ratio is expected to fall to 1.6x-1.7x from 2x during the same period. With this backdrop, Yuzhou’s funding access could get impacted, particularly bank funding for project development, Moody’s notes. Overall, they expect Yuzhou’s liquidity to remain adequate given ability to pay debt and land payment commitments over the next 12 months. Given the negative outlook, an upgrade is unlikely.

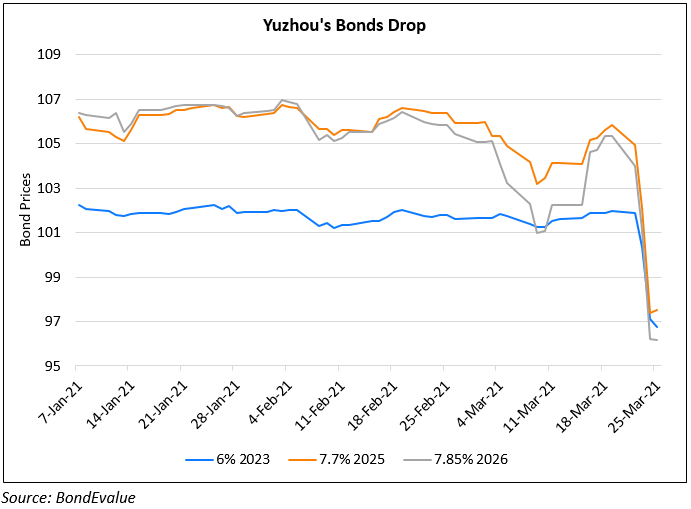

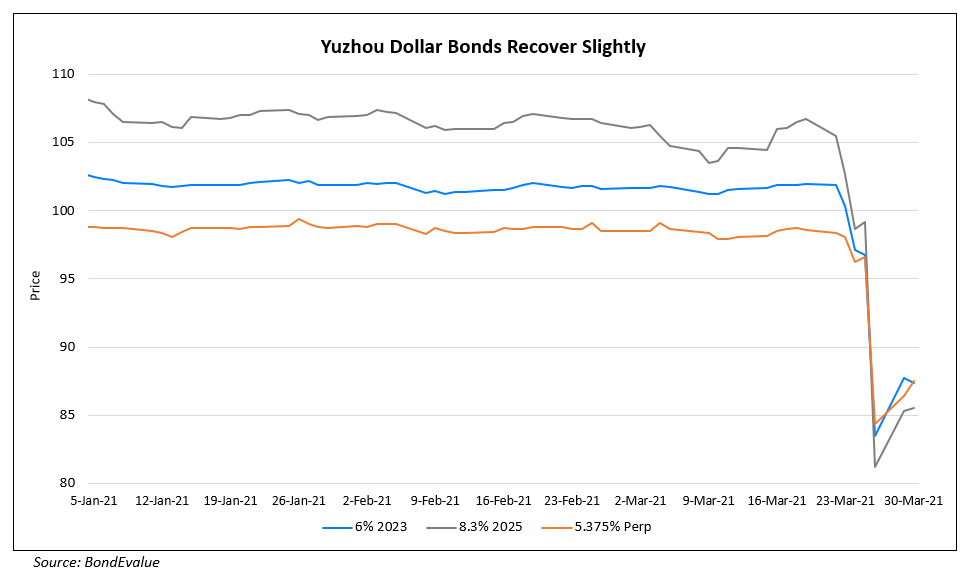

Yuzhou’s dollar bonds fell over 1 point yesterday – its 7.7% 2025s are down 3.3 points since the beginning of the week to 101.63, yielding 7.21% and its 8.5% 2023s are down 1.6 during the same period to 105.19, yielding 5.51%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: