This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

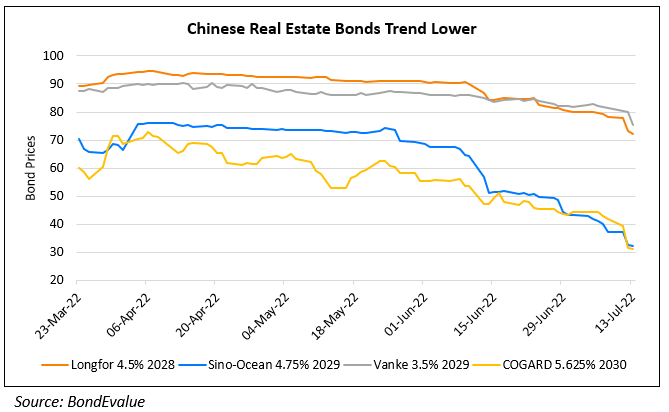

Vanke Secures $2.8bn Loan from State Lenders; Downgraded to BB-

May 24, 2024

China Vanke’s dollar bonds continued to rally, after the company secured funding in the form of a syndicated loan from Chinese state lenders amounting to RMB 20bn ($2.8bn). It already received half of the funding and pledged shares in unit Vanke Logistics Development for the borrowing. Total loans that Vanke and its units have taken out in May amount to ~RMB 28bn ($3.9bn), as per Bloomberg. Analysts note that the latest loan will help them improve liquidity and push forward fundraising.

Separately, the developer was also downgraded to BB- from BB by Fitch due to a reduction in liquidity buffer following weaker-than-expected sales this year. Fitch said that the sustained sales deterioration has affected Vanke’s non-bank funding access, and that the developer will increasingly rely on cash, asset disposals and secured onshore bank financing to address debt maturities in 2024 and 2025.

Vanke’s dollar bonds were up over 5% with its 3.15% 2025s now at 87.3, yielding 18.3%.

Go back to Latest bond Market News

Related Posts: