This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

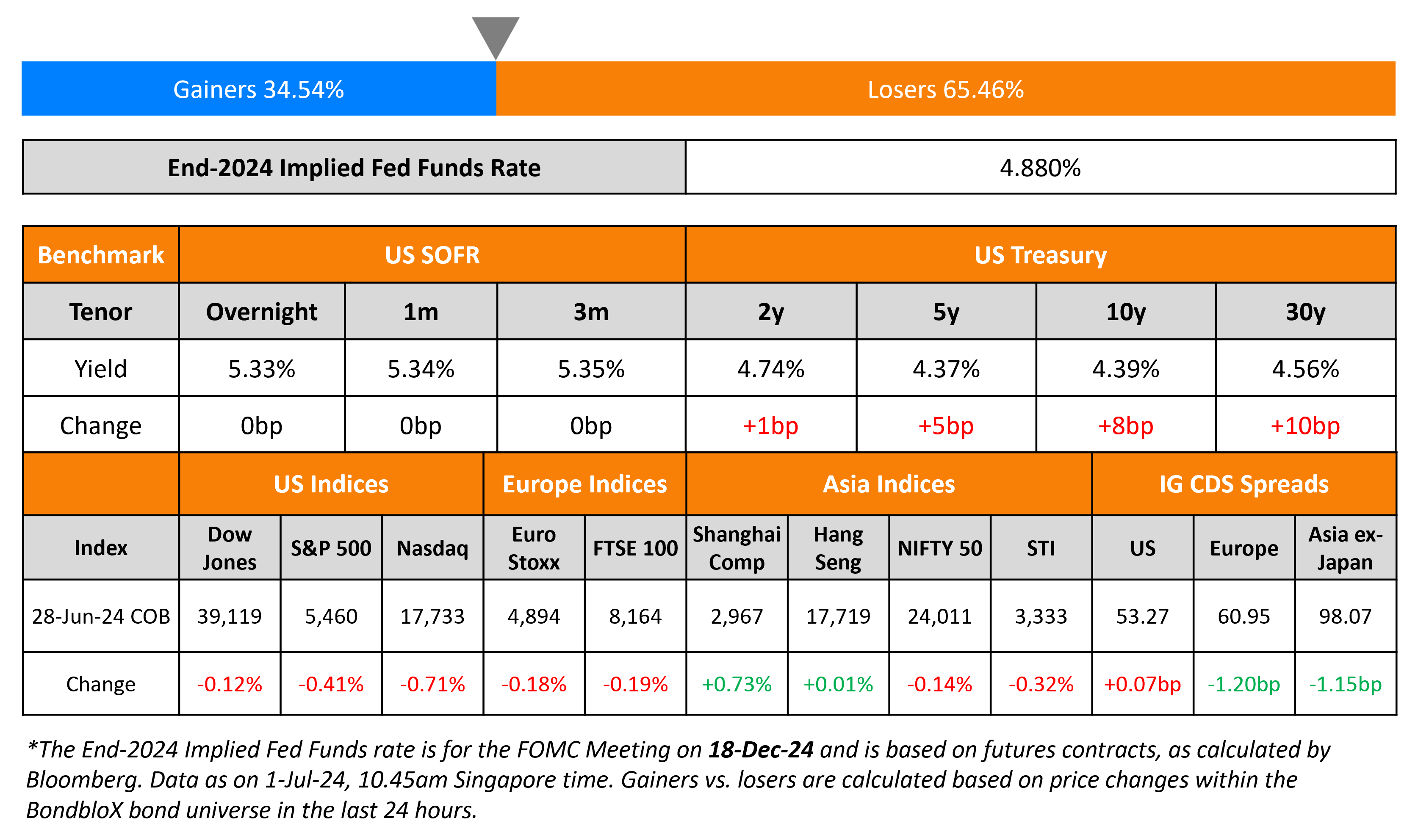

US Treasury Curve Bear Steepens

July 1, 2024

US Treasuries sold-off with the 2s10s curve bear steepening by 7bp. The US Headline and Core PCE prints were in-line with expectations, both of which saw a 2.6% YoY rise in May. The Michigan Consumer Sentiment came-in stronger at 68.2 vs the surveyed 66.0. Meanwhile, observers considered the first US Presidential elections debate to be a poor showing by the incumbent, with some analysts noting that the curve likely steepened on this. Looking at equity markets, S&P and Nasdaq were down 0.4% and 0.7%, respectively. US IG spreads were 0.1bp wider while HY CDS spreads widened by 1.2bp.

European equity indices ended lower too. In credit markets, the iTraxx Main and Crossover spreads were tighter by 1.2bp and 7bp respectively. Asian equity indices have opened higher this morning. Asia ex-Japan CDS spreads were 1.2bp tighter.

New Bond Issues

New Bonds Pipeline

- NongHyup Bank hires for $ 3Y/5Y bond

- Ho Bee Land hires for S$ 5Y Green bond

- Woori Bank hires for $ PerpNC5 bond

- TD Bank hires for S$ PerpNC5 bond

Rating Changes

- Alliance Resource Partners L.P. Rating Raised To ‘BB-‘ From ‘B+’ On Refinance, Removed From CreditWatch; Outlook Stable

- Moody’s Ratings upgrades Energy Transfer to Baa2; outlook is stable

- Fitch Assigns Final Ratings to Hertz’s 1L and 2L Secured Notes; Downgrades Unsecured Debt to ‘CCC-‘

- Moody’s Ratings raises Oman’s local currency country risk ceiling to Baa1 and foreign currency country risk ceiling to Baa2

Term of the Day

Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). A bear steepening move can occur due to different reasons some of them being long term expectations of inflation picking up, higher supply of longer-dated bonds, central bank tapering purchases with a focus on the long-end bonds etc.

Talking Heads

On The Year’s $321bn EM Bond Spree Is Set to Catch Its Breath

Alexander Karolev, bond syndicate head at JPMorgan

“In terms of 2024 funding need, probably 80% is already done… volumes that we’ve seen so far are not going to be sustainable”

Philip Fielding, co-head of EM at MacKay Shields

“Less issuance creates scarcity in bond markets… in the second half of the year, supply can be less than coupons and redemptions”

Adrian Guzzoni, LatAm debt markets at Citigroup

“There’s some risk of volatility on the Treasuries that impacts the cost of funding”

On Beware Market’s Sudden Wrath Over Debt – Claudio Borio, BIS

“We know from experience that things look sustainable until suddenly they no longer do. That is how markets work… confidence could quickly crumble if economic momentum weakens and an urgent need for public spending arises… Government bond markets would be hit first… central banks alone cannot deliver a durable increase in economic growth and prosperity”

On Inflation’s Stickiness Underestimated – ECB’s Holzmann

“I truly believe that it’s being underestimated how sticky inflation is… We have two main possibilities… we move too soon, or we move too late… my feeling is that moving too early creates greater risks than moving too late.”

Top Gainers & Losers- 01-July-24*

Other News

Rite Aid Averts Total Closure, Wins Restructuring Plan Approval

Go back to Latest bond Market News

Related Posts: