This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vanke Seeks to Alter Terms on Two Bank Loans; Wanda Seeks Extension of $400mn Bond

November 26, 2024

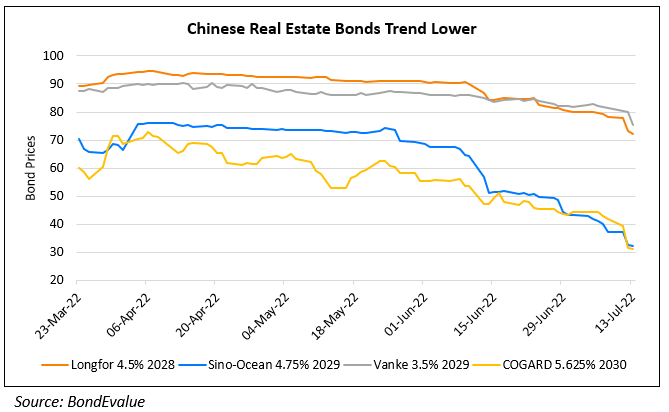

China Vanke is seeking approval from lenders to change terms on two offshore loans due in 2026. Vanke has requested waivers for covenants related to key financial ratios, such as debt to net worth. Approval is needed from lenders holding two-thirds of the loan values for the waivers to be granted. This comes following worsening financial conditions amid China’s ongoing property crisis. The company recently saw a 35% drop in contracted sales. Last week, S&P recently downgraded Vanke to B+ from BB-, citing slow debt reduction and high leverage.

Vanke’s dollar bonds were trading lower by over a point across the curve. Its 3.5% 2029s fell 1.6 points to 54.5, yielding 17.7%.

Separately, Wanda Properties Global, a unit of Dalian Wanda is seeking approval from bondholders to amend terms on its 11% 2025s. This includes extending the maturity date to January 2026 and adding a mandatory redemption of 25% of the bonds by January 2025. This aims to alleviate near-term liquidity pressures and better manage the company’s debt repayment schedule. If the amendments are not approved, the company risks triggering cross-default provisions. Again, this transaction comes due to the ongoing property market slowdown in China.

Wanda’s dollar bonds were trading stable across the curve, but have been trending lower. Its 11% 2025s have fallen from 97.7 cents on the dollar to 90 currently.

Go back to Latest bond Market News

Related Posts:

Vanke Unit to Raise ~$790mn via Hong Kong IPO

September 19, 2022