This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Woori Bank, SM Investments Launch $ Bonds

July 17, 2024

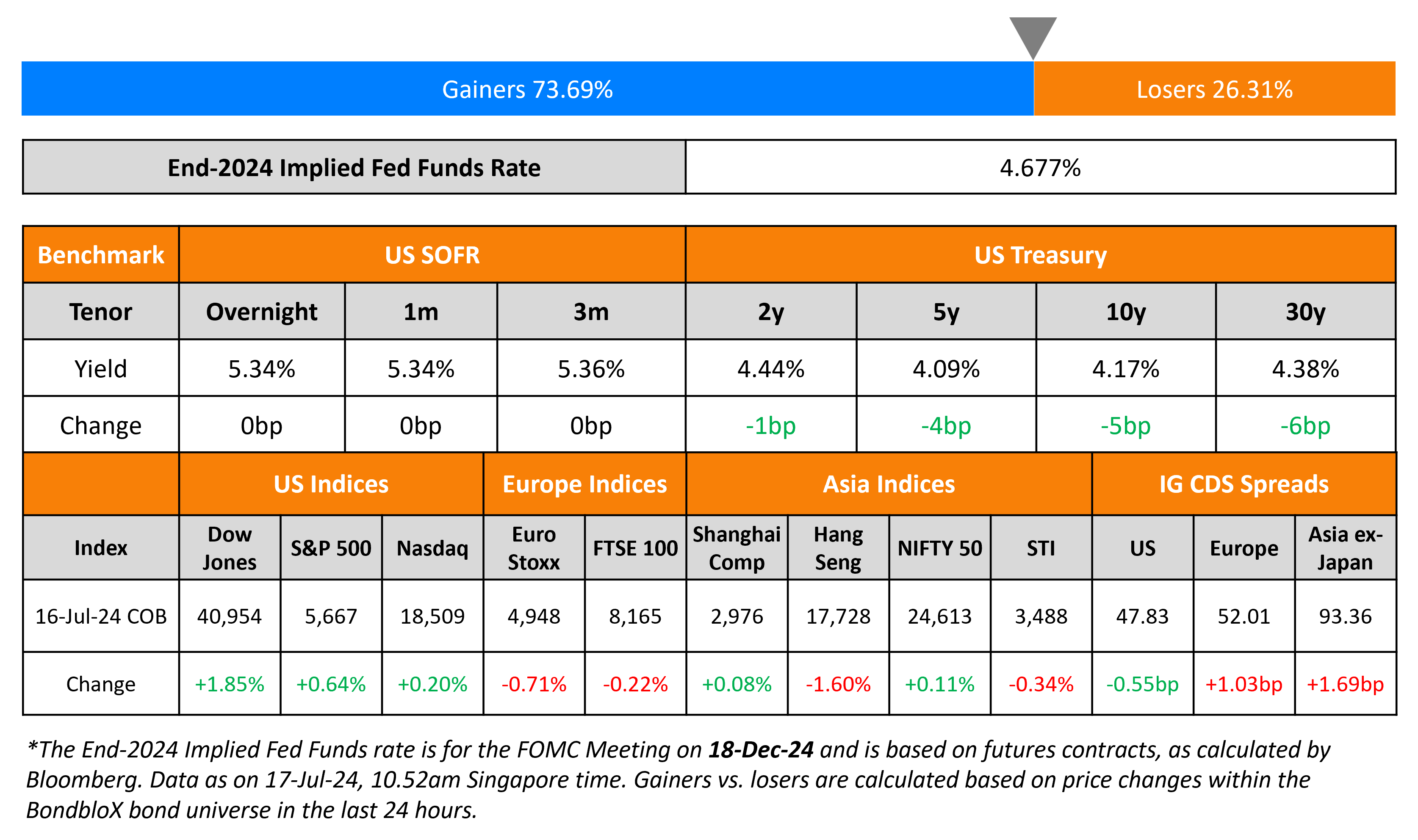

US Treasury yields moved lower as the curve bull flattened yesterday, with long-end yields down 5-6bp while the 2Y held steady. The move higher in Treasuries came despite stronger than expected data. US headline Retail Sales was unchanged in June, following an upwardly revised 0.3% gain in May. This was higher than expectations of a -0.3% print after a previously reported 0.1% gain in May. Core Retail Sales also grew stronger at 0.8% vs. expectations of a 0.2% rise. Fed governor Adriana Kugler said that she believed it will be “appropriate to begin easing monetary policy later this year” if economic conditions continued to evolve favorably. Looking at equity markets, S&P and Nasdaq ended higher by 0.2-0.6% each. US IG spreads were 0.6bp tighter and HY CDS spreads were tighter by 5.7bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were wider by 1bp and 2.8bp respectively. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads were 1.7bp wider.

New Bond Issues

-

SM Investments $ 5Y at T+170bp area

-

Woori Bank $ PerpNC5 at 6.75% area

- Ningbo Yincheng $ 3Y at 5.8% area

Goldman Sachs raised $5.5bn via a two-part offering. It raised $2.5bn via a 6NC5 bond at a yield of 5.049%, 28bp inside initial guidance of T+127bp area. It also raised $3bn via a 11NC10 bond at a yield of 5.33%, 28bp inside initial guidance of T+145bp area. The senior unsecured bonds are rated A2/BBB+. Proceeds will be used for general corporate purposes. The new 6NC5s are priced at a new issue premium of 18bp over its existing 2.6% 2030s (callable in 2029) that yield 4.87%.

China Cinda raised $1bn via a two-part offering. It raised $500mn via a 3Y bond at a yield of 5.387%, 50bp inside initial guidance of T+165bp area. It also raised $500mn via a 5.5Y bond at a yield of 5.548%, 52bp inside initial guidance of T+195bp area. The senior unsecured bonds are rated A- (Fitch). Proceeds will be used to repay existing indebtedness. The issuer is China Cinda 2020 I Management Ltd (CCAMCL) and the have a guarantee by China Cinda HK Holdings Co Ltd. The guarantor is rated Baa2/BBB+/A-. The new 3Y bond is priced roughly inline with its existing 4.4% 2027s that yield 5.37%. The new 5.5Y bond is priced ~6bp wider to its existing 3.125% 2030s that yield 5.49%.

New Bonds Pipeline

- Government of Hong Kong SAR hires for $/€ Green bond

- Mitsubishi HC hires for $ 5.25Y bond

- SM Investments hires for $ 5Y bond

Rating Changes

- Fitch Upgrades Delta Air Lines to ‘BBB-‘; Outlook Stable

- Moody’s Ratings upgrades TAP’s CFR to Ba3, outlook stable

- Moody’s Ratings upgrades Permian Resources to Ba2; outlook remains positive

- Moody’s Ratings affirms PNC Investment’s Ba3 CFR and upgrades its sukuk rating to Ba2; outlook stable

- Moody’s Ratings downgrades Consolidated Energy Limited to B2, negative outlook

Term of the Day

Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On IMF Warning Slower Disinflation Risks Higher Rates for ‘Even Longer’

“Services price inflation is holding up progress on disinflation… complicating monetary policy normalization… Upside risks to inflation have thus increased, raising the prospect of higher-for-even-longer”

On no rush for Fed to cut rates – IMF’s chief economist

“Given the good news on inflation, it’s very natural…. (Fed is) now starting to look at what’s happening in the labor market and wanting to make sure that they don’t overdo it. They’re in a position where they can afford to wait a little bit”

On Bond Kings Drawing Record $44bn to Actively Managed ETFs

Gargi Chaudhuri, BlackRock

“Investors are choosing active as a style… Having the income is important, but so is having active management and picking bonds”

Sinead Colton Grant, BNY Wealth

“The Fed is undoubtedly on a rate-cutting trajectory and at some point for the investors sitting in money market funds, the penny will drop”

Top Gainers & Losers- 17-July-24*

Go back to Latest bond Market News

Related Posts: