This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta, CK Hutch, StanChart Launch Bonds

September 10, 2024

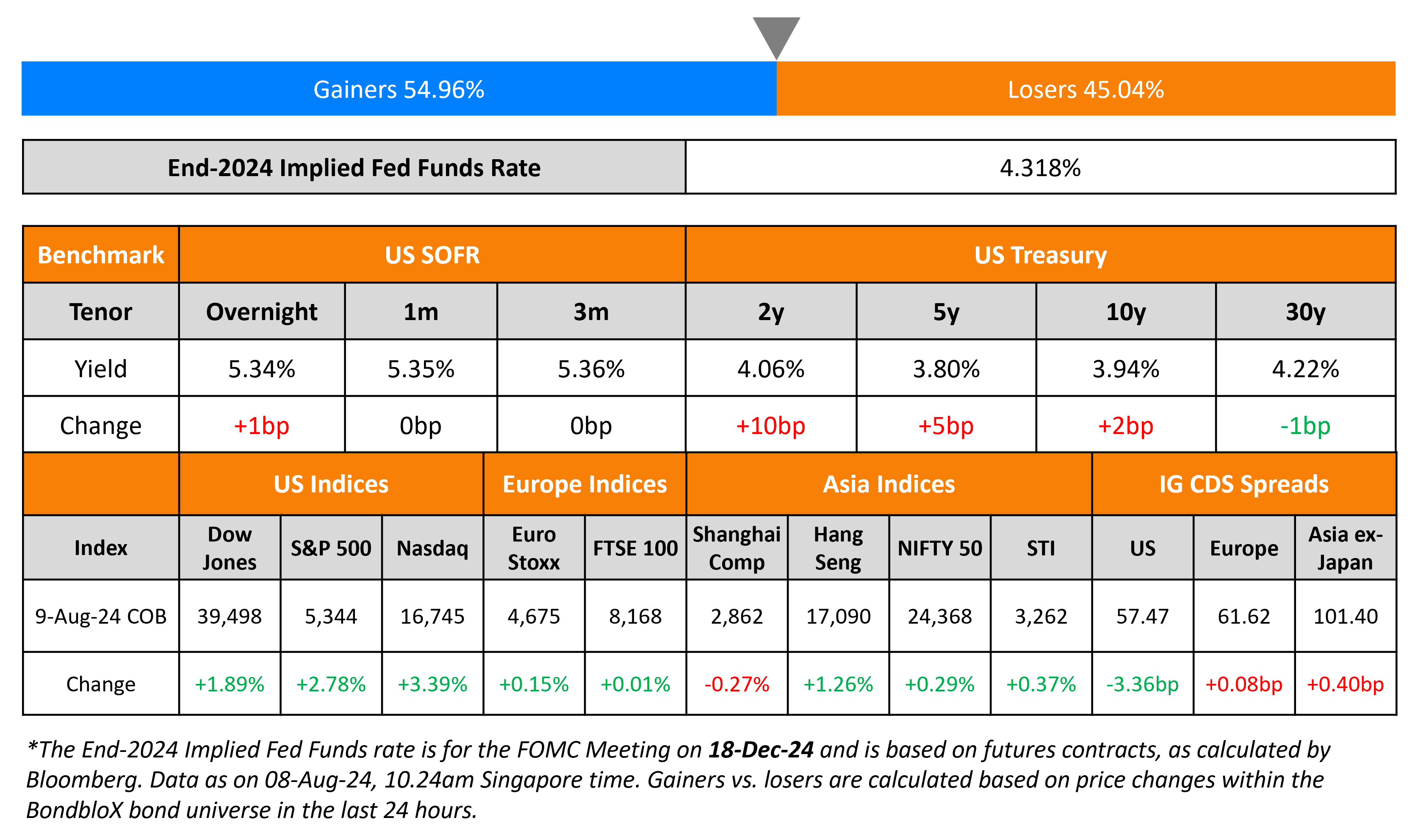

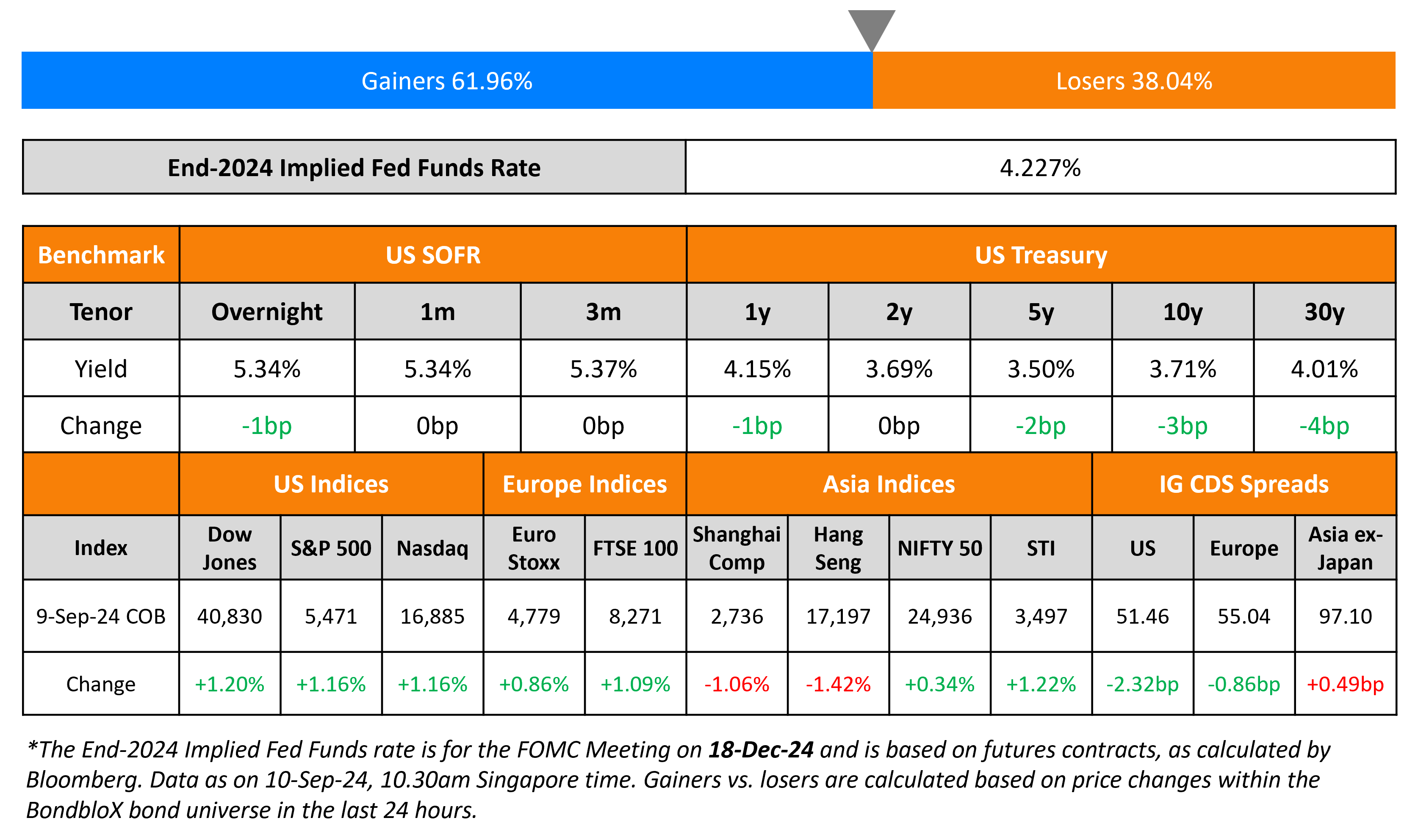

US Treasury yields held steady across the curve with no new data points or catalysts yesterday. Markets now await the inflation report on Wednesday and the FOMC meeting next week where the latest dot plots are expected. US IG CDS spreads tightened by 2.3bp and HY CDS spreads were tighter by 11.2bp. Looking at US equity indices, the S&P and Nasdaq were both higher by 1.2%.

European equity markets ended higher too. Looking at Europe’s CDS spreads, the iTraxx Main spreads were tighter by 0.9bp while Crossover spreads tightened by 5.7bp. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads widened by 0.5bp. Asian primary markets continue to remain active with popular new deals including Vedanta, CK Hutch and StanChart.

New Bond Issues

-

Vedanta Resources $ 5NC2 at 11.125% area

-

Standard Chartered S$ PerpNC5 at 5.7% area

-

CK Hutchison $ 5.5Y/10Y at T+125/145bp area

-

Nissan Motor $ 3Y/3Y FRN/5Y at T+185/SOFR Equiv/215bp area

BP Capital Markets raised ~$1.27bn via a multi-currency issuance. It raised €800mn via a 7Y bond at a yield of 3.36%, 30bp inside initial guidance of MS+130bp area. It also raised £300mn via a 12Y bond at a yield of 5.067%, 15bp inside initial guidance of UKT+120bp area. The senior unsecured notes are rated A1/A-/A+. Proceeds will be used for general corporate purposes, including repaying existing debt.

UniCredit raised €1bn via a PerpNC8 AT1 bond at a yield of 6.502%, ~50bp inside initial guidance of 7% area. The junior subordinated notes are rated Ba3, and received orders of over €2.8bn, 2.8x issue size. Coupons are fixed until 3 June 2032 and if not redeemed, resets then and every five years thereafter at the 5Y Mid-Swap plus 421.2bp.

New Bonds Pipeline

-

Piraeus Financial hires for € 11NC6 T2 bond

-

Qatar Islamic Bank hires for $ 5Y bond

Rating Changes

- Moody’s Ratings upgrades Kazakhstan’s ratings to Baa1, outlook changed to stable

- Fitch Upgrades Emirates Islamic Bank’s Ex-Government Support Ratings to ‘BBB(xgs)’ and ‘F2(xgs)’

- Moody’s Ratings downgrades Li & Fung’s CFR to Ba2; changes outlook to stable

- Moody’s Ratings affirms Standard Chartered’s ratings; changes outlook to positive

- Fitch Places Frontier Communications on Positive Watch Following Verizon Acquisition

- Moody’s Ratings places Methanex’s ratings under review for downgrade

- Moody’s Ratings affirms Embraer’s Ba1 rating; changes outlook to positive

Term of the Day

Risk Weighted Assets (RWA)

Risk Weighted Assets (RWA) is a calculation used in banking that helps determine the minimum amount of capital (capital adequacy ratio) that a bank should keep as reserves against unexpected losses arising out of its assets turning sour or insolvency/bankruptcy. Riskier assets like unsecured loans, high yield securities etc. that carry a higher risk of default are given a higher risk weightage and safer assets like Treasuries are given a lower weightage since high risk assets require higher capital adequacy ratios (CAR).The minimum capital requirements as a percentage of RWAs are set by regulatory agencies with banks required to keep a minimum of 10.5% of RWA as Tier 1 and Tier 2 capital under Basel III.

Talking Heads

On Further Yen Gains as Carry-Trade Era Winds Down – Amundi

“We think the fair value on the yen was and is 140″… BOJ’s July rate hike, and the shift in monetary policy it heralded, mark a “game changer” for the currency

On Bond Market Rally Riding on How Fast the Fed Cuts Rates

Bob Michele, JPMorgan Asset Management

“I don’t see anything breaking”… bond market has already run too far ahead of the Fed as the economy keeps chugging along

Jamie Patton, TCW Group

“The Fed is going to have to lower rates faster and more aggressively than what the market’s priced in”

John Madziyire, Vanguard

“The Fed needs to cut, we all know that, but the question is the pace”

Saira Malik, Nuveen

“The Fed will go slower rather than faster because the economy is not on the cusp of a recession”

On Morgan Stanley Turns Negative on EM and Touts Hedges

“Any further fall in UST yields will likely be risk-negative. It takes up to 12 months after the first cut for the rotation out of money market funds into risk assets to happen”

Top Gainers & Losers-10-September-24*

Go back to Latest bond Market News

Related Posts: