This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vistra Land, Piramal Capital Price $ Bonds

July 23, 2024

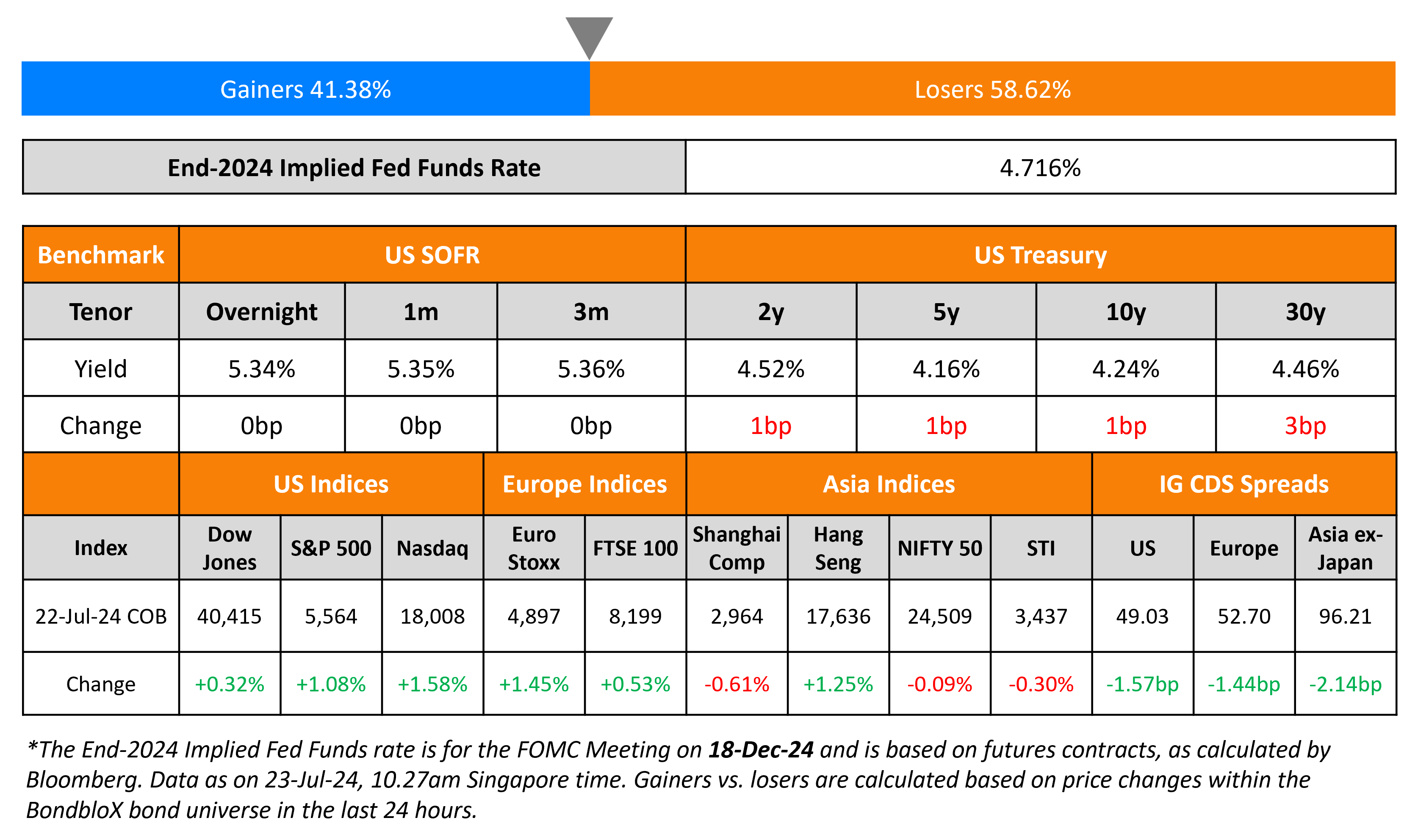

Treasury yields were stable with no major data points emerging from the US. Overall, risk markets gained across the board, having seen losses in the previous week with credit spreads also widening then. US equities saw the S&P and Nasdaq partly reverse the sell-off from last week, by notching gains of 1.1% and 1.6% respectively. US IG and HY CDS spreads tightened by 1.6bp and 3.3bp respectively.

European equity markets closed higher too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.4bp and 2.9bp respectively. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were tighter by over 2.1bp.

New Bond Issues

Vista Land raised $300mn via 5Y bond at a yield of 9.375%, 12.5bp inside initial guidance of 9.5% area. The bonds are unrated. Proceeds will be used for refinancing, working capital, investment and other general corporate purposes. VLL International Inc is the issuer, alongside guarantees from Vista Land & Lifescapes Inc, Brittany Corp, Camella Homes Inc, Communities Philippines Inc, Crown Asia Properties Inc, Vista Residences Inc and Vistamalls Inc.

Piramal Capital raised $300mn via a 3.5Y bond at a yield of 7.95%, 30bp inside initial guidance of 8.25% area. The senior secured notes are rated Ba3/BB- (Moody’s/S&P). The bond is issued by Piramal Capital & Housing Finance Ltd and has an amortization schedule of 50% at end of 39 month, i.e. 3.25 years. Proceeds will be used according to Sustainable Finance Framework and as permitted by RBI’s external commercial borrowing Guidelines.

Korea Hydro raised $500mn via a 5Y bond at a yield of 4.861%, 30bp inside initial guidance of T+100bp area. The senior unsecured bonds are rated Aa2/AA (Moody’s/S&P). Proceeds will be used for general corporate purposes.

American Express raised $3.4bn via a three-part deal. it raised:

- $1.2bn via a 4NC3 bond at a yield of 5.043%, 25bp inside initial guidance of T+100bp area

- $500mn via a 4NC3 FRN at SOFR+93bp vs. inside initial guidance of SOFR equivalent area

- $1.7bn via a 11NC10 bond at a yield of 5.284%, 27bp inside initial guidance of T+130bp area

The senior unsecured bonds are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

Rating Changes

- Netflix Inc. Upgraded To ‘A’ From ‘BBB+’ On Performance, Revised Financial Policy; Outlook Stable

- Moody’s Ratings upgrades Netflix’s senior unsecured notes to Baa1; outlook stable

- Moody’s Ratings downgrades Sunnova’s sr. unsecured rating to B2, changes outlook to negative

- Fitch Affirms GeoPark’s IDRs at ‘B+’; Outlook Revised to Stable

Term of the Day

Amortizing bonds

Amortizing bonds are debt instruments that pay both coupons and principal through the life of the bond. Unlike straight bonds that pay back the principal as a bullet payment at maturity, amortizing bonds pay back principal at regular intervals based on a predefined schedule prior to the maturity date. Since the principal is retired slowly over the life of the bond, the weighted average life (WAL) is keenly looked out for. Amortizing structures are more common in loans and mortgages.

Talking Heads

On ECB Cut Bets Not Fully Misplaced, But Not Baseline – ECB GC Member, Peter Kazimir

“We are on track to return to our target, but we are clearly not there yet… there is still a non-negligible risk of inflationary pressures re-emerging… is no need to rush our decisions… Enjoy the summer lull and wait for the much-anticipated September”

On Singapore Dollar Having Reasons to Win Asia’s Currency Crown Again

Alex Loo, macro strategist at TD Securities

“We expect SGD to continue its outperformance in the second half… don’t expect MAS to aggressively reduce the slope of the S$NEER policy band… SGD should continue to benefit from the appreciation path of the policy band, while the pickup in growth momentum and upswing in global trade should bolster SGD’s appeal”

On US bond market reacting to Biden’s exit with ‘Trump trade’ reversal

BMO Capital Markets

“The market’s response to the presumed change to Harris is a slight offset to the ‘Trump-trade’ of renewed inflationary angst”

Thierry Wizman, strategist at Macquarie

“Trump 2.0 will be a more inflationary policy regime, given restricted immigration, higher tariffs, and the extension of the Tax Cut and Jobs Act of 2025”

Top Gainers & Losers- 23-July-24*

Go back to Latest bond Market News

Related Posts: