This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

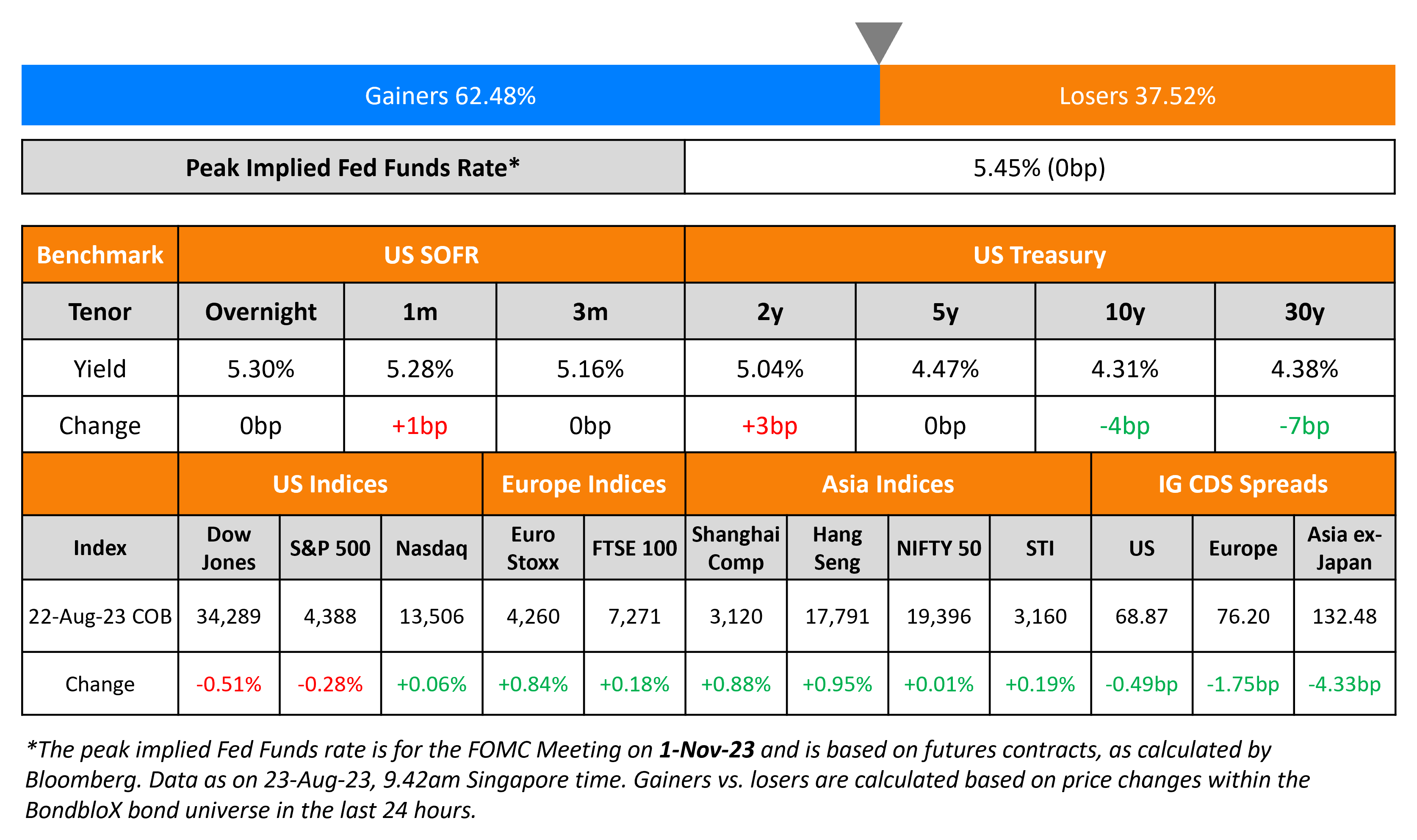

US Treasuries Bear Flattens; Markets Await Jackson Hole Symposium

August 23, 2023

The Treasury curve bear-flattened (Term of the Day, explained below) on Tuesday with the 2Y rising by 3bp to 5.04% and the 10Y tightening by 4bp to 4.31%. Market participants keenly await commentary from the Fed and other central bankers on the future path of interest rates at the Jackson Hole Symposium that kicks off on Thursday. US IG credit spreads were tighter by ~0.5bp while HY CDS spreads tightened by ~0.9bp. The S&P closed lower by ~0.3% while Nasdaq closed almost flat.

European equity markets traded higher. In credit markets, European main CDS spreads were 1.7bp tighter and Crossover CDS widened 6.9bp. Asia ex-Japan CDS spreads tightened by 4.3bp. Japan’s 10Y yield increased to 0.66%, the highest level since 2014 amid upward pressure in global rates. It raised speculations of the Bank of Japan coming into the market with an unscheduled bond-buying operation to stem the rise in yields. Asian equity markets have opened broadly mixed this morning.

New Bond Issues

- BOCOM HK $ 3Y Green FRN at SOFR+105bp area

Intesa Sanpaolo raised €2.25bn via a two-part senior-preferred deal. It raised €750mn via a 4Y bond at a yield of 4.46%, 20bp inside initial guidance of MS+125bp area. It also raised €1.5bn via a 8Y bond at a yield of 5.237%, 20bp inside initial guidance of MS+220bp area. The bonds have expected ratings of Baa1/BBB/BBB. The 4Ys received orders over €1.25bn, 1.7x issue size, while the 8Ys received orders over €3.25bn, 2.2x issue size. The bonds have a 75% clean-up call.

Hangzhou Shangcheng raised $200mn via a 3Y Green bond at a yield of 5.85%, 40bp inside initial guidance of 6.25% area. The bonds have expected ratings of BBB- (Fitch). Proceeds will be used for refinancing green debt.

New Bond Pipeline

- Singapore’s Monetary Authority of Singapore mandates for tap of S$1.8bn 2072 Green Bond

Rating Changes

- Exela Technologies Inc. Upgraded To ‘CCC’ From ‘SD’ On Subpar Debt Exchanges; Outlook Negative; Debt Ratings Raised

- The Dow Chemical Co. Outlook Revised To Stable From Positive On Weakening Operating Performance, Ratings Affirmed

Term of the Day

Bear Flattening

Bear flattening refers to a change in the yield curve where short-term rates move up faster than long-term rates, so that the two begin to converge. This phenomenon is widely regarded as a leading indicator for an economic contraction. If the yield curve moves lower and bond prices move lower, it is considered a bear move, while the opposite is a bull move. Typically, short-term rates rise when the market anticipates the central bank to embark on a tight monetary policy, often with the aim of bringing inflation down.

Talking Heads

On Possible ‘Reaccelaration Scenario’

Thomas Barkin, Richmond Fed President

“The reacceleration scenario has come onto the table in a way that it really wasn’t three or four months ago where inflation stays high and the economy strengthens. If I got convinced that inflation was remaining high and demand was giving no signal that inflation was going to come down, that would make the case for further tightening of monetary policy through higher interest rates.”

On 2Y Treasury at 5% Being A Pain For The Banks

Gennadiy Goldberg, Head of US rates strategy at TD Securities

“If you just track unrealized held-to-maturity and available-for-sale losses at banks, the pressure is on, referring to the securities that financial institutions hold as assets on their balance sheets”

On Treasuries Being The Top Bet

George Efstathopoulos, Manager at Fidelity International

“What is the 101 of bond investing? It’s buying when real yields are positive. Treasuries are looking more attractive than most other places.”

On Muddled Earnings Outlook For Chinese Banks

Gary Ng, senior economist at Natixis Corporate & Investment Banking.

“The biggest challenge for Chinese banks is navigating the increasingly low net interest margin as the credit demand remains subdued in the real economy. While there is support from greater exposure to government-related assets, it is more uncertain than ever on whether this can fully buffer the weak demand in households and corporates.”

Top Gainers & Losers- 23-August-23*

Other News

US fines Nomura US$35 million over traders’ lies about bond prices

Indonesia reviews plan to merge two state airlines

Thailand’s KBank in talks to buy Vietnam lender in up to $1 bln deal

Hong Kong developers line up home sales at heavy discounts to clear unsold stock

Go back to Latest bond Market News

Related Posts: