This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Curve Bear Flattens as Markets Reassess Fed Rate Cuts

August 12, 2024

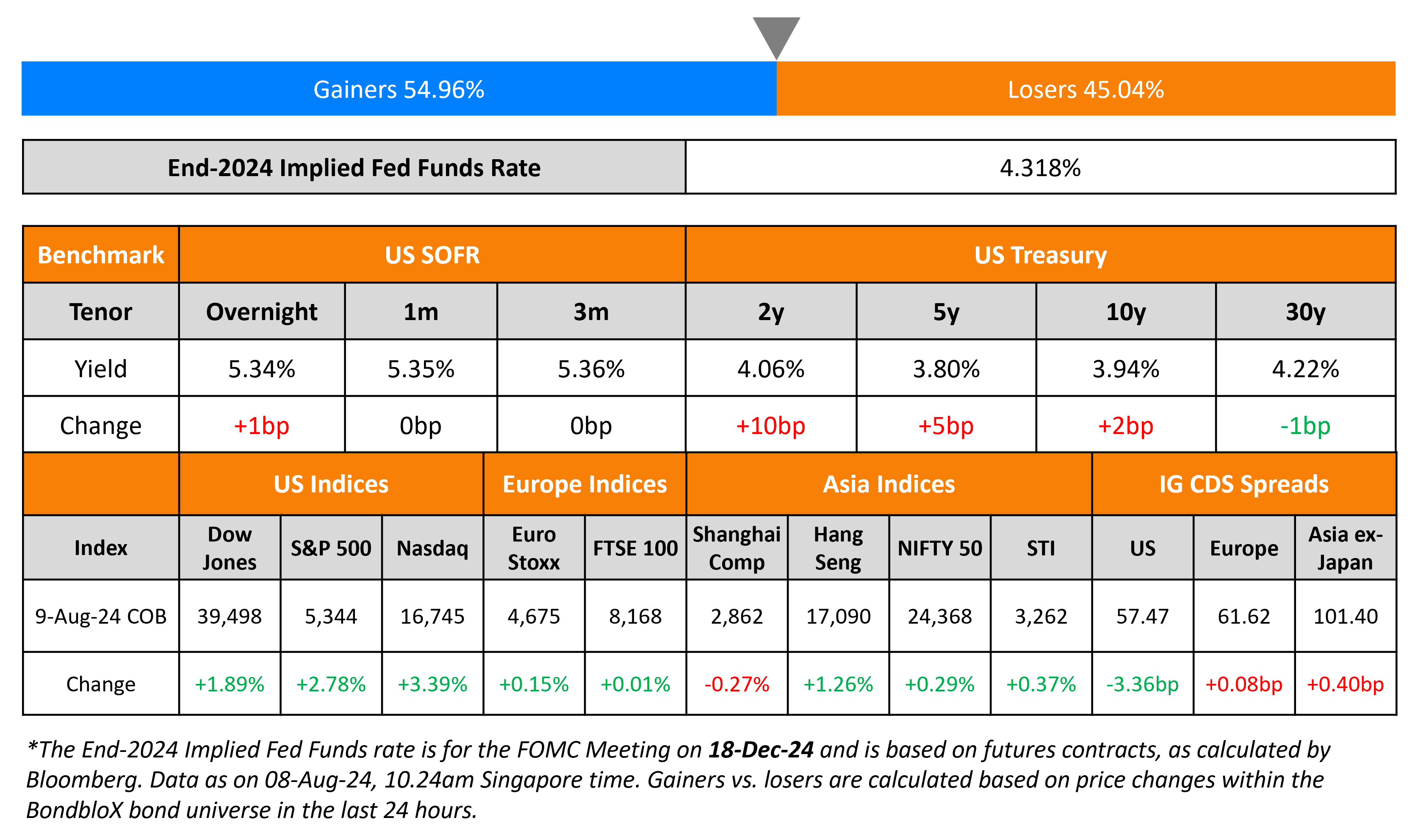

The US Treasury 2s10s curve bear flattened with the 2Y yield up 10bp and the 10Y up 2bp, as markets reassessed their views on Fed rate cuts. Initial jobless claims for the week before last fell by 17k to 233k, lower than expectations of 240k. This was its largest drop in about 11 months, easing fears of a further worsening in the labor market. Fed Governor Michelle Bowman said that said she still sees upside risks for inflation and continued strength in the labor market, indicating that she may not be ready to support a Fed rate cut in September. Separately, Boston Fed President Susan Collins said that if inflation continues to go down, with overall data going the way she expects, then she expects rate cuts soon.

Following the weak jobs report earlier this month, markets were initially pricing-in nearly 125bp of Fed rate cuts this year. However, this has now eased to 100bp by end-2024, looking at the Fed Funds Futures pricing. Over the last couple of trading sessions, US equities have bounced back sharply, with the S&P and Nasdaq up by 2.8% and 3.4% respectively. US IG and HY CDS spreads have also tightened by 3.4bp and 18bp respectively during this period.

European equity markets have held steady. Looking at Europe’s CDS spreads, the iTraxx Main spreads were 0.1bp wider and Crossover spreads widened by 1.1bp. Asian equity indices have opened mixed today. Asia ex-Japan CDS spreads were wider by 0.4bp.

New Bond Issues

- ESR-Logos Reit S$ PerpNC5 at 6.2% area

Rating Changes

- Community Health Systems Inc. Upgraded To ‘CCC+’ From ‘SD’ On Modest Performance Improvement; Outlook Negative

- Moody’s Ratings upgrades Paramount’s CFR to Ba2

- Fitch Revises Serbia’s Outlook to Positive; Affirms at ‘BB+’

Term of the Day

NAIRU

Non-Accelerating Inflation Rate of Unemployment (NAIRU) refers to the level of unemployment below which the rate of inflation is expected to rise. NAIRU is determined by several factors including demographics, productivity, bargaining power, monetary policy, supply-side pressures etc. NAIRU is sometimes referred to as the natural rate of unemployment.

Talking Heads

On Market Selloff Yet to Breach Key Levels – BofA’s Michael Hartnett

“Technical levels that would flip Wall Street’s narrative from soft to hard landing have not been broken… Investor feedback is ‘frazzled’… opportunities in assets that were “strangled by 5% yields and can breathe more easily with yields at 3-4%”

On ‘Appalled’ at Idea of Presidential Sway Over Fed Policy – Fmr. US Treasury Secy., Larry Summers

“Having politicians involved is a fool’s game. You end up with higher inflation and a weaker economy… I sure was appalled at how bad an idea it was… it may be that a 50 basis-point cut is appropriate (in September)”

On Bets Against Yen Cratering as Volatility Scares Carry Trade

Yuya Yokota, Mitsubishi UFJ Trust

“The recent move in the yen has caused a significant unwinding of carry trades”

Chris Weston, head of research at Pepperstone Group

“BOJ would’ve had a very strong idea about where the carry trade was and how much money was involved in it and how markets would react”

Brad Bechtel, Jefferies

“The sudden rush for the exits on the yen carry trade was impulsive… market was burned on the suddenness of the moves”

Top Gainers & Losers-12-August-24*

Go back to Latest bond Market News

Related Posts: