This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Estimate -7.5mn; Vedanta Seeks to Amend Covenants; FAB to Redeem $750mn AT1s; BEV Term of the Day: STAGFLATION

June 5, 2020

The rally in markets took a bit of a breather on Thursday ahead of the non farm payrolls number coming out later today. US treasuries are lower showing a continued shift away from safe haven assets. Spreads on Asian dollar bonds tightened for an eight consecutive day. ECB boosted its purchase plan by €600bn, which helped financial stocks, but did not prevent the DAX from slipping. Corporate bond sales in Europe’s primary market are heading for the second-slowest week since March as just three issuers sold €1.85bn on Thursday. Asian markets are opening mixed this morning and US index futures are slightly higher by 0.1%.

New Bond Issues

Thai state-owned oil and gas company PTTEP raised $500mn via 7Y bonds at a yield of 2.587%, 195bp over Treasuries and a massive 75bp inside initial guidance of T+270bp area. The bonds, rated Baa1 by Moody’s, met with great demand from investors, evident from the 75bp tightening and an orderbook of $7.4bn, almost 15x issue size. Instead of a change of control put, the bonds carry a covenant wherein the coupon will increase by 100bp if PTT ceases to own at least 50.1% of PTTEP, or if PTTEP ceases to own at least 50.1% of the issuer ((PTTEP Treasury Center Company), leading to a rating downgrade. State-owned PTT currently owns 64.79% in PTTEP. The company last riased $350mn via 10Y bonds in Jan this year at yield of 2.993%, 110bp over Treasuries at the time of issuance. The bonds are currently trading at a premium, yielding 2.84% on the secondary markets.

Chinese developer Zhenro Properties returned to the dollar bond market, raising $200mn via 3.25Y non-call 2.25Y bonds at a yield of 8.3%, 45bp inside initial guidance of 8.75% area. The bonds, rated B+ by Fitch, received orders worth a massive $2.8bn, 14x issue size. This deal follows Zhenro’s $200mn 3.8Y non-call 2.8Y issuance on May 14 at a yield-to-put of 8.35%, which ran along with a tender offer. Zhenro’s 9.15% $300mn bonds issued in November 2019 and maturing in May 2023 are currently trading at a yield of 7.97%.

Chinese real estate developer Seazen Group raised $400mn via 2Y bonds at a yield of 6.45%, 55bp inside initial guidance of 7% area. The bonds, rated Ba3 by Moody’s, received orders worth $3.2bn, 8x issue size, at the time of final guidance. Seazen last issued a 2Y bond worth $350mn in December 2019 at yield of 7.5% at the time of issuance. The bonds are currently trading at a premium, yielding 6.27% on the secondary markets.

Chinese film distribution and property developer Nan Hai Corp raised $350mn via 2Y non-call one-year credit-enhanced bonds at a yield of 2.9%, 35bp inside initial guidance of 3.25% area. The bonds, rated Baa2 by Moody’s, carry an irrevocable standby letter of credit denominated in US dollars issued by China Citic Bank Shenzhen branch (BBB+/Baa2/BBB).

Rating Changes

Fitch Downgrades Vakif Katilim’s Long-Term FC IDR to ‘B’; Upgrades VR to ‘b’

S&P cuts Serbia’s outlook to stable from positive, affirms BB+ rating

ECB Widens Emergency Stimulus Purchases by €600 Billion

The European Central Bank plans to actively counter the unusual contraction on the back of the pandemic by expanding its emergency bond purchases by €600 billion to €1.35 trillion. The purchases are planned to continue till Jun 2021 and have been planned amidst the downward revisions of growth in the Euro zone. ECB President Lagarde revealed that the bloc could see a contraction of up to 8.7% in 2020 before rebounding to 5.2% in 2021, reported Bloomberg. The stimulus package would help reign in the inflation to 1.3% by 2022 against a planned inflation target of 2%. The central bank had earlier incentivized lenders so that they continue to extend credit to companies and did not discuss inclusion of junk bonds in the deal. The package is likely to infuse the required fluidity to counter effects of the pandemic. The announcement of the package comes a day after the announcement of a stimulus package by the German government.

For full story, click here

Market Awaits May’s Non-Farm Payroll Data

Nonfarm payrolls are expected to fall by 7.5 million in May, far less than the 20.5 million plunge in April, but still a very concerning number. That’s expected to push the unemployment rate up to 19.1%. On the back of the recent rally, the downside for a worse than expected number is probably limited compared to the upside for a better than expected number. Having said that, while the recent rally in US equities is remarkable, traders should be guarded against an extended rally. There is still no clarity on how this pandemic will turn out, and we are yet to see deeper effects on the economy as the second quarter’s data releases filter through. If new virus cases flare up again now that most economies have reopened, that could force a return to lockdowns or at least a longer period of mandatory social distancing measures.

The US employment report is due at 8:30pm Singapore time (8:30 am ET) on Friday, June 4, 2020:

- Median NFP estimate: -7,500K

- April: -20,537K (all time record)

- Highest estimate: -800K

- Lowest estimate: -12,000K

- Average estimate: -7,361.05K

- Standard deviation: 2,404.17K

- Unemployment rate consensus estimate: 19.1%

For the full story, click here

Vedanta Resources Offering Incentives to Amend Bond Covenants

Vedanta Resources is offering its dollar bond holders incentives if they agree to changes of certain covenants. These changes would give more flexibility to incur debt as chairman Anil Agarwal takes the India-listed indirect subsidiary Vedanta Limited private. The bonds include:

- $900m of 8.250% 2021s

- $1bn of 6.375% 2022s

- $500m of 7.125% 2023s

- $400m of 8.000% 2023s

- $1bn of 6.125% 2024s

- $600m of 9.250% 2026s

Holders of its 2021s are offered a payment of $3.75 per $1,000 of principal if they agreed before an early bird deadline of June 23 (dropping to $2.5 thereafter), while the other bond holders are offered $5.00.

First Abu Dhabi Bank to Redeem Its $750mn 5.25% AT1 Perps

UAE’s largest bank First Abu Dhabi Bank (FAB) announced that it will be redeeming its $750mn 5.25% additional Tier 1 perpetual bonds on its upcoming call date on June 17. We had reported on May 19 that FAB would be weighing its options on whether to call the bonds or not, especially since it would be cheaper for the bank to not call the bonds based on the coupon reset. The bank said in a statement that it decided to call the bonds “taking into consideration all factors, including investors’ interests, and notwithstanding strong economic rationale”. The bonds (can be found on our App by searching for NBAD) jumped from 96.97 yesterday to 99.5 this morning. The bonds have a call price of 100.

For the full story, click here

L Brands, Royal Caribbean and CDPQ Capitalize on Investor Demand With New Dollar Bond Deals

American fashion retailer L Brands raised $1.25bn via a two-tranche deal. It raised $750mn via senior secured 5Y non-call 2Y bonds at a yield of 6.875%, 112.5bp inside initial guidance of 8% area and $500mn via senior unsecured 5Y at a yield of 9.375%, also 112.5bp inside (lower bound) initial guidance of 10.5-10.75% area. This is the first issuance by the company after its proposed deal worth $525mn to sell a 55% stake in Victoria’s Secret to private equity firm Sycamore Partners fell through last month. Sycamore sued to terminate the deal on grounds of L Brands violating the terms of its agreement by failing to pay rent and furloughing thousands of employees amid the pandemic. L Brand’s 297mn 6.694% bonds due 2027 are currently trading at 89.6 cents on the dollar, yielding 8.80% on the secondary markets.

For the full story, click here

Royal Caribbean Raises $1 billion Via Bonds, Second Issue in a Month

As the cruise shipping sector continues to be stressed, Royal Caribbean raised $1bn on Thursday to boost liquidity. This comes after a similar issuance of $3.3 billion earlier in May. The new 3Y bonds were sold at par with a coupon of 9.125%, significantly tighter than its 3Y bonds issued last month at a yield of 11.7%. While the new bonds are unsecured, they have a similar structure to the bonds issued last month, backed by a different pool of seven ships worth about $7.7bn. The cruise line is also looking to raise $1bn via convertible bonds, which are yet to price. The 3Y convertibles are being offered at a coupon of 5-5.5% with a 20-25% conversion premium, and do not carry a similar guarantee as the straight bonds.

The trend of raising debt funds has been continuing in the sector and has already been exercised by Carnival Corp, Norwegian Cruise Line Holdings and Viking Cruise Ltd. The market has been positive as manufacturing activity picks up with the re-opening of the economy. Wall Street banks see the opportunity to raise funds while this sentiment lasts. The new guaranteed notes have been rated BB by S&P Global. However, since the issuance will directly affect the cash flow of the company, the rating agency has placed the company’s rating under review. Earlier Moody’s had downgraded the company’s unsecured debt to non-investment grade Ba2 in May and S&P had downgraded it to junk in April.

For full story, click here

India’s SBI Looks to Raise $1.5 Billion Via Dollar Bonds

India’s largest public sector bank, State Bank of India plans to raise $1.5bn through a public offer or a private placement of senior secured dollar bonds during this fiscal. While the government has already infused INR 3.5 trillion ($46.47bn) into public sector banks in the last few years, a Credit Suisse report dated May 27, assessed that the private sector banks could require to raise up to $7bn and public sector banks up to $13bn to counter the impact of the pandemic. SBI has been a key instrument of the Union government’s stimulus plan called Atmanirbhar Bharat Abhiyan and has disbursed up to INR 3000 crore ($398mn) to 22,000 micro, small and medium enterprises (MSME). SBI’s asset quality could come under stress due to the worsening economy, which is forecasted to contract in the current fiscal year.

For full story, click here

Abu Dhabi Sovereign Fund Mubadala Invests in Reliance’s Jio Platforms

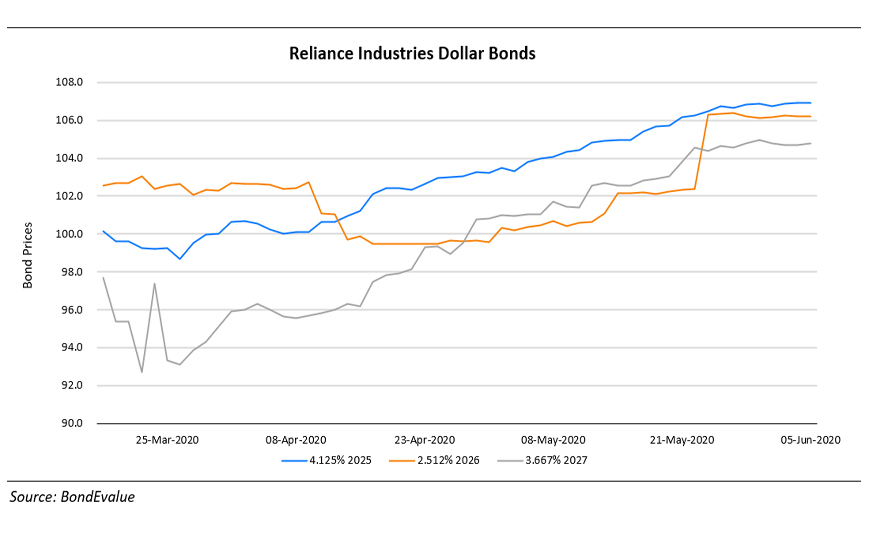

As per an announcement by Reliance Industries Limited (RIL) and Jio Platforms, Abu Dhabi based sovereign wealth fund, Mubadala will invest $1.2bn for a 1.85% stake in Jio platforms. This is a planned move by RIL to restructure its debt. Jio platforms, valued at $65bn has already raised $11.6bn through Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR and Mubadala within the last six weeks. Jio Platforms is a wholly-owned subsidiary of RIL and is a high growth next generation technology platform which aims to reach more than 388 million subscribers through high-quality, affordable digital services. Earlier on May 31, Economic Times had reported that RIL was on its way to repay its entire debt even without a deal with the Saudi Oil major Saudi Aramco, which is in the pipeline. The article also noted that the company raised a total of INR 78,562 crore ($10.42bn) through deals (excluding the Mubadala deal) and plans to raise INR 53,125 crore ($7.05bn) through a rights issue. According to Edelweiss, the company was expected to repay its entire net debt of INR 1.6 lakh crore ($21.23bn) in 2020-21, however, it would take some more time before it repays the adjusted net debt of INR 2.57 lakh crore ($34.08bn). The bonds of the company have been rallying since the debt restructuring was implemented and have been rising through the last two months.

For full story, click here

BEV Term of the Day

Stagflation

Stagflation is (stag)nant economic growth and high in(flation). It is an economic phenomenon when economic growth is stagnant and the unemployment rate and inflation are high. Stagflation is most commonly caused by supply shocks leading to higher commodity prices or monetary policies that increase money supply in the economy too quickly. An example of stagflation was in the US during the 1970s, when high inflation and high unemployment was at its peak on the back of a surge in commodity prices. Generally. monetary and fiscal policies are not effective at solving economic problems related to a supply side shock, hence it is tougher to get through a period of stagflation.

Stagflation in Today’s Context

Interesting thing to note is how investors are confident that the Fed will pin short term interest rates at current levels and are buying short term treasuries while shorting the 10-year and 30-year. The Treasury yield curve is the steepest in three years, with long-maturity rates climbing as the Federal Reserve prints billions of dollars a week to add to its stockpile of government debt and other assets. The steepening phenomenon is typically a signal of improving growth prospects, and riskier assets such as stocks are certainly rallying. Yet some investors are more wary about what it says about inflation expectations, with U.S. activity merely giving a hint of bottoming out from what’s likely the deepest slump in living memory. The risk that the market is starting to grapple with is that in the pandemic’s wake, stagflation — a troublesome combination of tepid growth and accelerating inflation — takes hold in the years ahead and vexes markets as it did in the 1970s. Cash is flooding into funds that invest in inflation-protected securities, and breakeven rates, another gauge of consumer-price expectations, are ticking back higher.

Talking Heads

“In line with the global risk-on mood, African hard-currency bonds alongside equities have been on a tear. Markets have shrugged off these concerns.” Seven of the 12 top-performing emerging-markets this quarter are in Africa.

Paul Chan says that Hong Kong is determined to defend the HK dollar, which is pegged to the US dollar, and that the city will continue its role as an international financial center. Chan also said that Hong Kong has over 440 billion U.S. dollars in foreign exchange reserve, which is more than twice the city’s monetary base. He also referred to a swap arrangement with the People’s Bank of China, in which the bank swaps U.S. dollars and Hong Kong dollars. “With such a strong support, I think we would be more than able to defend any attack on our currency,”, Chan said after the US may have threatened to strip Hong Kong of it’s privileges following some national security concerns.

Top Gainers & Losers – 5-Jun-20*

Go back to Latest bond Market News

Related Posts: