This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

A Sea of Red; Wynn Macau Launches $ Bond; EU Proposes Relief Measures for Banks

June 12, 2020

.png?upscale=true&%20Global%20Indices%2012%20Jun%20(1).png&width=1400&upscale=true&name=US%20Benchmark%20&%20Global%20Indices%2012%20Jun%20(1).png?upscale=true&%20Global%20Indices%2012%20Jun%20(1).png)

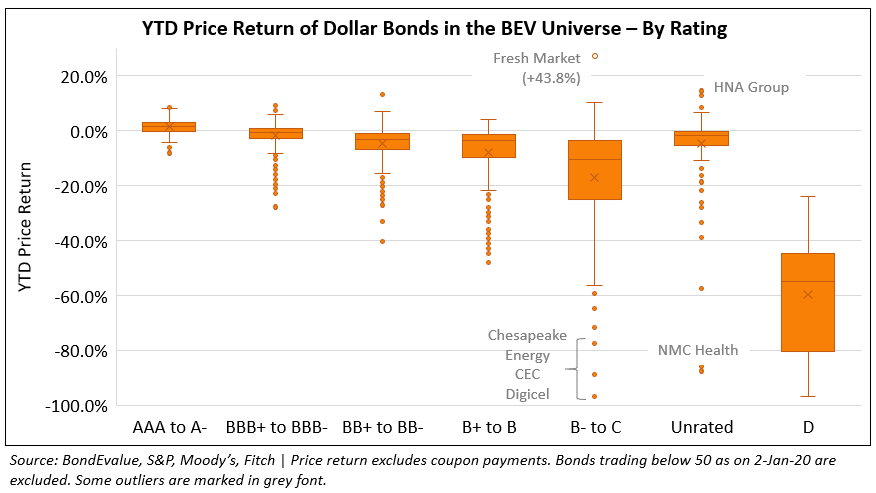

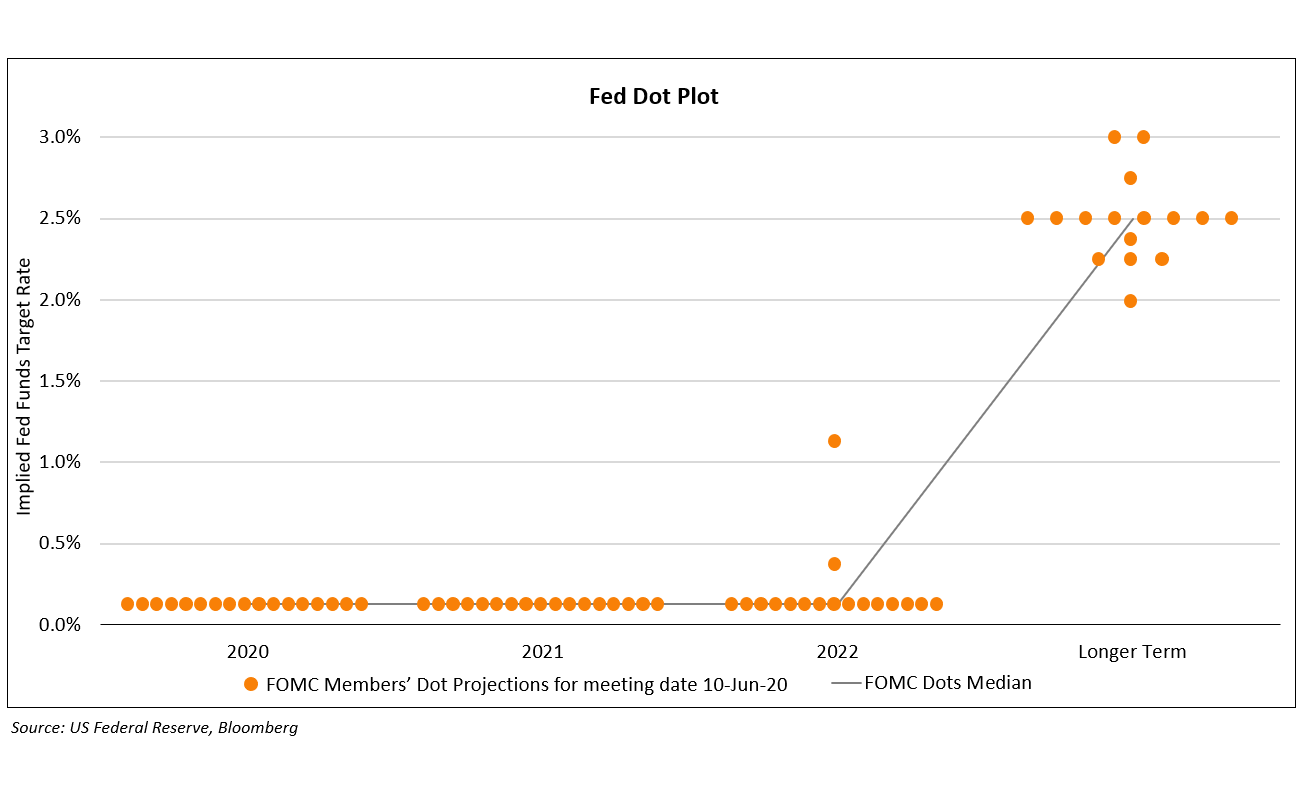

A sea of red. Markets saw a sharp sell-off yesterday as investors showed concerns after the gloomy Fed outlook and economic data, the pace of the recent rally and signs of a possible second wave of the coronavirus. S&P saw its fourth largest drop in the last 5 years (top three also being in this year), and pulled it back from the highs of 2020. The S&P, DJI and Nasdaq sank 5.9%, 6.9% and 5.3% respectively by the end of the session.The US dollar saw a bid along with long dated treasuries as a safe haven and also on speculation that the Fed will adopt yield control measures. Bonds were not spared as CDS spreads widened across the board, and 61% of bonds in our universe fell in price. Asian markets are opening lower by 2-3% this morning.

New Bond Issues

- Wynn Macau $ 750 mio 5.5NC2 @ 5.5% area

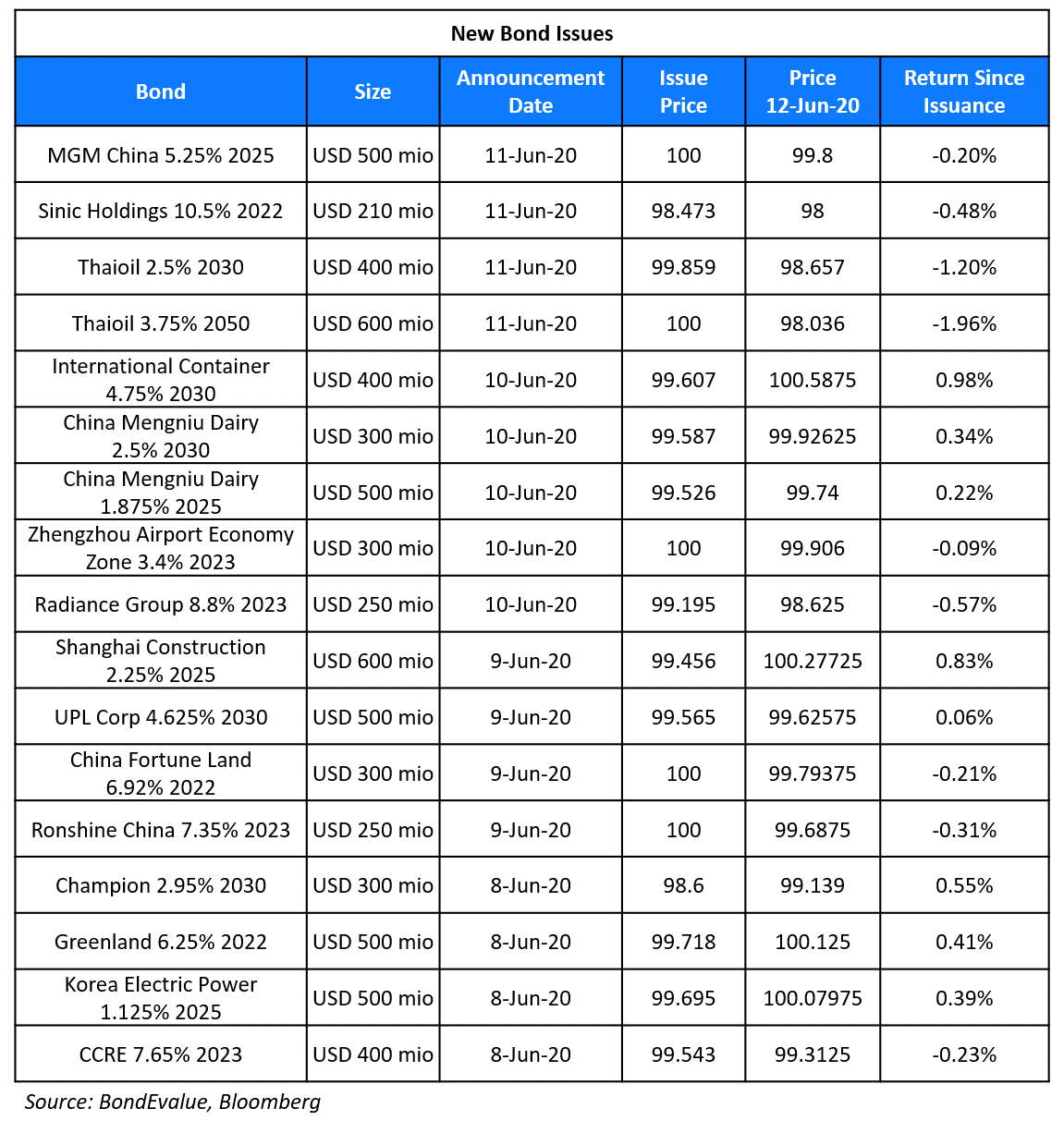

Thai Oil raised $1bn via a two-tranche deal on Thursday. It raised $400mn via 10Y bonds at a yield of 2.516%, 185bp over Treasuries and 60bp inside initial guidance of T+245bp area. It raised $600mn via 30Y bonds at a yield of 3.75%, 55bp inside initial guidance of 4.3% area. The bonds, expected to be rated BBB+/Baa2, will be issued by subsidiary Thaioil Treasury Centre and guaranteed by Thai Oil, which is indirectly partly-owned by the Thai government.

Macao-based casino hotel operator MGM China raised $500mn via 5Y non-call 2Y bonds at yield of 5.25%, 37.5bp inside initial guidance of 5.625% area. The bonds, expected to be rated BB-/Ba3, carry a change of control put (Term of the day, explained below) at 101 and a special put at 100 upon occurrence of certain events related to termination, rescission, revocation or modification of its gaming license. The pricing on the new bonds falls between its 5.375% bonds due 2024 and 5.875% bonds due 2026, which are yielding 4.84% and 5.57% on the secondary markets currently.

Chinese property developers continue to tap the dollar bond markets with Sinic Holdings raising $210mn via 2Y bonds at 11.375%, 50bp inside initial guidance of 11.875% area. The bonds, expected to be rated B+, received orders worth $1.5bn, over 7x issue size.

Rating Changes

Kerala Infrastructure Investment Fund Board Downgraded To ‘BB-/B’; Outlook Stable

European Banks Likely to Get Relief on Govt Bond Holdings

The European Union is set to sign off on a new legislation that would nullify the negative impact of mark-to-market losses on sovereign bond holdings on bank’s capital requirements, according to Bloomberg. The past few weeks have seen increased volatility in sovereign bonds’ prices, which is threatening to crimp banks’ capacity to lend. If passed, the legislation will temporarily free banks from taking a hit on their capital ratios on account of its holding of sovereign bonds. The legislation is on course to receive final agreement over the next few days. This is the latest measure that the European Union and the ECB is taking to support banks in the region to combat the impact of the pandemic. As per the ECB, the relief measures provided, which include a break to investment banks’ trading desk on capital rules for market risk, will be temporary in nature. The proposed relief measure with respect to sovereign bond holdings will be especially beneficial to Italian banks, given their large holdings of its government’s bonds. Intesa Sanpaolo has about €100bn of sovereign debt, including insurance and banking assets, making it the second-largest creditor of the state after the ECB, CEO Carlo Messina said earlier this month. Intesa’s Euro perpetuals traded lower yesterday, with its 3.75% and 7.75% perpetuals down about ~2-3 points to 80.8 and 109.2 respectively.

In our editorial view, this seems to be just the beginning. We expect governments and central banks world over to announce further tweaks on the calculation of capital ratios for the banking sector as banks’ bloated balance sheets need to be covered without raising massive amounts of fresh capital.

For the full story, click here

S&P Skeptical about Softbank’s Creditworthiness

S&P raised questions on the creditworthiness of Softbank, which has been through a period of lows for some while now. In May, while Moody’s had downgraded the company to junk rating, S&P had stopped short and only lowered its outlook to Negative. Moody’s was dropped by Softbank after it downgraded the company and raised doubts over the portion of its portfolio that was not doing well. The credit rating agency now feels that the company’s creditworthiness is under pressure. Softbank has been through some tough times and has initiated steps to restructure its financing. The company intends to raise $41bn through asset sales and is likely to embark on a share buyback plan worth 2.5tn yen ($23.9bn). On May 18, CNBC had reported that Softbank incurred its first loss in 15 years and had further warned that out of its portfolio of 88 companies in the Vision Fund, there were at least 15 unicorns which could potentially go bankrupt due to the pandemic. For the year ending 2020, the company had reported an operating loss of $13bn and a loss of $17.7bn for the Vision Fund. The valuation of one of its holdings, WeWork had dropped to $2.9bn from a high of $47bn.

For full story, click here

EM State-Owned Firms Need Bail Out on the Road to Recovery

India was downgraded to Baa3 with a negative outlook by Moody’s on June 1, Indonesia’s outlook was revised to negative with a rating BBB by S&P on April 17, and South Africa was downgraded to junk on March 27 by Moody’s and on April 3 by Fitch. The story for emerging markets has been of gloom and stress. While countries like South Korea and Taiwan have been more resilient, those including India, Indonesia, South Africa and Turkey are grappling with increasing fiscal deficits.

The slow re-opening of the economies in the emerging market has also come with a requirement of a bail out for State-Owned Enterprises (SoEs). SoEs hold an important position in these markets as they provide much required employment. While as per the IMF, SoEs make up 55% of the infrastructure investment, Institute International Finance estimates that these hold 60% of non-financial corporate debt. The high debt of these SoEs has potential to cause a significant dent to the government’s bailout. This is why Indonesia increased the deficit ceiling to 6.3% from the earlier 3%. India and South Africa could have a deficit of as much as 7% and 6.8% respectively. While power utility major Eskom Holding and South African Airways are among the SoEs requiring a bailout from the South African government, Krakatau Steel and two state insurers require intervention from the Indonesian government. In India, the pandemic has stressed the state-run banks, which have non-performing asset ratios of 9.3%, among the highest in the world. While the Indian government has already spent over ₹2.6tn ($34bn) on the public sector banks, there could be a need of another $13bn, according to Credit Suisse. Indonesia has also set aside $10bn for SoEs and South African Eskom could require upto $27bn to support it. The road to recovery for emerging markets would require to bailout these SoEs, not only because they represent the nation but also as they are a big source of employment. Pulling up these SoEs would adversely affect the GDP and potentially lower the positive slope of the recovery. The sovereign bonds of India(EXIM IN as proxy for the government), Indonesia and South Africa have been trotting back to recovery after a huge drop in March.

For full story, click here

Casino Operators Rush to Issue Dollar Bonds

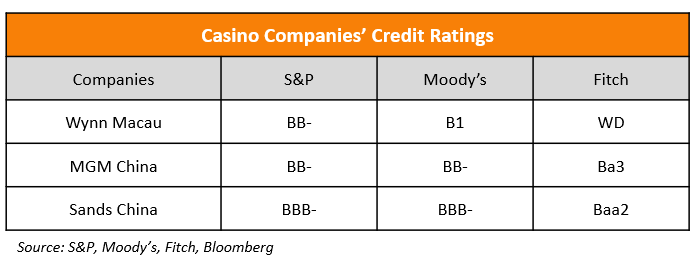

The gaming industry has been hit hard by travel restrictions imposed because of the pandemic, and this effect is expected to last until 2021, according to forecasts by Fitch. Liquidity is not a major concern as balance sheets were bolstered by new debt and equity issuance. Casino operators Wynn Macau announced yesterday a new 5Y bond worth $750mn, which is expected to be rated BB- by S&P.

This follows fellow casino operator MGM China, which raised $500mn of bonds 5Y non-call 2Y bonds yesterday as well. According to IFR, in the two months ended May 31, MGM China lost an average of $61.2mn per month, measured in property EBITDA terms, as compared to an average monthly profit of $107.6mn during the same period last year. As of end March, MGM had $265mn in cash and $676mn in undrawn loans. The new bonds are rated BB- by Fitch.

Sands China, which operates the Venetian Macao, sold US$1.5bn of bonds last week, split between $800m 3.8% bonds due 2026 and $700m 4.3% bonds due 2030. The bonds are rated Baa2 by Moody’s. Sands China reported a net loss of $180mn in April, on the back of monthly expenses of $200mn.

BEV Term of the Day

Change of Control Put

Change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On finance front-running the economy – Mohamed El-Erian, Allianz’s chief economic adviser and president-elect of Queens’ College, University of Cambridge

The scale of binge borrowing was once unthinkable, but it gradually became the norm post the 2008 financial crisis. So now when the COVID-19 shock hit the economy and markets, everyone is facing a new threat of depression. To overcome the risks of market malfunction and a credit freeze, the Fed is now underwriting not just liquidity risk and credit risk for high-quality companies, but also the risk of default in the junk-bond market. The immediate impact on financial markets is beneficial, but if growth disappoints, the economy and markets will have to cope with a massive debt overhang that results in even greater central bank distortions of markets and lower growth potential. There will be widespread debt restructurings too, and disorderly non-payments.

The steep decline in developing-nation debt earlier this year has created an opening for investors to scoop up notes with low default risk on the cheap. “For an active manager, you cannot ask for a better market because there have been so many opportunities,” Shaykevich said.

While Shaykevich does not expect assets to recover to pre-Covid levels anytime soon, he said there’s room for some notes to rebound further. “The level of financing needs for emerging-market governments remains very high,” Shaykevich said. “That is going to ultimately benefit investors in emerging markets because countries will have to continue to offer concessions in order to access the markets to fund these gaps.”

Chinese government restrictions on cross-border capital flows have made it difficult for foreign funds to access domestic markets, making Hong Kong an attractive option. As U.S. political pressure accelerates, New York-listed Chinese companies are quickly turning to Hong Kong.

Recently, the Chinese government has increased efforts to open up the domestic financial industry further to foreign players. “The moves are part of a years-long trend…We’ve seen a lot of interest in the market,” Chantal Grinderslev said. “For those clients that are looking into China … they all realize: In the current global environment, there isn’t an alternative to China.” In one of the latest moves by a foreign firm, Fidelity International last month to set up a wholly owned mutual fund unit. In 2018, the company launched a five-year partnership with Ant Fortune, a subsidiary of Alibaba-affiliate Ant Financial, to study retirement preparedness among people in China.

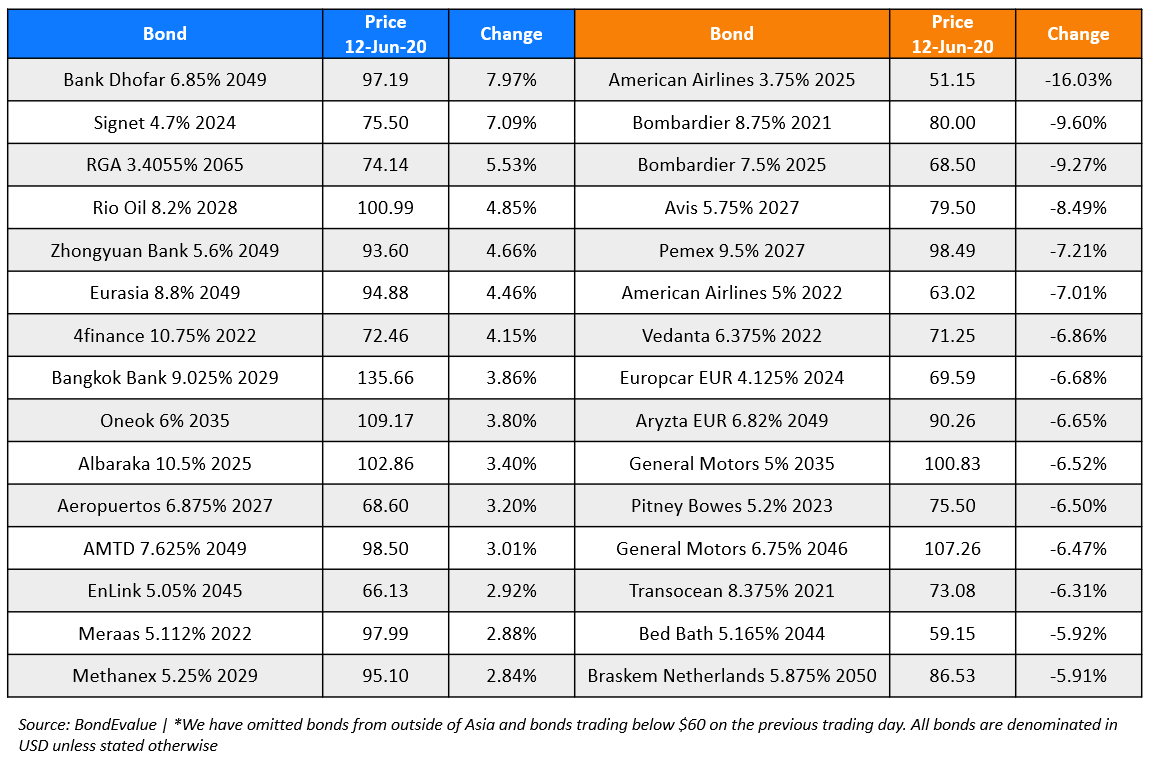

Top Gainers & Losers – 12-Jun-20*

Go back to Latest bond Market News

Related Posts: