This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Westpac NZ, Saudi national Bank, Mizuho Price $ Bonds

February 21, 2024

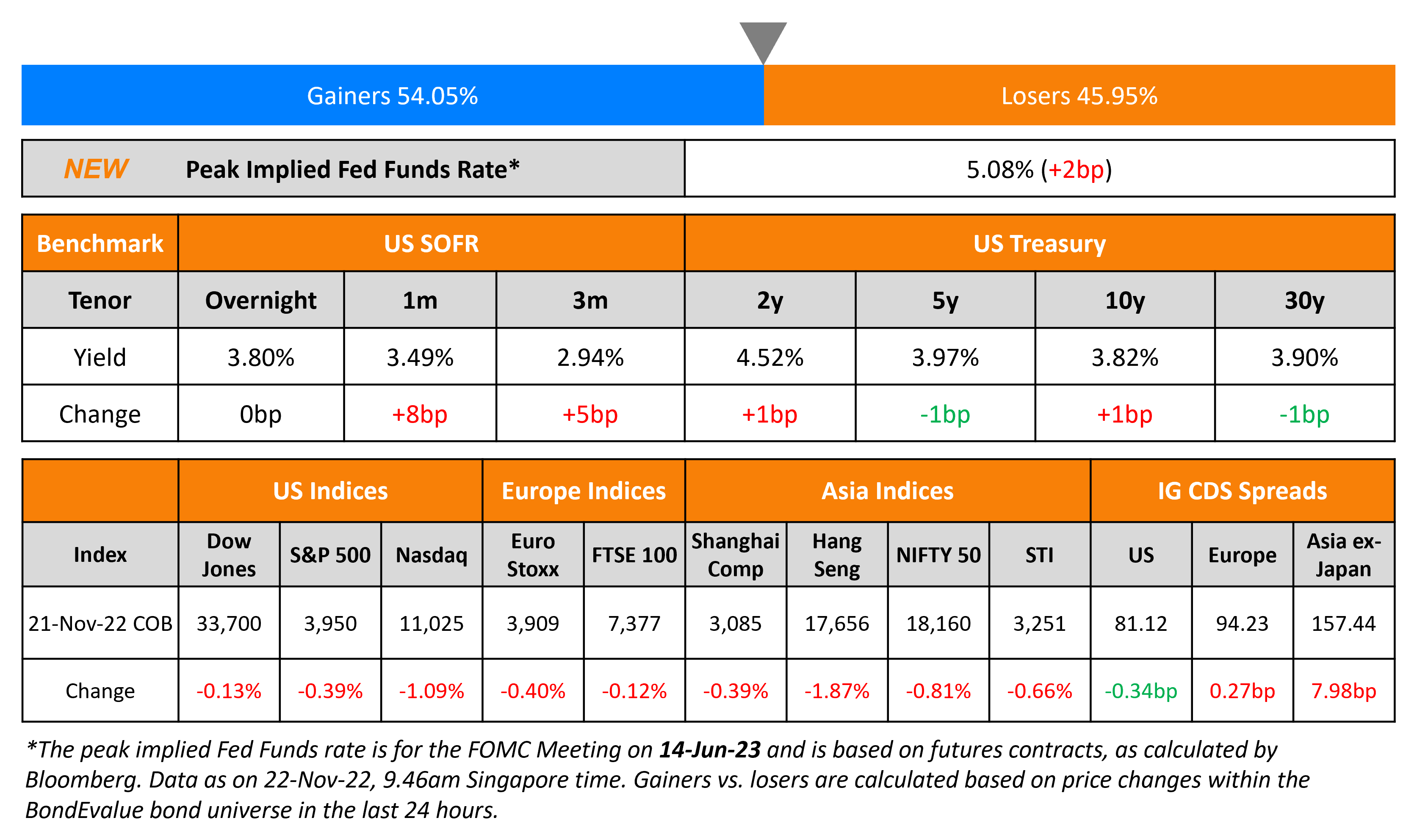

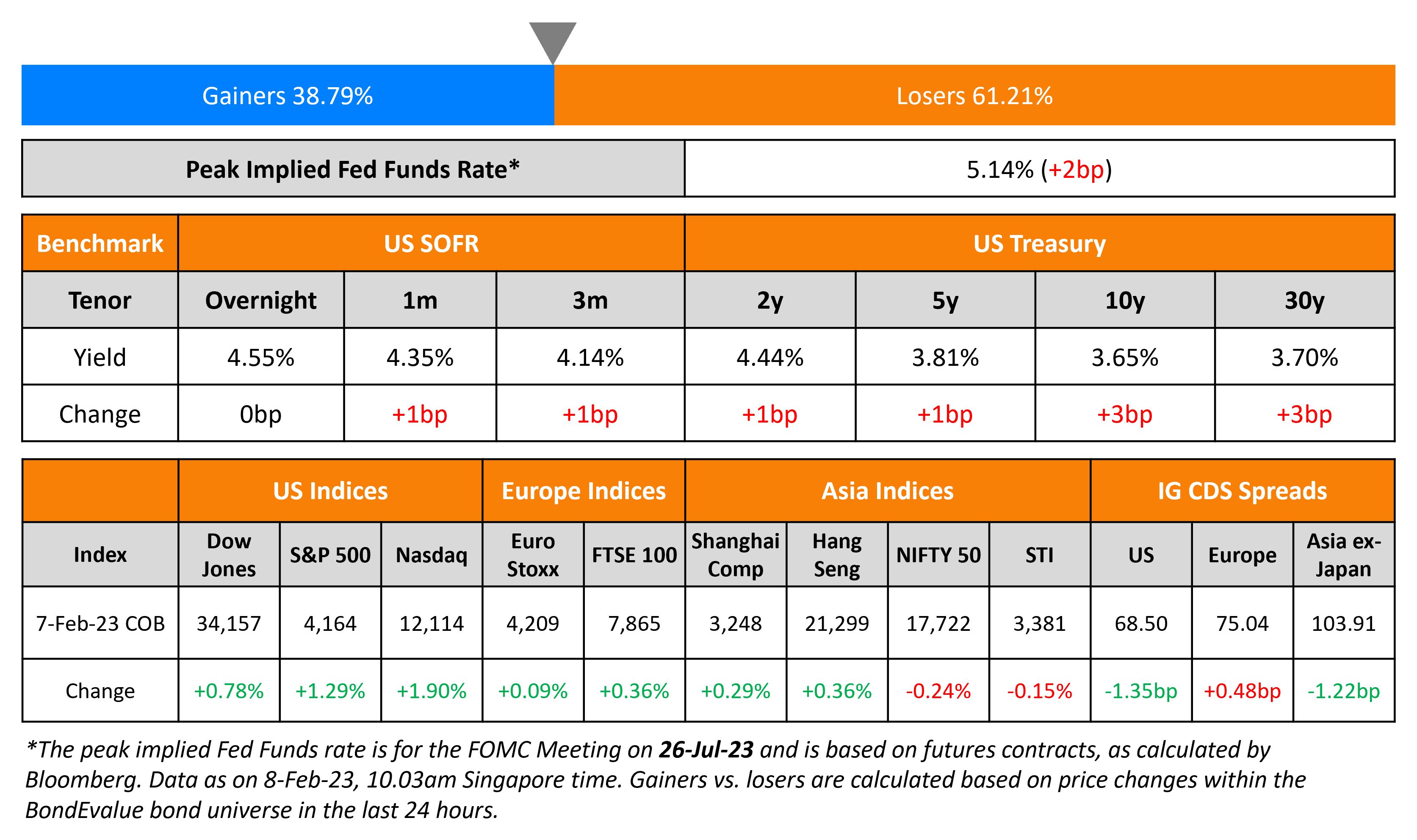

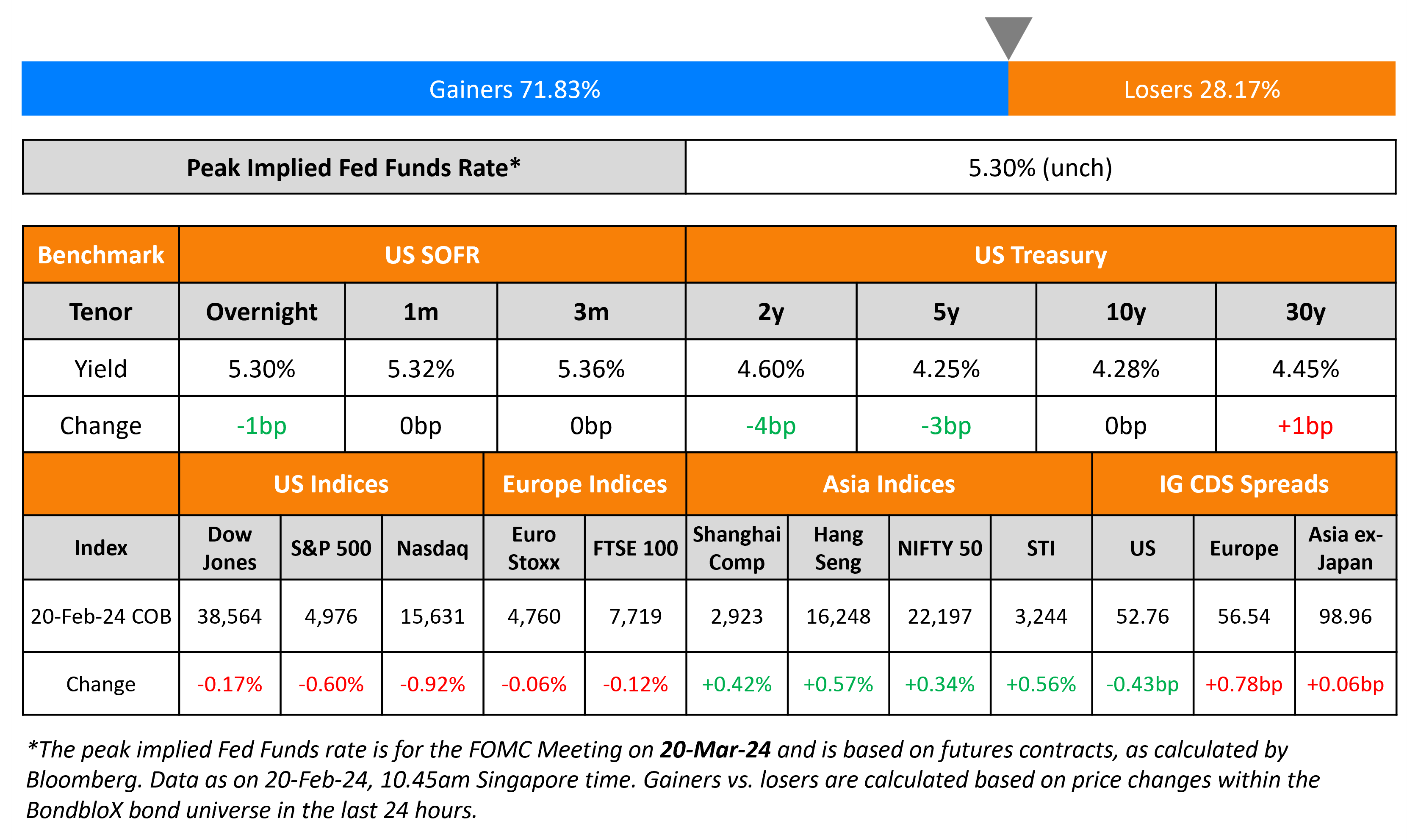

US Treasury yields were slightly lower by 3-4bp on Tuesday. There were no major data points from the US. However, equity markets saw the S&P and Nasdaq fall 0.6-0.9% after a drop in tech stocks including the likes of Nvidia, Tesla amongst others. Looking at credit markets, US IG CDS spreads tightened 0.4bp and HY CDS spreads were 1bp tighter.

European equity markets ended lower. Credit markets in the region saw the European main CDS spreads widen by 0.8bp while crossover spreads widened by 5.9bp. Asian equity markets have opened stronger today. Asia ex-Japan IG CDS spreads were broadly flat.

-png.png)

New Bond Issues

Westpac New Zealand raised $1.5bn via a two-part deal. It raised $750mn via a 3Y bond at a yield of 5.132%, 25bp inside initial guidance of T+100bp area. It also raised $750mn via a 5Y bond at a yield of 5.195%, 25bp inside initial guidance of T+120bp area. The senior unsecured notes are rated A1/AA-. Proceeds will be used for general corporate purposes.

Korea Housing Finance Corp raised $500mn via a 3.5Y social bond at a yield of 4.942%, 32bp inside initial guidance of T+90bp area. The senior unsecured bonds are rated Aa2/AA. Proceeds will be used proceeds to facilitate access to housing finance for end users in Korea via a diverse range of mortgage loan products as given in KHFC’s sustainable financing framework.

Saudi National Bank raised $850mn via a 5Y sustainability sukuk at a yield of 5.129%, 30bp inside initial guidance of T+120bp area. The senior unsecured notes are rated A-/A- (S&P/Fitch), and received orders of over $3.6bn, 4.2x issue size. Proceeds will be used finance and/or refinance, in whole or in part, “eligible projects” as defined in its November 2021 Sustainable Financing Framework.

Mizuho raised $1.5bn via a two-part deal. It raised $750mn via a 6.25NC5.25 bond at a yield of 5.376%, 33bp inside initial guidance of T+145bp area. It also raised $750mn via a 11.25NC10.25 bond at a yield of 5.579%, 35bp inside initial guidance of T+165bp area. The senior unsecured notes are rated A1/A-. Proceeds will be used to make a loan intended to qualify as internal TLAC under Japanese TLAC standard.

New Bond Pipeline

-

Shinhan Card hires for $ 5Y Dual-Listed Formosa bond

- Del Monte Philippines hires for $ Perp

- Daewoo Engineering & Construction hires for S$ bond

- Greenko Mauritius hires for $ bond

Rating Changes

-

Oceaneering International Inc. Issuer Credit And Unsecured Note Ratings Raised To ‘BB’ On Debt Paydown; Outlook Stable

-

Moody’s downgrades Lumen Technologies’ CFR to Caa2; outlook stable

-

Moody’s downgrades Whirlpool’s ratings to Baa2; outlook stable

-

Fitch Downgrades Close Brothers Group to ‘BBB+’; Outlook Negative

-

Fitch Revises Outlook on Alam Sutera to Negative; Affirms at ‘B-‘

Term of the Day

Z-Spread

Z-Spread, also known as Zero-volatility spread is a fixed spread over the Treasury spot curve that makes the present value of the bond equal to its price. The Z-spread indicates the extra compensation or spread for credit, liquidity and optionality risk that investors would receive for buying that bond. The idea of calculating the spread is that a coupon paying bond can be valued as a series of zero-coupon bonds and the present value of these should be equal to the price of the bond. A simple approximate formula to understand Z-spread better is:

Treasury Yield + Z-Spread of the Bond ≈ Yield of the Bond

A widening z-spread indicates increased risk in the bond and a tightening z-spread indicates reducing risk.

Talking Heads

On Fed to cut US rates in June with risks skewed towards later move

Kevin Cummins, chief U.S. economist at NatWest Markets

“The ‘transitory’ blunder has made officials determined not to be caught on the wrong side of the inflation story for the second time in the same cycle.”

Michael Gapen, chief U.S. economist at BofA

“For now, risks to our growth forecasts are slightly to the upside. If this leads to stickier inflation…The Fed might end up staying on hold for longer than expected”

On US hard landing bets rise in rate options market after Fed hikes

Bruno Braizinha, interest rates strategist, at BoFA Securities

“From a macroeconomic standpoint, risks are roughly balanced between a hard landing and no landing”

Jeff Klingelhofer, co-head of investments at Thornburg Investment

“Just textbook economics: Higher rates mean the bar for future demand is tougher. And because a recession hasn’t come to fruition at this point, a lot of investors are quickly pivoting to, well, it’s not going to happen. I think that’s a mistake”

On US asset managers ready for China recovery with products stacked up

Jonathan Krane, CEO of China-focused ETF provider KraneShares

“This is potentially a once-in-a-lifetime opportunity to buy China equities at valuation levels not seen for a long time”

Bryon Lake, global head of ETF Solutions at JP Morgan Asset Management

“Do we fundamentally think that the second-largest economy in the world plays a role in investor portfolios? Yup, no question”

Top Gainers & Losers- 21-February-24*

Go back to Latest bond Market News

Related Posts: