This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasuries Sell-Off Continues With Strong US NFP Print at 336k

October 9, 2023

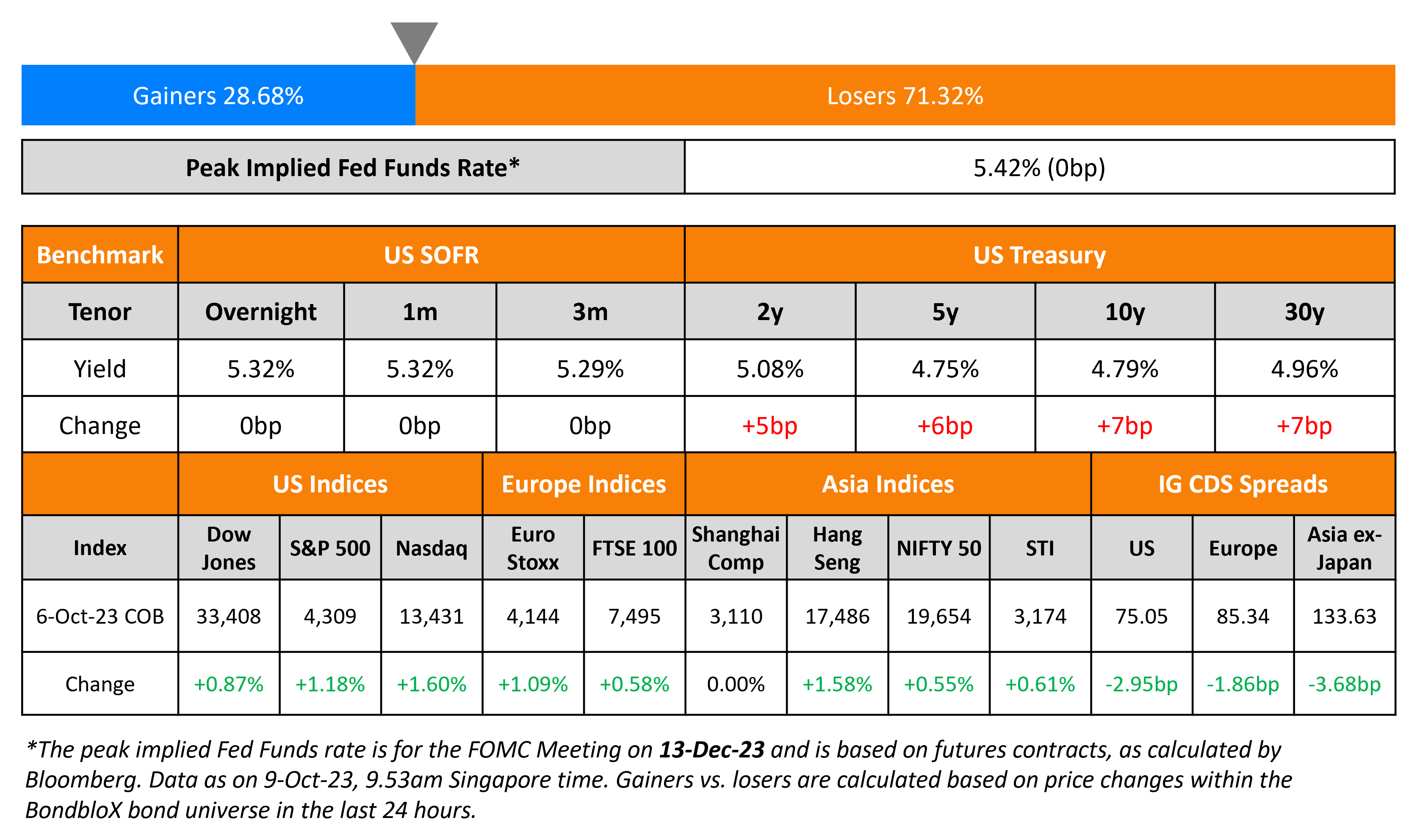

US Treasuries sold-off following the stronger-than-expected jobs report on Friday with yields higher by 5-7bp across the curve. US Non Farm Payrolls (NFP) came at 336k, significantly higher than the expected 170k and the Average Hourly Earnings (AHE) YoY print was at 4.2%, slightly lower than the expected 4.3%. The unemployment rate stood at 3.8%, higher than the surveyed 3.7%. In credit markets, US IG CDS spreads were 3bp tighter while HY spreads tightened 13bp. US equities jumped higher with the S&P and Nasdaq rising 1.2% and 1.6% respectively. Separately, oil prices jumped as sentiment deteriorated in the markets after the shock attacks by Hamas within Israel over the weekend. WTI Crude rose more than 4% to over $86/bbl Monday.

European equity markets ended higher too. In credit markets, European main CDS spreads were tighter by 1.9bp and crossover spreads tightened 7.4bp. Asian equity markets have opened slightly lower this morning. Asia ex-Japan IG CDS spreads tightened 3.7bp.

New Bond Issues

- Jiangyin State-Owned Assets $ 3Y at 4.15% area

New Bond Pipeline

- Oman Telecom hires for $ 7Y sukuk bond

Rating Changes

- Fitch Upgrades Rolls-Royce & Partners Finance to ‘BB’; Outlook Positive

- Uganda Long-Term Ratings Lowered To ‘B-‘ On Rising Debt Servicing Burden; Outlook Stable

- Fitch Revises Croatia’s Outlook to Positive; Affirms at ‘BBB+’

Term of the Day

Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back.

Talking Heads

On Distressed Debt Anxiety Is Spreading Across EMs

Jennifer Taylor, head of emerging-market debt at State Street

“In a higher-for-longer rates environment, it is inevitable that vulnerable issuers will have difficulty accessing primary markets and be forced to re-profile their debt load”

Arthur Budaghyan, chief EM strategist at BCQ Research

“It would be strange if this current ascent in bond yields ended without significant casualties in the global financial system”

On Deepening Bond Rout Having BlackRock, Columbia Favoring Short End

Al-Hussainy, a global rates strategist at Columbia Threadneedle

“It is most likely that growth is being mispriced next year. You can say people have positioned for a recession prematurely and have been burnt, but you can only look forward”

Jeffrey Rosenberg, PM at BlackRock

“We don’t want to buy bonds, like 30-year bonds, but the front end of the curve is really starting to get to levels that are much more attractive”

Jerome Schneider, head of short-term portfolio management at PIMCO

“Inflation is still likely to remain sticky, above the Fed’s 2% target for a while, which all bodes for more term premium to be built into the long-end of the yield curve”

On Wall Street Worried That the Bear Market Has ‘Unfinished Business’

Sam Stovall, CIO at research firm CFRA

“My real worry is does this bull market die an early death, or do we end up with a new all-time high and worry instead about what happens in 2024?”

Chris Zaccarelli, CIO for Independent Advisor Alliance

“The economy remains resilient, meaning the Fed will remain restrictive, yields will likely keep rising and stocks will continue to decline”

On Euro Parity Back on the Market’s Radar Amid US Yields Surge

Jordan Rochester, a FX strategist at Nomura

If oil prices surge past $110/bbl, “it will be difficult for the euro to avoid parity”

Andreas Koenig, head of global FX at Amundi

“Of course it’s a possibility, but I don’t think we will see parity this time. I think we have now priced everything positive for the dollar”

Top Gainers & Losers- 09-October-23*

Go back to Latest bond Market News

Related Posts: