This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

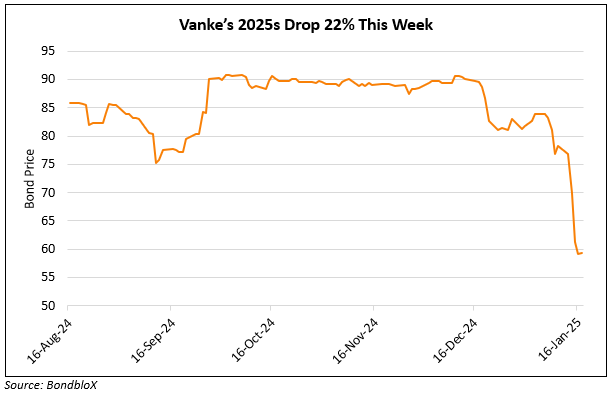

Vanke’s Dollar Bonds Drop on 43% Dip in January Contracted Sales

February 6, 2025

China Vanke’s dollar bonds fell by 2-3 points yesterday. A report noted that if Vanke’s sales worsens further, the Shenzhen government’s support, including facilitating its asset sales and refinancing may not be sufficient to help with its liquidity for 2025. This comes after Vanke’s contracted sales for January dropped by 43%, to a 16Y low. The report added that Shenzhen Metro’s tight cash coverage of short-term debt at 98% implies the need for them to tap funds from Shenzhen’s SASAC.

Vanke’s 3.5% 2029s fell over 3 points to 56.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Vanke Downgraded to B3 by Moody’s

January 20, 2025