This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Korea Hydro, CICC Launch $ Bonds; Macro; Rating Changes; Talking Heads

July 11, 2023

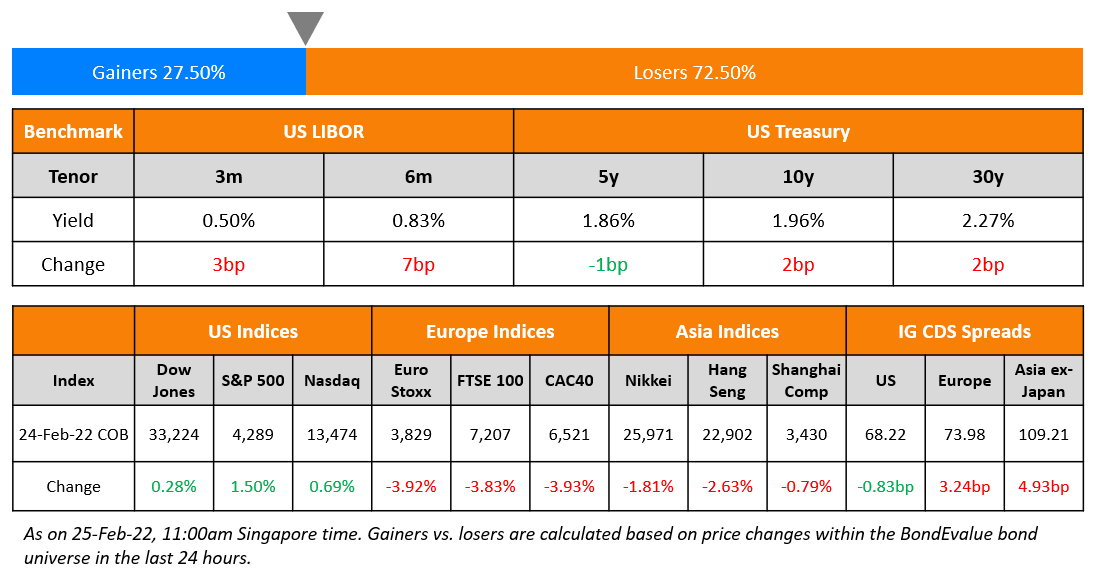

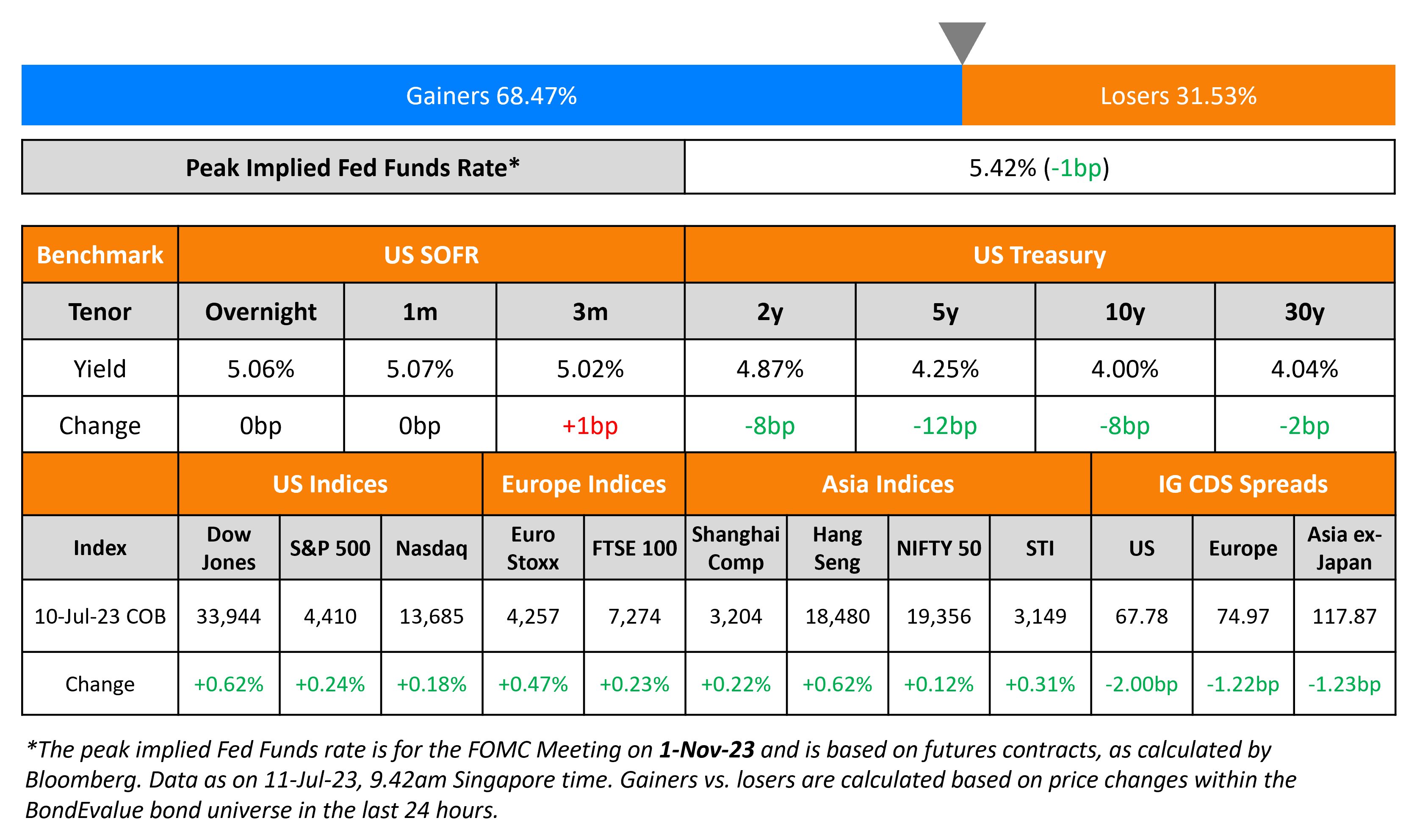

US Treasury yields dropped lower with the 2Y and 10Y yields down 8bp each while the belly of the curve (Term of the Day, explained below) saw the 5Y yield drop 12bp. The peak Fed Funds rate fell 1bp to 5.42%. CME probabilities show a 94% probability of a 25bp hike at the 25 July meeting with a likely hold on rates through the rest of the year. This is despite Fed speakers like Mary Daly who came out yesterday calling for two more hikes by year end. US equity indices were higher with the S&P and Nasdaq up ~0.2%. US IG and HY CDS spreads tightened 2bp and 11bp respectively.

European equity indices closed lower with European main CDS spreads 1.2bp tighter and Crossover CDS tighter by 5bp. Asia ex-Japan CDS spreads were 1.2bp tighter and Asian equity markets have opened higher today. China’s CPI came at 0% YoY, with core inflation slowing from 0.6% to 0.4% indicating a slowing down in inflationary pressures. Meanwhile, its PPI fell by 5.6%, much more than the expected rate of 5%. Some have called for the government to launch a stronger stimulus package to sustain China’s post-Covid recovery. Some economists have called for the PBoC to make a couple of rate cuts due to softening inflation.

New Bond Issues

- Korea Hydro & Nuclear Power $ 5Y green at T+120bp area

- CICC International $ 3Y at T+125bp area

Hong Kong Land raised $400mn via a 10Y bond at a yield of 5.28%, 35bp inside initial guidance of T+160bp area. The senior unsecured bonds have expected ratings of A2/A (Moody’s/S&P) and have a 3-month par call. It received orders over $3.5bn, 8.8x issue size. Proceeds will be used for general corporate purposes.

Doosan Enerbility raised $300mn via a 3Y Green bond at a yield of 5.582%, 37bp inside initial guidance of T+135bp area. The senior unsecured bonds have expected ratings of Aa2 (Moody’s) and are guaranteed by the Korea Development Bank (rated Aa2/AA/AA–). It received orders over $980mn, 3.3x issue size. Asset and fund managers took the bulk of the deal at 41%, central banks, sovereign wealth funds and policy banks snapped up 35%, while other financial institutions, including insurers and private banks took the remaining 2%. Asia accounted for 69% and EMEA 31%. Proceeds will be used to finance/refinance, new or existing Eligible Green Projects in accordance with the Doosan Enerbility Green Financing Framework.

TD Bank raised $3.5bn in a three-part deal. It raised

- $1.8bn via a 3Y bond at a yield of 5.532%, 27bp inside initial guidance of T+125bp area. The new bonds offer a new issue premium of 12.2bp over its existing 5.103% 2026s that yield 5.41%.

- $450mn via a 3Y FRN bond at a yield of 6.172%. The floating coupon will be set at the overnight SOFR+108bps, and will be paid quarterly.

- $1.25bn via a 5Y bond at a yield of 5.523%, 27bp inside initial guidance of T+155bp area.

The senior unsecured bonds have expected ratings of A1/A/AA-. Proceeds will be used for general corporate purposes.

New Bond Pipeline

-

Hanhwa Q Cells hires for $ 5Y green bond

-

Shinhan Financial hires for $ 5Y social bond

Rating Actions

- Moody’s downgrades Casino’s CFR to Ca; outlook remains negative

- Fitch Upgrades Pakistan to ‘CCC’

Term of the Day

Belly of the Curve

The belly of the curve is the middle (belly) portion of a yield curve, referring to bonds with maturities around the 5-year mark. While the short-end of the yield curve is primarily driven by the policy rate set by the central bank and the rate at which banks borrow and lend to each other, the belly and the long-end are impacted by more factors. As we go further down the curve, the term premium or the premium required for a longer tenor, expectations of the central bank policy rates in the future and long term inflation expectations start to become more important. These factors focus attention most of the time into the belly of the curve (up to ten years) and generally make this part of the curve more volatile and sensitive to changes.

Apart from trading strategies such as Laddering that is used to spread risk across the curve, traders also use strategies such as Spreads and Butterfly Spreads. A simple Spread trade is where you either Buy the short-end and Sell the long-end or vice versa. A Butterfly Spread is where you either Sell the belly and Buy the short- & long-end or Buy the belly and Sell the short- & long-end. The duration risk taken at each part of the curve is matched such that net duration is close to zero and profit/loss is driven only by changes in the shape of the curve such as flattening or steepening.

Talking Heads

On More Interest Rate Hikes Required to Bring Down Inflation

Michael Barr, Fed Vice Chair for Supervision

“I would say we’re close, but we still have a bit of work to do.”

Mary Daly, San Francisco Fed President

“We’re likely to need a couple more rate hikes over the course of this year to really bring inflation back into a path that’s along a sustainable 2% path…Inflation is our No. 1 problem.”

Loretta Mester, Cleveland Fed President

“In order to ensure that inflation is on a sustainable and timely path back to 2%, my view is that the funds rate will need to move up somewhat further from its current level and then hold there for a while as we accumulate more information on how the economy is evolving.”

Raphael Bostic, Atlanta Fed President

“I have the view that we can be patient — our policy right now is clearly in the restrictive territory…We continue to see signs that the economy is slowing down, which tells me the restrictiveness is working.”

On ECB’s Inflation Management – ECB Governing Council member Joachim Nagel

“I’m convinced that we can manage it in a way that the economy weakens a bit, but that there won’t be a hard landing and high unemployment.”

On the Sustainability of Italy’s Debt – UniCredit group chief economics adviser Erik Nielsen

“When you shake these numbers properly and compare them with other OECD countries, you can only conclude that Italian sovereign debt — while higher than desirable — ought to not be a concern for financial markets…I remain highly confident that the European institutional and policy combination, including the NGEU and the ECB toolbox, is now sufficiently powerful to address speculative attacks in the euro-zone sovereign-debt market.”

“Interest cuts may erode household wealth income and accelerate precautionary savings, thus resulting in a reduction in consumption at present…SMEs’ investment decisions mainly depend on the accessibility of loans, rather than interest rates…interest rate adjustments will not have a significant impact on the investment decisions of Chinese enterprises for the time being…A more practical approach is to expand transfer payments from the central government to local governments, or take on debt by means of treasury bonds…What China needs for the economy to pick up and grow sustainably is to support consumption and the high-tech sector.”

On Inflation in the UK – BoE Governor Andrew Bailey

“Looking ahead, headline inflation is set to fall markedly over the remainder of the year. This largely owes to lower energy prices as last year’s substantial increases drop out of the annual calculation. Food prices should fall too as lower commodity prices feed through to prices in the shops.”

Top Gainers & Losers – 11-July-23*

Go back to Latest bond Market News

Related Posts: