This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Economy Grew at 4.9% in Q3; Treasury Yields Move Lower

October 27, 2023

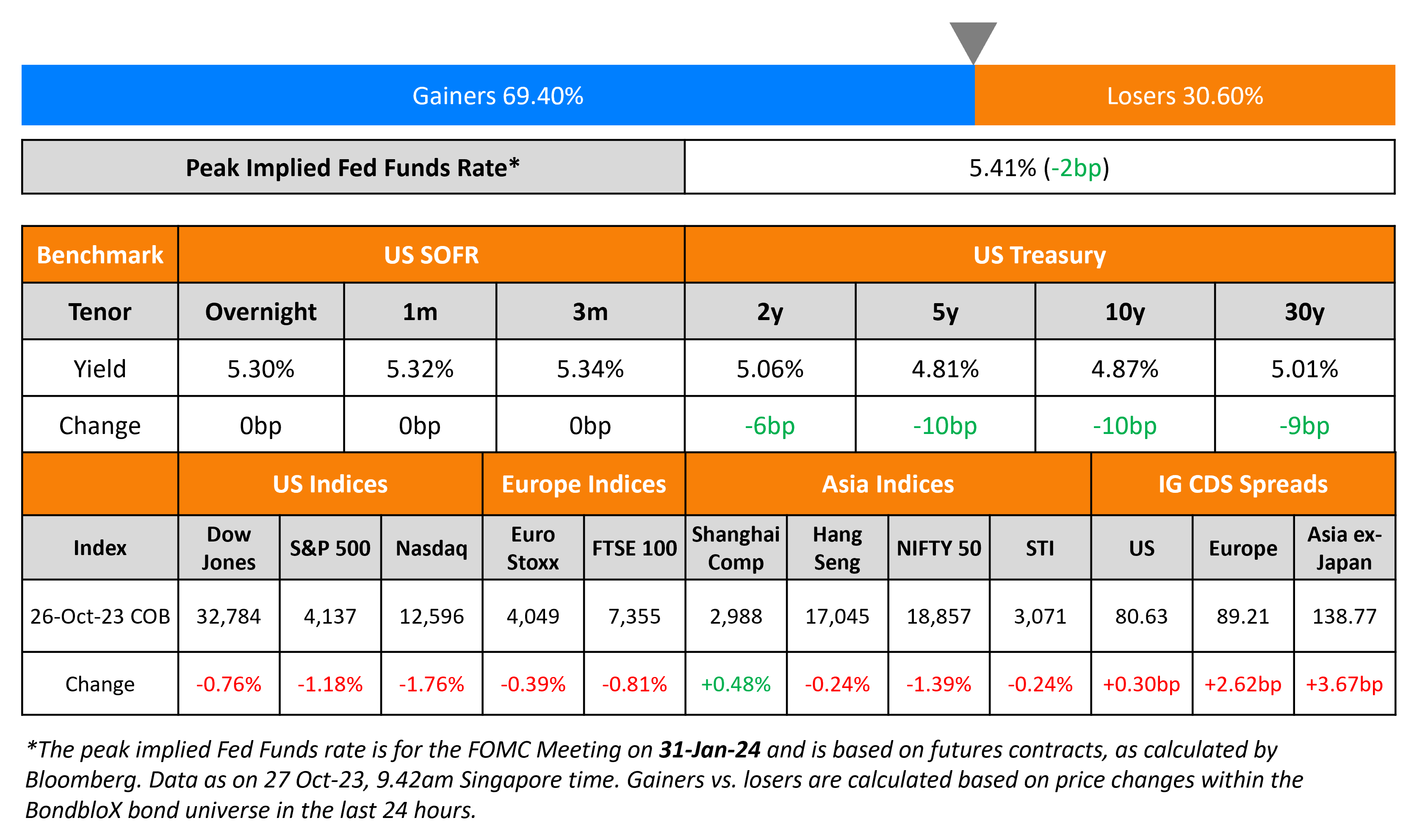

US Treasury yields dipped across the curve yesterday despite solid economic data. The 2Y yield fell 6bp while the 5Y, 10Y and 30Y yields fell 9-10bp. The preliminary Q3 US GDP print showed that the economy grew at an annualized rate of 4.9% last quarter, the fastest since 2021. This is more than double that of the Q2 pace of 2.1%, and also higher than estimates of 4.5%. Personal consumption also jumped the most since 2021 by 4%, in-line with estimates. Core PCE for the prior quarter rose 2.4%, lower than the expected 2.5% and the previous quarter’s 3.7%. Also, durable goods orders for September rose sharply by 4.7%, significantly higher than the forecasted 1.9% and the prior month’s 0.1%. Initial jobless claims rose to 210k last week from 200k, above estimates of 207k.

US credit markets saw IG CDS spreads widen 0.3bp and HY spreads wider by 0.6bp. Investment managers including Vanguard, T. Rowe Price and others have come out with calls to buy bonds again, given that treasury yields crossed the 5%-mark earlier this week (scroll down to the ‘Talking Heads’ section to read more). US equity markets continued to sell-off, with the S&P and Nasdaq down 1.2% and 1.8% respectively.

European equity markets were lower too. In credit markets, European main CDS spreads were wider by 2.6bp and crossover spreads widened 8.4bp. The ECB kept its policy rates unchanged as expected, ending a streak of 10 consecutive rate hikes. However, they noted that the market talk of rate cuts was premature. Asian equity markets have opened in the green today. Asia ex-Japan IG CDS spreads widened 3.7bp.

New Bond Issues

Fujian Zhanglong raised $500mn via a short 3Y blue bond at a yield of 6.7%, 20bp inside initial guidance of 6.9% area. The senior unsecured bonds have expected ratings of BBB- (Fitch). Proceeds will be used for financing/refinancing of the group’s eligible blue projects.

New Bond Pipeline

- Changde Economic Construction hires for € 364-day bond

- Ziraat Katilim hires for $ 3Y sukuk bond

- Oman Telecom hires for $ 7Y Sukuk

- Korea Investment & Securities hires for $ 3Y bond

- KHFC hires for $ 3Y Fixed/FRN bond

Rating Changes

- Fitch Upgrades Wharf to ‘BBB+’ from ‘BBB’; Outlook Stable

- Moody’s downgrades Victoria’s CFR to B2 from B1; outlook stable

- Barbados Outlook Revised To Positive On Stronger Economy; ‘B-‘ Rating Affirmed

Term of the Day

Transition Bonds

Transition bonds are bonds aimed at industries with high greenhouse gas (GHG) emissions a.k.a. “brown industries” to raise capital with the objective of becoming less brown and thereby shift to greener business activities. Industries issuing transition bonds could range from mining, utilities, transport, chemicals etc. These bonds are different from ‘Green Bonds’ in that the use of proceeds is less clear; also the latter are generally issued by industries/companies already on the path of reducing emissions.

Japan has planned to issue the world’s first sovereign transition bond to raise up to JPY 20tn ($130bn).

Talking Heads

On Yields Above 5% and Safe to Start Buying Bonds Again – Asset managers

Stephen Bartolini, fixed-income PM at T. Rowe Price

“The arithmetic starts to move in your favor after having been out of your favor for a very long time… takes a lot larger increase now to wipe out total return over a 12-month horizon because you’re getting yield… If the 30Y rallies a hundred basis points, you’re making 20%”

Vanguard Asset Management

“At these levels of yields your risk/reward is much better…(belly of the curve) will benefit most in the initial stages of any economic weakness….(plans to) add more if yields rise further”

Anthony Saglimbene, chief market strategist at Ameriprise Financial

“The normalization of the bond market is what we are seeing right now”

On Fed Hikes Still in Play on Strong Economy – Pimco’s Richard Clarida

“Progress on inflation has stalled since the summer, and we are not seeing labor market slack… good news for the Fed is that expected inflation is pretty well anchored… The longer bond yields stay at these levels, the more we will see the effects of these rates on the economy… Where the discussion gets interesting, is a situation where the Powell Fed starts to cut rates and inflation is not back to 2%”

On Private Credit Lenders Giving Up Protections to Win Bigger Deals

Derek Gluckman, Moody’s

“Private credit is dropping maintenance covenants in larger deals… Private credit loans are strikingly more protective than broadly-syndicated loans, but differences will narrow”

On Soaring Treasury yields threatening long-term performance of US stocks

Quincy Krosby, chief global strategist for LPL Financial

“It isn’t as if we have never had 5, 5.5% – that was the norm. What is difficult for the market is that has not been the norm for many years. The market is having to adjust to a new calculus”

Keith Lerner, co-CIO at Truist Advisory

“My message would be don’t get overly negative on equities just because you have more competition from cash and Treasuries, because that is historically the norm”

Top Gainers & Losers- 27-October-23*

Go back to Latest bond Market News

Related Posts: