This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Surge Higher as Trump Leads

November 6, 2024

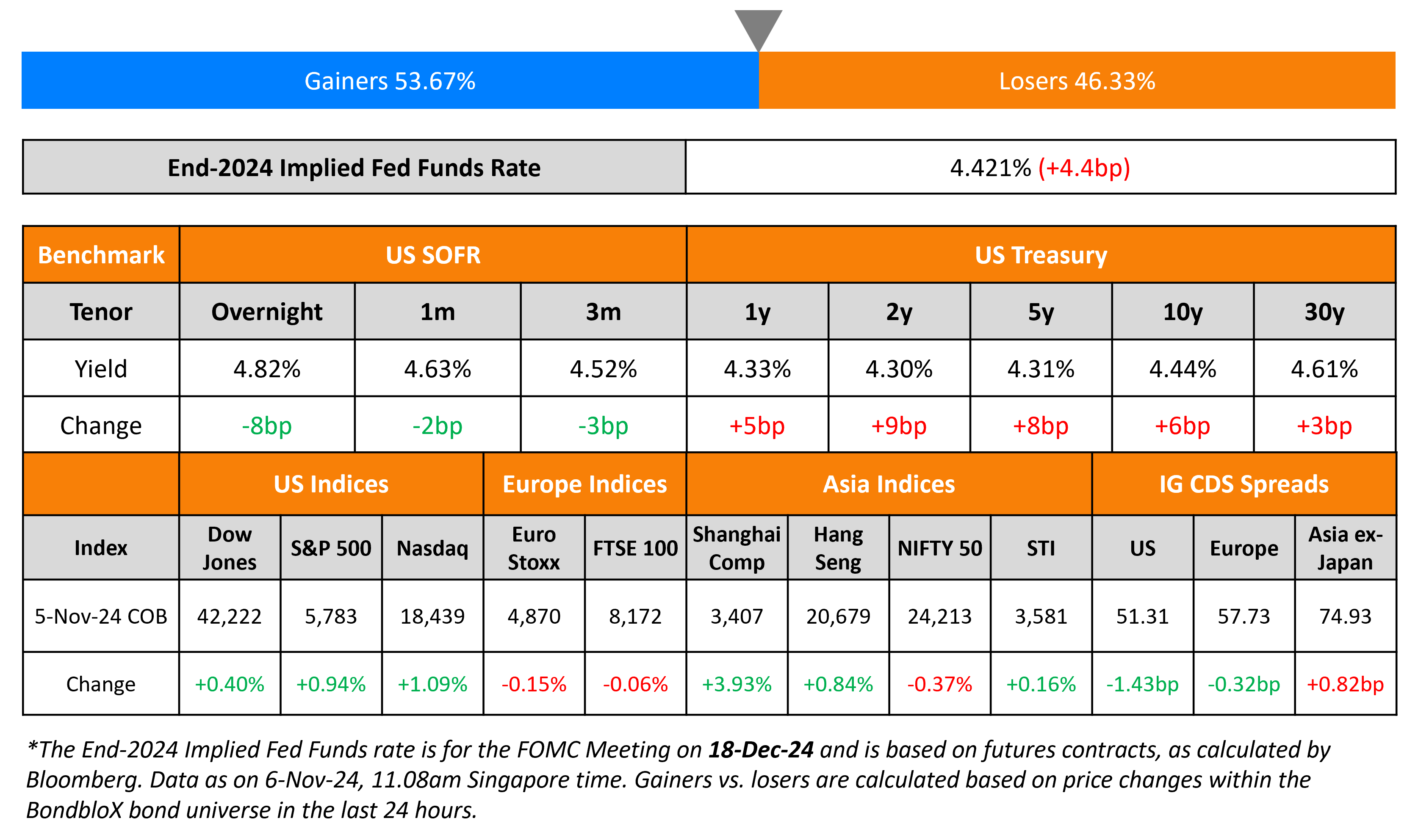

US Treasury yields rose across the board by 7bp on average yesterday. The ISM Services Index came-in stronger than initial expectations at 56.0 (vs. 54.9 last month). Aside from this, the US Treasury held a 10Y auction where the bid-to-cover ratio came in higher than the prior auction at 2.58x (vs. 2.48x last month). The indirect acceptance rate came in lower at 61.7% compared to the prior auction’s 77.6%. US IG and HY CDS spreads tightened by 1.4bp and 10.5bp respectively. Looking at US equity markets, S&P and Nasdaq both closed higher by 0.9% and 1.1% respectively.

European equities closed lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.3bp and 6.9bp respectively. Asian equities opened mixed this morning. Asia ex-Japan CDS spreads widened by 0.8bp.

New Bond Issues

Guocoland raised S$200mn via a 3Y bond at a yield of 3.307%, ~19bp inside initial guidance of 3.5% area. The issuer is GLL IHT Pte Ltd and GuocoLand Ltd is the guarantor. Proceeds will be used to finance general working capital and group’s corporate requirements.

New Bond Pipeline

- Tata Capital hires for $ bond

Rating Changes

- Fitch Upgrades UniCredit Bank GmbH to ‘A-‘; Outlook Stable

-

Ardagh Metal Packaging Finance PLC’s Unsecured Notes Downgraded To ‘CCC’ Following Debt Issuances

- Fitch Revises Peru’s Outlook to Stable; Affirms at ‘BBB’

Talking Heads

On Bond investors minimizing bets as US election overshadows Fed meeting

Brendan Murphy, Insight Investment

“We have initiated small, long positions on the curve, but overall we’re closer to neutral… What’s holding us in being more aggressive with that position is the uncertainty surrounding the election. We’re going to wait and see”

Janet Rilling, Allspring Global Investment

“Making a call on the winner, which way Congress is going to go, and positioning for that, doesn’t make sense… would rather be in a position where we can respond”

On Top EM Ranked Hedge Fund Seeing More Distressed Debt Gains

Genna Lozovsky, Sandglass Capital Advisors

“Unquestionably we have seen a strong move higher in the average price of distressed credits, but there remains quite a bit of dispersion… Argentina is by far the largest in depth given the $60bn bond stack… (if Egypt issued longer-dated, local-currency debt) very attractive bond for investors optimistic about Egypt’s success on the inflation-fighting effort”

On Credit Markets Facing Risk of a $60bn Wave of Fallen Angels

Hunter Hayes, Intrepid Capital

“It’s kind of this slow-moving car wreck… some of these bigger, on-the-cusp, IG names have had some issues — Boeing… But there are a handful of them, and what’s interesting about it to us is just the size… It’ll be an interesting litmus test to see how well high-yield can absorb that”

Top Gainers & Losers 06-November-24*

Go back to Latest bond Market News

Related Posts: