This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vanke Downgraded to B3 by Moody’s

January 20, 2025

China Vanke was downgraded by two notches to B3 from B1 by Moody’s. Its senior unsecured bonds were also downgraded by a similar extent to Caa1 from B2. The downgrade reflects Vanke’s deteriorating liquidity profile amid its sluggish sales performance and rising maturity dues over the next 6-12 months. China Vanke’s contract sales dropped 35% in 2024, falling to RMB 246bn ($33.6bn) from RMB 376bn ($51.4bn) in 2023, due to the slow recovery of China’s property market. According to Moody’s, the company’s cash flow is insufficient for deleveraging, and its debt maturity in 2025 is significantly higher than in 2024, with challenges in refinancing both onshore and offshore bonds. In addition, Vanke’s credit metrics are weakening, with the EBIT-to-interest ratios expected to drop and debt-to-EBITDA ratios to rise in the coming years. The company’s liquidity remains weak, with insufficient unrestricted cash, to cover land payments and refinancing needs in the next 12-18 months. It was downgraded by S&P and Fitch in September last year.

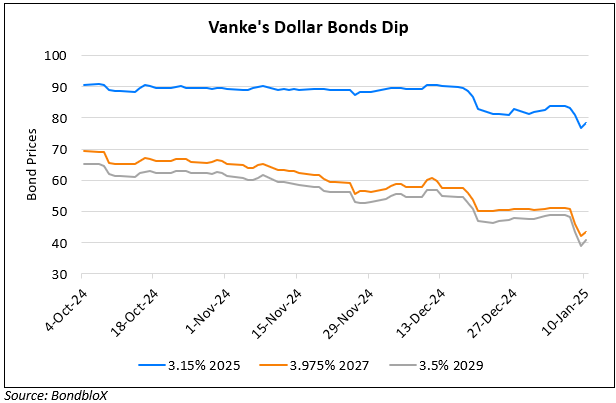

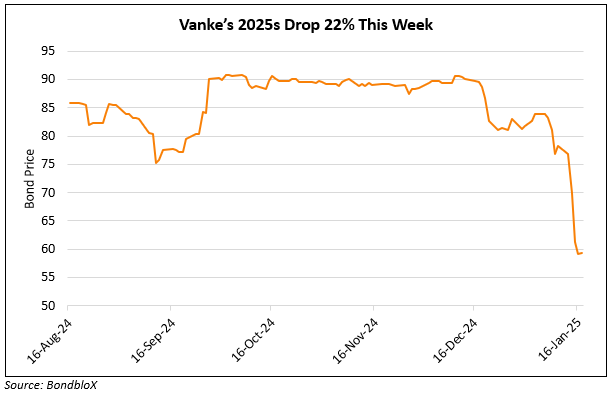

Vanke’s dollar bonds were down by 1.5-2 points across the curve with its 3.15% 2025s down at 64.48 cents on the dollar.

Go back to Latest bond Market News

Related Posts: