This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ADP Payrolls Softer Than Expected

December 7, 2023

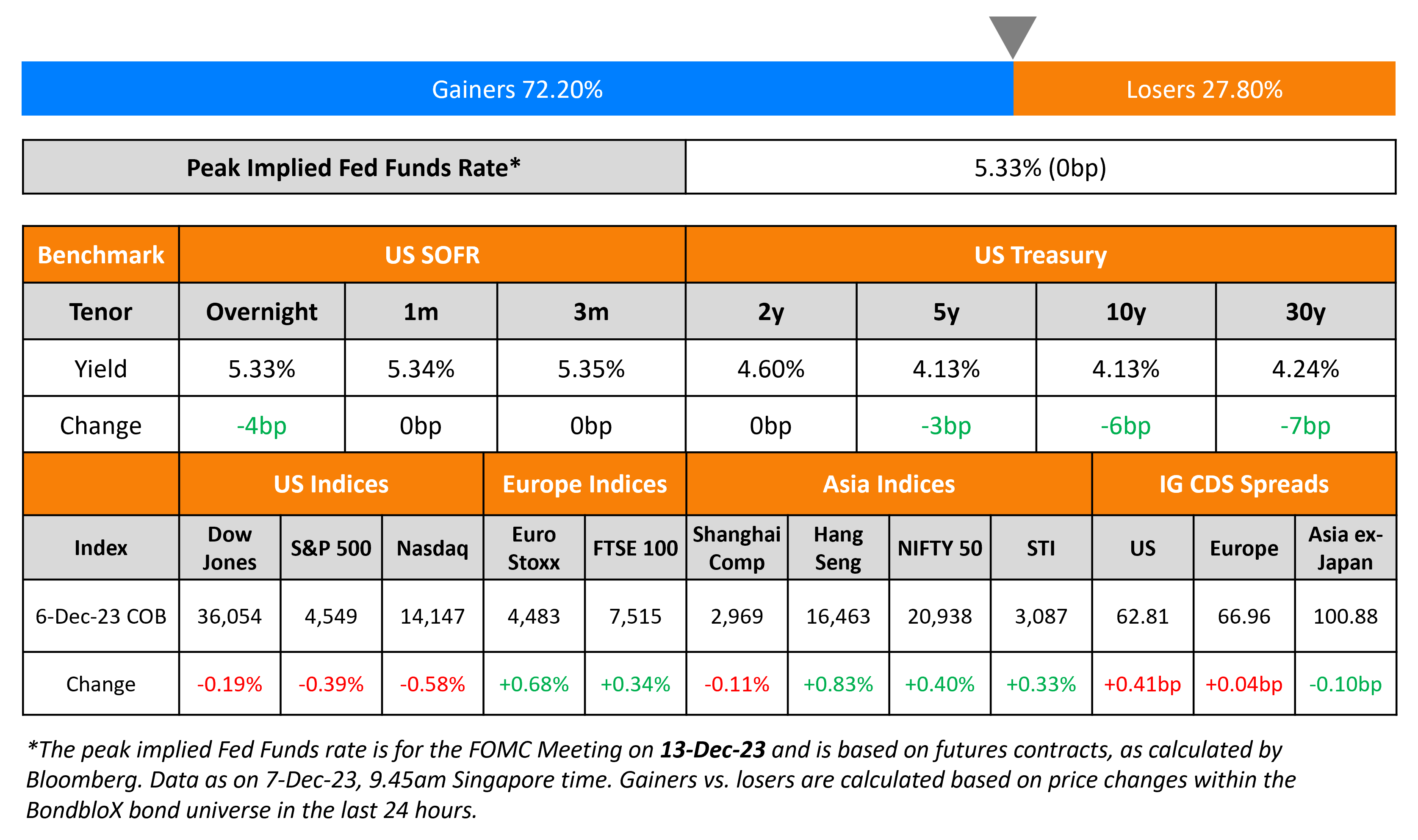

US Treasury yields were broadly down by 3-7bp across the curve on Wednesday. ADP Private payrolls increased 103k last month vs. estimates of 130k. Leisure and hospitality, considered a major driver of job creation during the pandemic recovery, cut jobs for the first time since February 2021, with payrolls in the sector decreasing by 7k. ADP data also showed a cooling in wage growth. US credit markets saw IG CDS spreads widen 0.3bp and HY widening by 4.7bp. Equity markets ended in the red on Wednesday, a third straight day, with the S&P ending 0.4% lower and Nasdaq down by 0.6%.

European equity markets ended slightly higher. In credit markets, European main CDS spreads were near flat and crossover spreads tightened by 0.1bp. Asian equity markets have opened slightly lower today. Asia ex-Japan IG CDS spreads were tighter by 0.1bp.

One-day course on bonds in Singapore | 14 Dec | 50/70% Funding for Locals

.png)

New Bond Issues

- Changchun Urban Development $ 2.5Y Green at 7.3% area

Rating Changes

- Republic of Suriname Foreign And Local Currency Ratings Raised To ‘CCC+/C’ From ‘SD’; Outlook Stable

- Moody’s downgrades China Jinmao’s ratings; outlook negative

- Moody’s places 26 Chinese LGFVs’ ratings on review for downgrade following sovereign action

- Moody’s affirms Hong Kong SAR’s Aa3 rating, changes outlook to negative from stable

- Moody’s changes outlooks to negative on eight Chinese banks following sovereign rating action

Term of the Day

Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.

Talking Heads

On EM Asia Bonds’ High Valuations May Start to Worry Investors

Alvin Tan, head of Asia FX strategy at RBC Capital Markets

“I expect Asian currencies to by and large underperform global EM FX in 2024, partly because of the generally lower carry on offer by Asian currencies and partly because a US slowdown will have a negative impact on export-dependent Asian economies”

On Market Expectations Can Complement Fed’s Policy – US Treasury Secy, Janet Yellen

“The markets anticipate future Fed moves based on their reading of incoming data… a healthy reaction in a way that — if markets are thoughtful when reading the data — can be helpful as a complement to monetary policy… Fed is going to take whatever action they think it appropriate”

On Moody’s outlook cut complicating Beijing’s ‘war’ against market bears

Yuan Yuwei, founder and CIO of Water Wisdom Asset Management

“This is a financial war”

Ryan Yonk, economist at the American Institute for Economic Research

“The pressures on Chinese stocks and the economy more generally are likely to increase if the cost of insuring the sovereign debt continues to rise and bailouts begin”

Top Gainers & Losers- 07-December-23*

Go back to Latest bond Market News

Related Posts: