This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

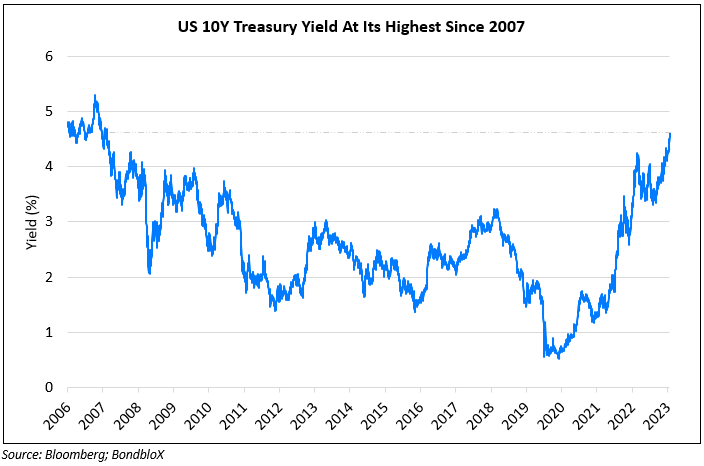

US Treasury Yields Surge With the 10Y Now at 2007 Levels

September 28, 2023

Following a slight pull back on Tuesday, US Treasury yields continued its surge higher on Wednesday – 2Y yields rose 8bp to 5.14% and the 10Y rose 10bp to 4.62%. Positive economic data continued to strengthen the case for the ‘higher for longer’ theme. The preliminary print for US Durable Goods Orders saw a 0.2% increase in August, much higher than expectations for a -0.5% print. Also, Capital Goods Orders (non-defense ex-air) saw an increase of 0.9% in August vs. expectations of 0.1%. Both data points continued to show economic resilience on the consumer and industrial standpoints. Besides, inflationary pressures from the oil market also weighed on markets. Oil prices rose to a 1Y high as crude stockpiles in the largest US storage hub declined to the lowest since July 2022. WTI crude topped $93/bbl and Brent moved to over $95/bbl. In credit markets, US IG CDS spreads were 0.4bp tighter while HY spreads widened by a stark 20bp. The S&P and Nasdaq eked out marginal gains on Wednesday.

European equity markets ended marginally higher too. In credit markets, European main CDS spreads were wider by 1.6bp and crossover spreads widened 12bp. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issues

- Changde Urban Construction $100mn 3Y at 6.1% area

NBN raised $1.25bn via a two-part deal. It raised $750mn via a 5Y bond at a yield of 5.767%, 27bp inside initial guidance of T+135bp area. It also raised $500mn via a 10Y bond at a yield of 6.037%, 22bp inside initial guidance of T+165bp area. The senior unsecured bonds have expected ratings of Aa3/AA (Moody’s/Fitch). The newly issued notes have a change of control put at 101. Proceeds will be used for general corporate purposes, including repaying borrowings under existing loan facilities.

Glencore raised $2.5bn via a three-tranche deal. It raised

- $750mn via a 5Y bond at a yield of 6.226%, 25bp inside initial guidance of T+180bp area.

- $750mn via a 7Y bond at a yield of 6.474%, 30bp inside initial guidance of T+210bp area.

- $1bn via a 10Y bond at a yield of 6.553%, 30bp inside initial guidance of T+225bp area.

The senior unsecured bonds have expected ratings of Baa1/BBB+. The newly issued bonds have change of control put at 101. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Philippines hires for $1bn Retail bond

- NBN hires for $ 5Y/10Y bond

- Emirates NBD hires for Sustainable bond

Rating Changes

- Moody’s upgrades DNB Bank’s deposit ratings to Aa1; outlook stable, and affirms senior unsecured ratings at Aa2 with a positive outlook

- Moody’s affirms CAR Inc.’s B3 ratings, changes outlook to stable

- Petrofac Ltd. Outlook Revised Downward To Stable; Ratings Affirmed

Term of the Day

Soft Landing

A soft landing refers to a slowdown in the economy, whereby it stops growing but does not lead to a recession. Thus, for example in a soft landing, the central bank would raise interest rates just enough to prevent an economy from overheating and experiencing high inflation, whilst also not triggering a stark increase in unemployment and a recession that would lead to a hard landing. Market participants expect the rate hikes by the Fed and the economic trajectory to hopefully lead to a ‘soft landing’.

Talking Heads

On Building Portfolios Resilient to High Rates – Greg Lippmann, CIO LibreMax Capital

“We’ve tried to create portfolios that are resilient to either a harder landing or the persistence of higher interest rates, which would surprise a lot of people”… include partially paid down CLOs backed by leveraged loans… value in selectively investing in CMBS.

On Fed May Do Less If Risks Like Shutdown Hit – Minneapolis Fed president, Neel Kashkari

“If these downside scenarios hit the US economy, we might then have to do less with our monetary policy to bring inflation back down to 2% … If our interest-rate increases are not slowing the economy the way that we expect, then there is that risk that we might have to go higher”

On Yield Surge Helping Fed on Inflation, With Risks a Harder Landing

Diane Swonk, the chief economist at KPMG

“It’s becoming a series of unfortunate events. The soft landing is being jeopardized”

Lou Crandall, chief economist Wrightson ICAP

“If bond yields are moving higher, there’s even less need for the Fed to have to tighten further”

Mark Zandi, Moody’s Analytics chief economist

“I think the economy can digest 4.5% 10-year Treasury yields, but anything over 5% for more than a few months will be tough to bear”

On Seeing Insurers Betting on Credit, Paring Private Equity – BlackRock

“Insurers still want to increase their allocations to private markets — they still broadly feel like they are under-allocated. There is some greater selectivity… In the world before 2022, where every bond was in an unrealized-gain position, you could rotate whenever you saw the opportunity… now you don’t have the freedom to do that.”

Top Gainers & Losers- 28-September-23*

Go back to Latest bond Market News

Related Posts: