This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta, San Miguel Launch $ Bonds

November 25, 2024

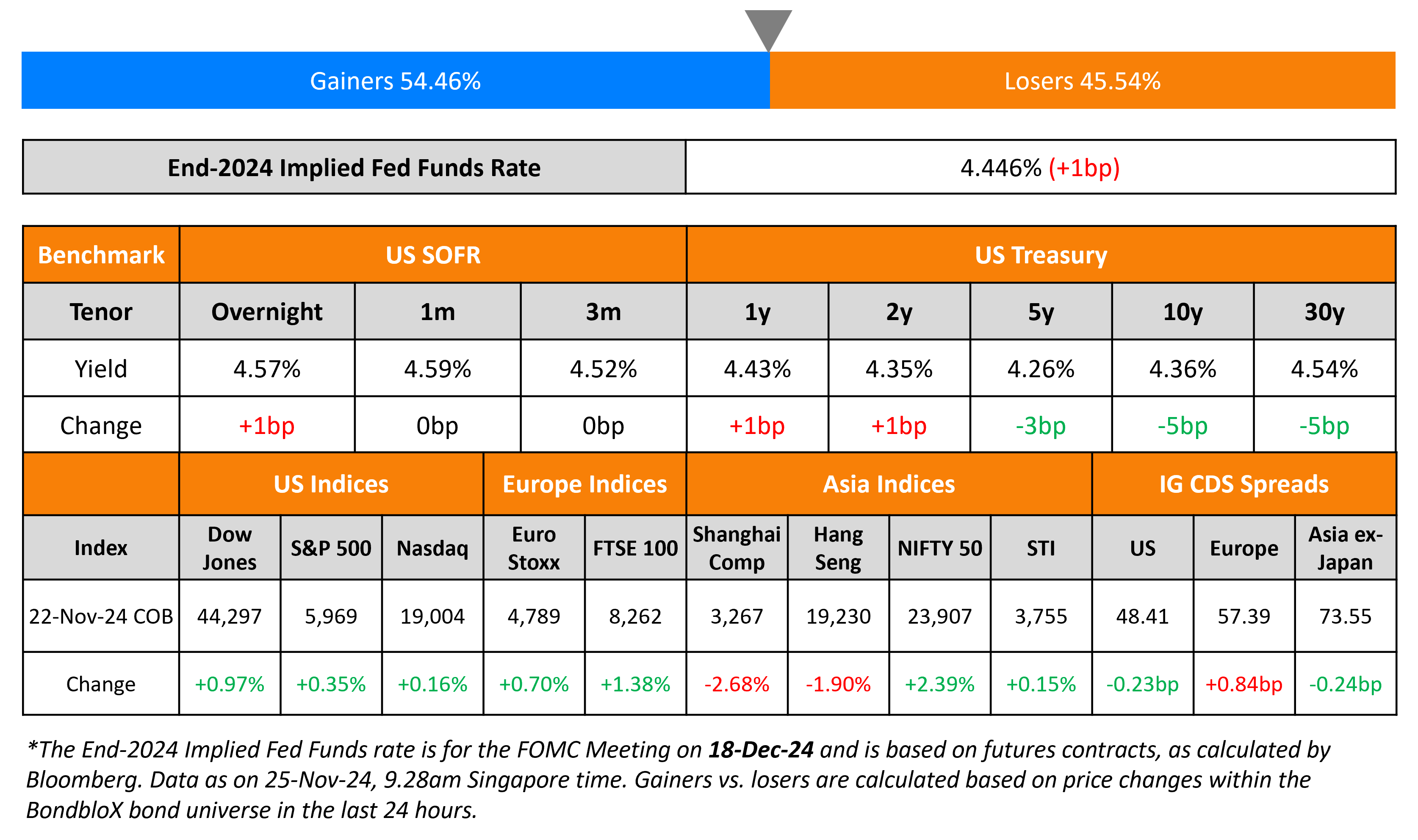

US Treasury yields eased on the long-end by about 5bp on Friday. This followed President-elect Donald Trump’s selection of Scott Bessent as the next Treasury Secretary. Bessent is said to be considered a “fiscal hawk” on Wall Street. Bessent recently pitched a “3-3-3” mandate, which aims for 3% economic growth, reducing the budget deficit to just 3% of GDP, and raising domestic oil production by 3mn barrels per day. Analysts observe that the plan might help pare inflation expectations arising from potential higher tariffs and corporate tax cuts. Aside from this, preliminary figures for November’s S&P Manufacturing and Services PMIs were released. The manufacturing print came-in at 48.8 (vs. 48.5 last month), while services came-in at 57 (vs. 55 last month).

US IG and HY CDS spreads tightened by 0.2bp and 0.4bp respectively. In terms of the US equity markets, the S&P and Nasdaq closed 0.4% and 0.2% higher. European equities followed suit and closed higher across the board too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.8bp and 4.2bp respectively. Asian equities have opened broadly mixed this morning. Asia ex-Japan CDS spreads tightened by 0.2bp.

Rating Changes

-

Moody’s Ratings upgrades Saudi Arabia to Aa3; changes the outlook to stable from positive

-

Marathon Oil Corp. Upgraded To ‘A-‘ From ‘BBB-‘ Following Acquisition By ConocoPhillips, Ratings Off Watch Positive

-

Fitch Upgrades Nykredit Realkredit A/S to ‘A+’; Outlook Stable

-

Moody’s Ratings upgrades Cyprus’ ratings to A3 and changes outlook to stable

-

Ras Al Khaimah Upgraded To ‘A/A-1’ On Stronger Growth Prospects And Resilient Fiscal Performance; Outlook Stable

-

Bharti Airtel Outlook Revised To Positive On Earnings Strength; ‘BBB-‘ Rating Affirmed

Term of the Day: SPV

An SPV is a separate legal entity with its own assets and liabilities created by an organization (parent). SPVs are typically setup for a specific purpose such as issuing debt. SPVs can be in the form of limited partnerships, trusts, corporations or limited liability companies. Some benefits of setting up SPVs include:

– Isolating financial risk for the parent that is setting up the SPV

– Securitization of assets

– Tax savings if the SPV is domiciled in a tax haven such as the Cayman Islands

– Some SPVs can also be referred to as ‘bankruptcy-remote entities’ in that its operations are limited to the acquisition and financing of specific assets in order to isolate financial risk.

Talking Heads

On Junk Bonds at Risk as EMs Brace for ‘Trumponomics’

Reza Baqir, Alvarez & Marsal

“Trump’s anticipated policy changes will likely push the Federal Reserve to pause rate cuts… weakens emerging-market currencies against the dollar”

Vittoria Zoli, Moody’s

“Disruptions to global trade from tariffs and other measures will obviously be bad for emerging markets that export to the US”

Luca Paolini, Pictet Asset

“Roughly 50% of what Donald Trump proposed during the election campaign will be implemented”

On Investors seeing Bessent as calming US bond market worries

Michael Purves, Tallbacken Capital

“There was some level of anxiety priced in that Trump was going to pick someone who was not good or some kind of absolute tariff fanatic, so this is a very good answer”

Joe McCann, Asymmetric.

“The beauty of this nomination is that Bessent is a fiscal conservative… sets the stage for more fiscal discipline, which the market is really going to welcome”

On Man Group, Abrdn Counting on China Stimulus to Revive Bull Run

Andrew Swan, Man Group

“China policymakers may want more visibility before deciding on the size and timing of fiscal stimulus measures… we think the direction of travel is clear, and the continued structural reform in China supports our optimism”

Elizabeth Kwik, Abrdn

“Any major pullback in the market due to US tariff uncertainties would be a good time to add to China”

Top Gainers and Losers- 25-November-24*

Go back to Latest bond Market News

Related Posts: