This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Drop by Over 20bp

November 2, 2023

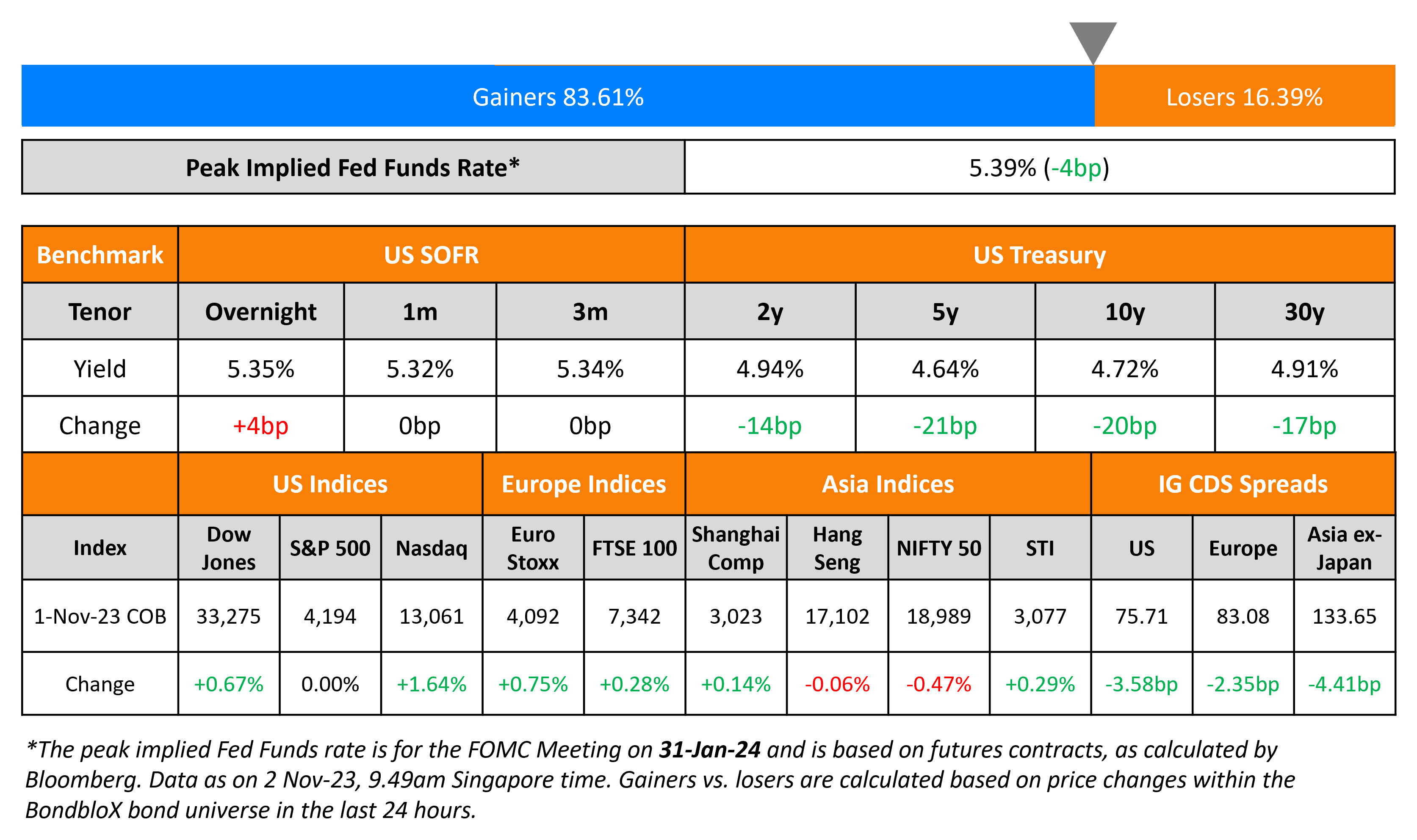

US Treasury yields fell sharply across the curve on Wednesday with the 2Y down 14bp while the 10Y fell 20bp. The peak Fed Funds Rate also fell by 4bp to 5.39%. Treasury yields moved lower steadily through the US session, helped by three factors in the following sequence:

- First, the ISM Manufacturing Index fell 2.3 points in October, the biggest monthly decrease in over a year, to 46.7. This was below the previous month’s data and estimates of 49. Whilst initially showing optimism of a possible pick-up in manufacturing activity in September, the latest print now shows a softening in activity.

- Second, the US Treasury surprised markets with a slowdown in the pace of increases in its quarterly debt issuances. Broadly, they boosted the monthly 2Y and 5Y auctions by $3bn, the 3Y and 10Y (new issue and tap) by $2bn, the 7Y and 30Y (new issue and tap) by $1bn. The upcoming week’s auctions for the 3Y, 10Y and 30Y securities are set to total $112bn, while dealers expected a $114bn number (the same size as the prior quarterly number).

- Third, the FOMC kept its policy Fed Funds range unchanged as expected, at 5.25-5.5%. While Fed Chair Jerome Powell left the door open for further hikes, he noted that financial conditions have “tightened significantly” given the move higher in “longer-term bond yields, among other factors”. Markets viewed the policy decision as ‘dovish’ where they broadly believe that the Fed is likely to not continue hiking rates

Besides, US ADP data indicated that private payrolls increased 113k last month, below estimates of 150k. Also, JOLTS job openings were mixed. It came at 9.6mn from a downwardly revised 9.5mn in August. However, this was above estimates of 9.4mn. US credit markets saw IG CDS spreads tighten 13.6bp and HY spreads tighten by 15.5bp. US equity markets continued to move higher, with the S&P and the Nasdaq up 1% and 1.6% respectively.

European equity markets closed higher too. In credit markets, European main CDS spreads were tighter by 2.4bp and crossover spreads tightened by 10.5bp. Asian equity markets have opened higher today. Asia ex-Japan IG CDS spreads tightened 4.4bp.

New Bond Issues

- BOC Aviation $ 5Y at T+155bp

New Bond Pipeline

- Oman Telecom hires for $ 7Y sukuk

- KHFC hires for $ 3Y Fixed/FRN bond

- Korea National Oil Corp hires for $ 3Y Fixed or FRN/5Y bond

Rating Changes

- Fitch Upgrades Energean Plc to ‘BB-‘; Outlook Stable

- Fitch Upgrades Ghana’s Long-Term Local-Currency IDR to ‘CCC’

- WeWork Cos. LLC Downgraded To ‘SD’ On Forbearance Agreement; Issue-Level Ratings Lowered To ‘D’

Term of the Day

Local government financing vehicle (LGFV)

Local government financing vehicles or LGFVs are debt-issuing entities set up by local governments in China to fund infrastructure and related projects. LGFVs came into existence because local governments were prohibited from raising debt directly. Hence, these local governments set up off-balance sheet entities known as LGFVs. LGFVs have become popular over the past decade and are regular issuers of Chinese yuan and US dollar bonds. While these issuers are backed by local governments, there were concerns among investors about their ability and willingness to repay debt driven by events in the past when LGFVs defaulted on their bonds.

Talking Heads

On US Slowing Pace of Increase in Quarterly Long-Term Debt Sales

Josh Frost, the Treasury’s assistant secretary for financial markets

“We are not overly reliant on any one investor or set of investors

TBAC

“There is a view among market participants that the growing imbalance between supply of and demand for US Treasury debt may also have contributed to the selloff… Demand for US Treasuries may have softened among several traditional buyers”

On Refinancing at Current Rates Doesn’t Make Sense – Costco CFO, Richard Galanti

When money is flowing, it’s easy for some to get a little ahead of themselves. If interest rates are lower, more projects make sense… Refinancing would only make sense if banks were incentivizing you to do it, if they’re giving you a better-than-market rate to do so. But I don’t see that happening.

On Having ‘Massive’ Bullish Bets on 2-Year Notes – Stan Druckenmiller

“I started to get really nervous”… “So I bought massive leveraged positions” in the short-term notes… I am confident the yield curve will normalize… That’s a trade I expect to have for some time.”

“The ‘higher-for-longer’ concept has a really dark underbelly to it that I think has affected the bond market… interest expense is starting to come home very quickly. One thing that the market has to confront is we cannot sustain these interest rates and this deficit any longer”

Top Gainers & Losers- 02-November-23*

Go back to Latest bond Market News

Related Posts: