This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Woori, SM Investments, Morgan Stanley Price $ Bonds

July 18, 2024

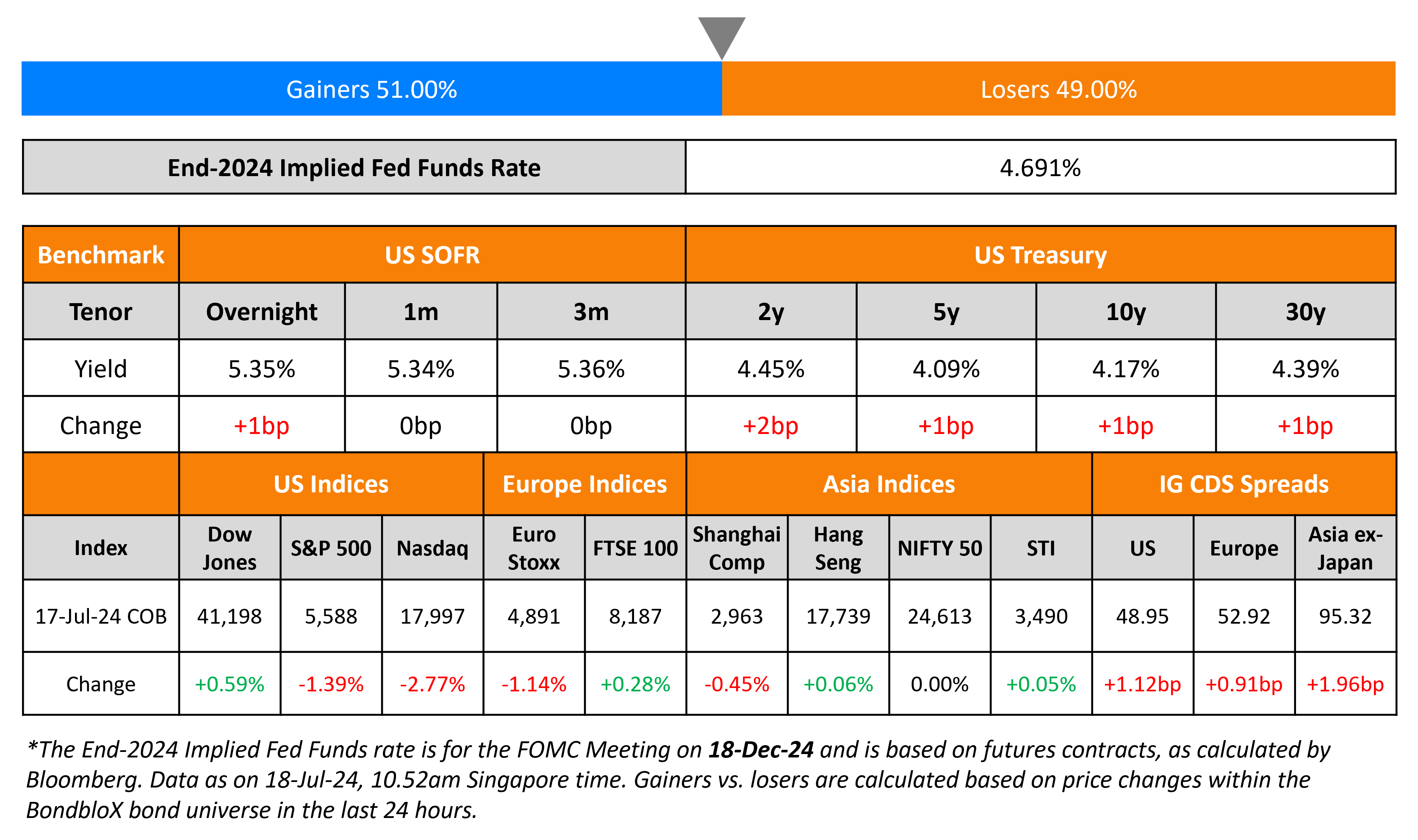

US Treasury yields held steady across the curve yesterday. However, equity indices dropped, particularly with the Nasdaq falling 2.8% and the S&P down 1.4%, on the back of a sharp drop across semiconductor stocks. Fears of heightened US trade tensions with China and uncertain relations with Taiwan weighed on markets after comments by Donald Trump, the Republican presidential nominee. He said, “Taiwan should pay for defense”, underlining the role of the US in helping Taiwan with analysts also noting that markets are slowly believing in Trump getting elected. Also, anonymous sources said that the Biden administration, told allies that it was considering using the most severe trade restrictions available on companies like Tokyo Electron and ASML Holding if they continue to give China access to advanced chip technology. US IG spreads were 1.1bp wider and HY CDS spreads were wider by 6.8bp.

European equity indices ended mixed. In credit markets, the iTraxx Main and Crossover spreads were wider by 1bp and 5bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 2bp wider.

Happening Today

New Bond Issues

- R.R. Donnelley $ at 9.25% area

Morgan Stanley raised $8bn via a four-part offering.

Both the 4NC3s are issued by Morgan Stanley Bank NA under the 3(a)(2) bank note program with an Aa3/A+/AA- rating. The other two senior unsecured bonds issued by the group itself and are rated A1/A-/A+. Proceeds will be used for general corporate purposes. The new fixed-rate 4NC3s are priced almost in-line with its existing 4.952% 2028s (callable in 2027) that yield 4.98%. The new 6NC5s are priced in-line with its existing 5.656% 2030s (callable in 2029) that yield 5.04%. The new 11NC10s are also priced roughly in-line with its existing 5.831% 2035s (callable in 2034) that yield 5.29%.

Woori Bank raised $550mn via a PerpNC5 bond at a yield of 6.375%, 37.5bp inside initial guidance of T+165bp area. The junior subordinated bonds are rated BBB- (S&P). If not called by 24 July 2029, the coupons will reset to the 5Y UST plus a spread of 227.7bp then and every five years thereafter. The bonds will be fully and permanently written-off upon designation of the issuer as an “insolvent financial institution” pursuant to Act on the Structural Improvement of Financial Industry of Korea. The bonds have a dividend stopper (Term of the Day, explained below).

SM Investments raised $500mn via a 5Y bond at a yield of 5.466%, 35bp inside initial guidance of T+170bp area. The senior unsecured bonds are unrated. The issuer is Smic SG Holdings Pte and the bonds have a guarantee from SM Investments Corp. Proceeds will be used for general corporate purposes.

Greensaif Pipelines raised $3bn via a two-part issuance. It raised $1.4bn via a 12Y bond at a yield of 5.852%, ~22.5bp inside initial guidance of T+205bp area. It also raised $1.6bn via an 18Y bond at a yield of 6.103%, 22.5bp inside initial guidance of T+225bp area. The senior secured bonds are rated A1/A+ (Moody’s/Fitch), and have an amortizing repayment profile. The new 12Y bonds have a weighted average life (WAL) of 10.2 years and the 8Y notes have a WAL of 14.7 years. Greensaif Pipelines Bidco, the issuer indirectly owned by BlackRock and Hassana Investment Co and is the issuing entity of Aramco Gas Pipelines Co.

New Bonds Pipeline

- Masdar hires for $ 5Y/10Y Green bond

Rating Changes

- BRB – Banco de Brasilia S.A. Long-Term Credit Rating Cut To ‘B’ On Capital And Profitability Strains; Outlook Stable

- Fitch Downgrades Intrum to ‘CC’

- Grupo IDESA Downgraded To ‘CCC+’ From ‘B-‘ Following Weak Operating Cash Flows; Outlook Stable

- Moody’s Ratings changes PetSmart’s outlook to negative; affirms B1 CF

Term of the Day

Dividend Stopper

Dividend stopper is a common covenant seen in perpetual bond structures that requires the bond issuer to not pay a dividend, if it decides to stop coupon payments on the perpetual bonds. Some contingent convertible (CoCo) perpetual bonds have a clause that allows the issuer to skip a coupon payment at their discretion, if the financial situation of the issuer is stressed. In such cases, a dividend stopper covenant is beneficial to the CoCo bondholders as it restricts the issuer from paying dividends on its equity in times when it has not paid coupon to its CoCo bondholders. This is why the presence (or absence) of a dividend stopper covenant is seen as the determining factor on whether the CoCo perpetual bonds are not (or are) subordinated to its equity.

Talking Heads

On US Election Angst May Create Buying Opportunity for Korean Bonds

Choi Jinyoung, Mirae Asset

“There’s a risk for bond yields to climb, led by longer tenors, due to uncertainties around the US November elections”

On BOJ Likely to Skip Rate Hike This Month – Former Official, Hideo Hayakawa

“I don’t think there’s a chance of a rate hike in July. It’s hard to confirm from recent data that the economy is definitely progressing in line with BOJ expectations… shouldn’t be ultra-cautious about cutting back its bond buying”

On Fed should be patient on next move – JP Morgan’s Dimon

“Inflation is moving in the right direction. But it would be good if the Fed waited now… there are a lot of reasons why inflation could rise again in the future: increasing government spending, the re-militarization of the world… “

Top Gainers & Losers- 18-July-24*

Go back to Latest bond Market News

Related Posts: