This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Soar Higher, Curve Bear Steepens

November 4, 2024

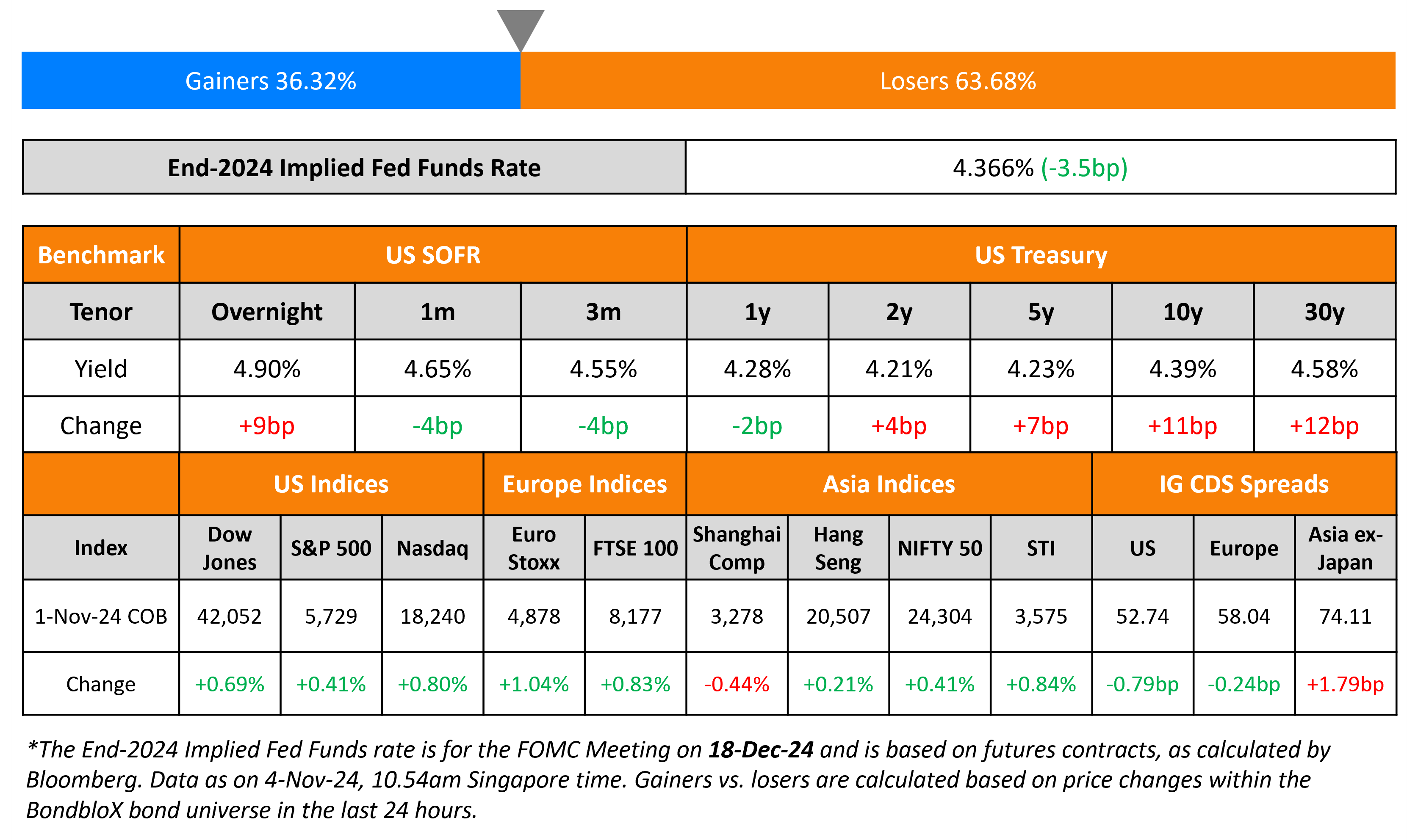

US Treasuries bear steepened, with long-end yields rising by over 10bp while short-end yields rose ~4bp. US Non Farm Payrolls (NFP) for October saw only 12k job additions as compared to expectations of 100k. Analysts noted that this was due to one-off factors such as the hurricanes that occurred and the major labor strike that took place. However, the Average Hourly Earnings (AHE) YoY rose 4.0%, inline with expectations and the Unemployment Rate held steady at 4.1%, again inline with expectations. Following this, the ISM Manufacturing Index came at 46.5, lower than expectations of 47.6. Among the sub-components, the Price Paid Index rose to 54.8, higher than expectations of 50.0 and the prior month’s contractionary reading of 48.3. US IG and HY CDS spreads tightened by 0.8bp and 3.4bp respectively. Looking at US equity markets, both S&P and Nasdaq closed higher by 0.4% and 0.8% respectively.

European equity markets ended higher as well. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 1.9bp respectively. Asian equity indices have opened broadly mixed as of today morning. Asia ex-Japan IG CDS spreads saw a 1.8bp widening.

New Bond Issues

New Bond Pipeline

- Tata Capital hires for $ bond

-

Islamic Development Bank hires for € 5Y Sukuk bond

Rating Changes

- Fitch Upgrades Egypt to ‘B’; Outlook Stable

- Turkiye Upgraded To ‘BB-‘ On Reserve Accumulation And Disinflation; Outlook Stable

- Icahn Enterprises L.P. Downgraded To ‘BB-‘ Following Subsidiary’s Dividend Suspension; Outlook Stable

- Europcar Mobility Group Downgraded To ‘B’ On Weaker Operating Performance; Outlook Negative

- Fitch Downgrades Whirlpool’s IDR to ‘BBB-‘; Outlook Negative

- Moody’s Ratings places GLP Capital Partners Holdings 2 Limited’s Baa2 rating on review for downgrade

- Boeing Co. Ratings Affirmed On Greater-Than-Expected Equity Issuance; Remains On CreditWatch

Term of the Day

Non-Farm Payrolls (NFP)

Non-Farm Payrolls (NFP) is a key data point that is released by the US Bureau of Labor Statistics (BLS) usually on the first Friday of every month. NFP measures net changes in employment excluding agricultural, local government, private household and not-for-profit sectors over the past month and is a key economic indicator in the United States. A high reading of the NFP is considered a positive sign for the US economy while a negative reading is considered a sign of a slowdown in the US jobs market. The NFP indicator is closely watched by traders, especially as it is one of the first monthly economic indicators to be released, and because of the direct relationship between job creation and economic growth.

Top Gainers & Losers 04-November-24*

Go back to Latest bond Market News

Related Posts:

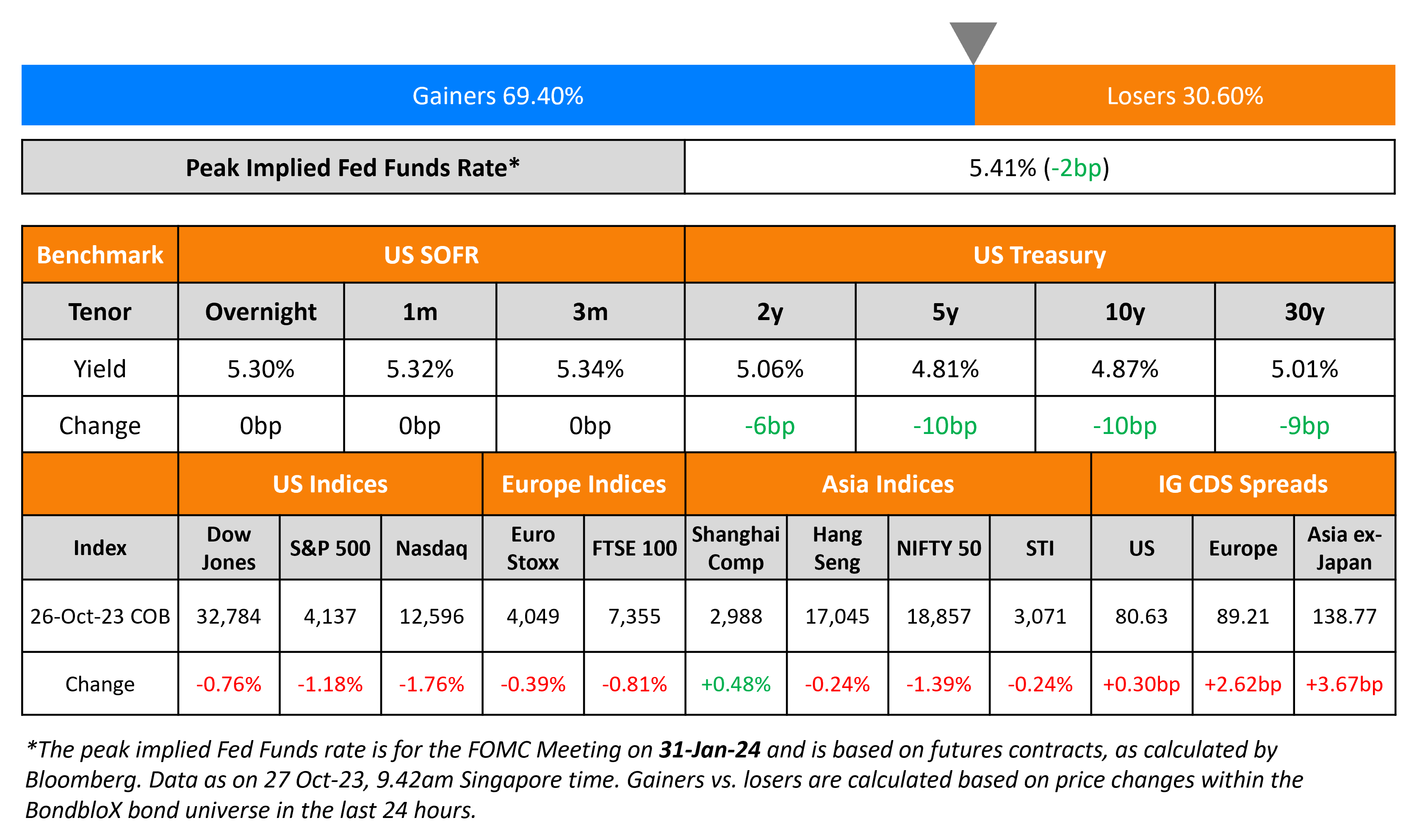

US Economy Grew at 4.9% in Q3; Treasury Yields Move Lower

October 27, 2023

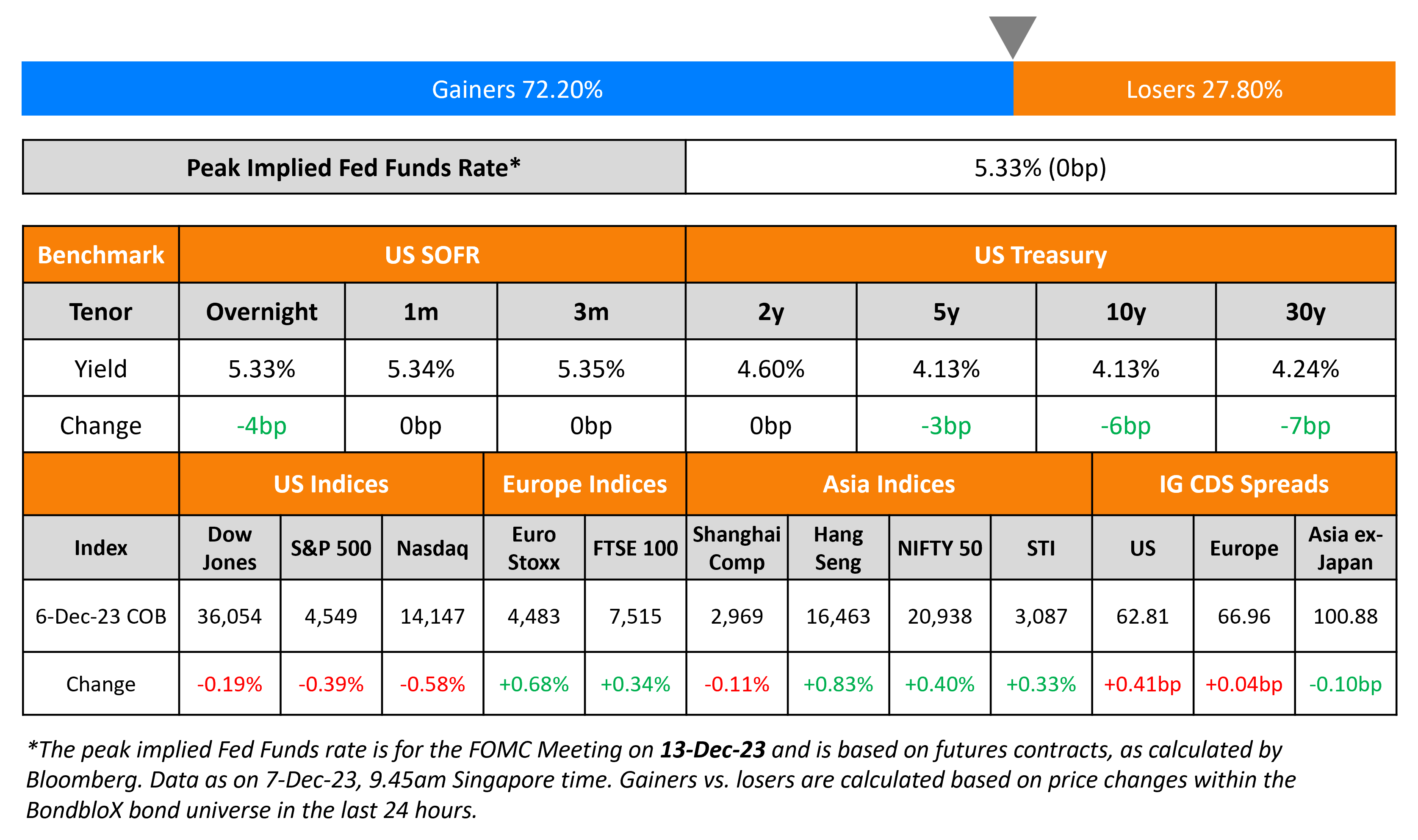

ADP Payrolls Softer Than Expected

December 7, 2023