This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

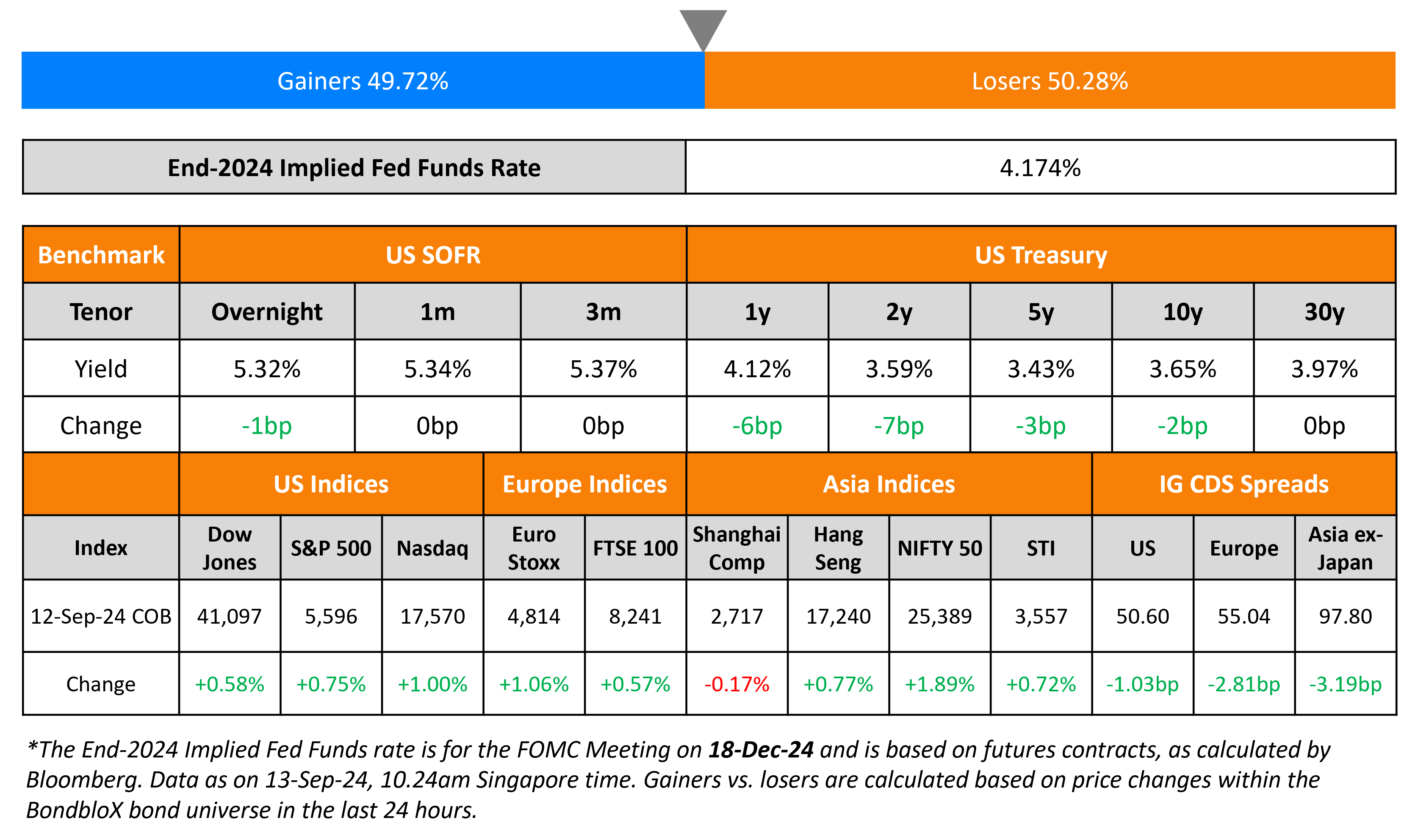

US Treasury Curve Bull Steepens; ECB Cuts Rates

September 13, 2024

US Treasury yields moved lower across the board yesterday, with the 2s10s curve bull steepening by 5bp. The 2Y yield was down notably by 7bp while the 10Y yield was lower by 2bp. US PPI rose as expected, with annual growth for August at 1.7% compared to 2.1% in July. Core PPI held steady and was in-line with expectations at 2.4%. Separately, the 30Y yield remained unchanged despite a solid 30Y note auction. The auction saw a bid-to-cover ratio of 2.38x (vs. 2.31x last month) and an indirect acceptance rate of 68.7% (vs. 65.3% last month). Markets are now pricing-in roughly 110bp in Fed rate cuts by end-2024, as per the Implied Fed Funds Futures Rate. US IG CDS tightened by 1bp and HY CDS spreads tightened by 6bp. Looking at US equity indices, the S&P and NASDAQ both posted gains yesterday, by 0.8% and 1.0% respectively.

European equity markets ended higher. Looking at Europe’s CDS spreads, the iTraxx Main spreads were tighter by 2.8bp while Crossover spreads tighter by 12bp. In Europe, the ECB cut its deposit rates b y 25bp to 3.50% from 3.75%. ECB President Christine Lagarde offered little guidance on subsequent rate cuts and remarked that they will not commit to any persistent course in cuts, citing that it will largely base its decisions on the upcoming data releases. Currently, markets have dropped their probability for an October deposit rates reduction to 20%, from 40% prior. Asian equity indices have opened broadly lower this morning. Asia ex-Japan CDS spreads tightened by 3.2bp.

New Bond Issues

Citigroup Inc. raised $4.1bn via a two-part offering. It raised:

- $3bn via a 6NC5 bond at a yield of 4.542%, 22bp inside initial guidance of T+130bp area. The senior unsecured notes are rated A3/BBB+/A. The new bonds are priced at a new issue premium of 5.2bp over its existing 5.142% 2030s (callable in February 2029) that currently yield 4.49%.

- $1.1bn via a 15NC10 bond at a yield of 5.411%, 27bp inside initial guidance of T+200bp area. The subordinated notes are rated Baa2/BBB/BBB+.

Proceeds will be used for general corporate purposes.

HP raised $9bn via a six-tranche issuance.

The senior unsecured bonds are rated Baa2/BBB/BBB+. Barring a special mandatory redemption, net proceeds will be used to fund all or part of the consideration for its Juniper acquisition, to pay related fees and expenses. Any remainder will be used for general corporate purposes. A special mandatory redemption is applicable to 5Y, 7Y, 10Y and 30Y notes at 101.

Rating Changes

- Moody’s Ratings upgrades Carvana’s CFR to Caa1 with a positive outlook

- Fitch Downgrades China Vanke to ‘B+’; Outlook Negative

- Moody’s Ratings downgrades Operadora de Servicios Mega debt rating to C, outlook revised to stable

- BCE Inc. Downgraded To ‘BBB’ From ‘BBB+’; Outlook Stable; Debt Ratings Lowered

Term of the Day

Macro Linked Bonds

Macro Linked Bonds are a type of sovereign bond being planned by sovereigns as part of their debt restructuring process. Here, the bond’s coupon payments automatically reduce beginning at a future date if the sovereign fails to meet some of the economic targets linked to their IMF program, thus leading to a step-down in payments. Holders of the MLBs would then agree to grant additional debt relief if needed to achieve certain targets like the IMF’s Debt Sustainability Analysis target.

Talking Heads

On IMF supports imminent start of US Fed easing cycle as inflation, economy slow

“We see the imminent start of a loosening cycle, as telegraphed by the Fed, as appropriate… the upside risks to inflation, while less, have not entirely disappeared and the Fed will have to continue to calibrate the pace and extent of rate cuts with incoming economic data going forward”

On cutting exposure to corporate bonds in global portfolios – UBS Asset Management

“We’re priced pretty close for perfection in credit markets from here, but plenty of things can knock you off track… If risks around a U.S. recession grow, then credit spreads are going to underperform… We’re not saying you shouldn’t own any credit, it’s just that we should be wary”

On Where Money Managers See Dollar Going as Fed Cuts, US Votes

Derek Schug, Kestra Investment

“It’s so difficult to predict shorter-term currency movements… We’re setting ourselves up for an extremely volatile path for the dollar for the rest of the year”

Kathleen Brooks, XTB

“Without a doubt, the No. 1 driver of the dollar is going to be relative interest-rate differentials

Top Gainers & Losers-13-September-24*

Go back to Latest bond Market News

Related Posts: