This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US PCE, Core PCE Slightly Above Expectations

April 29, 2024

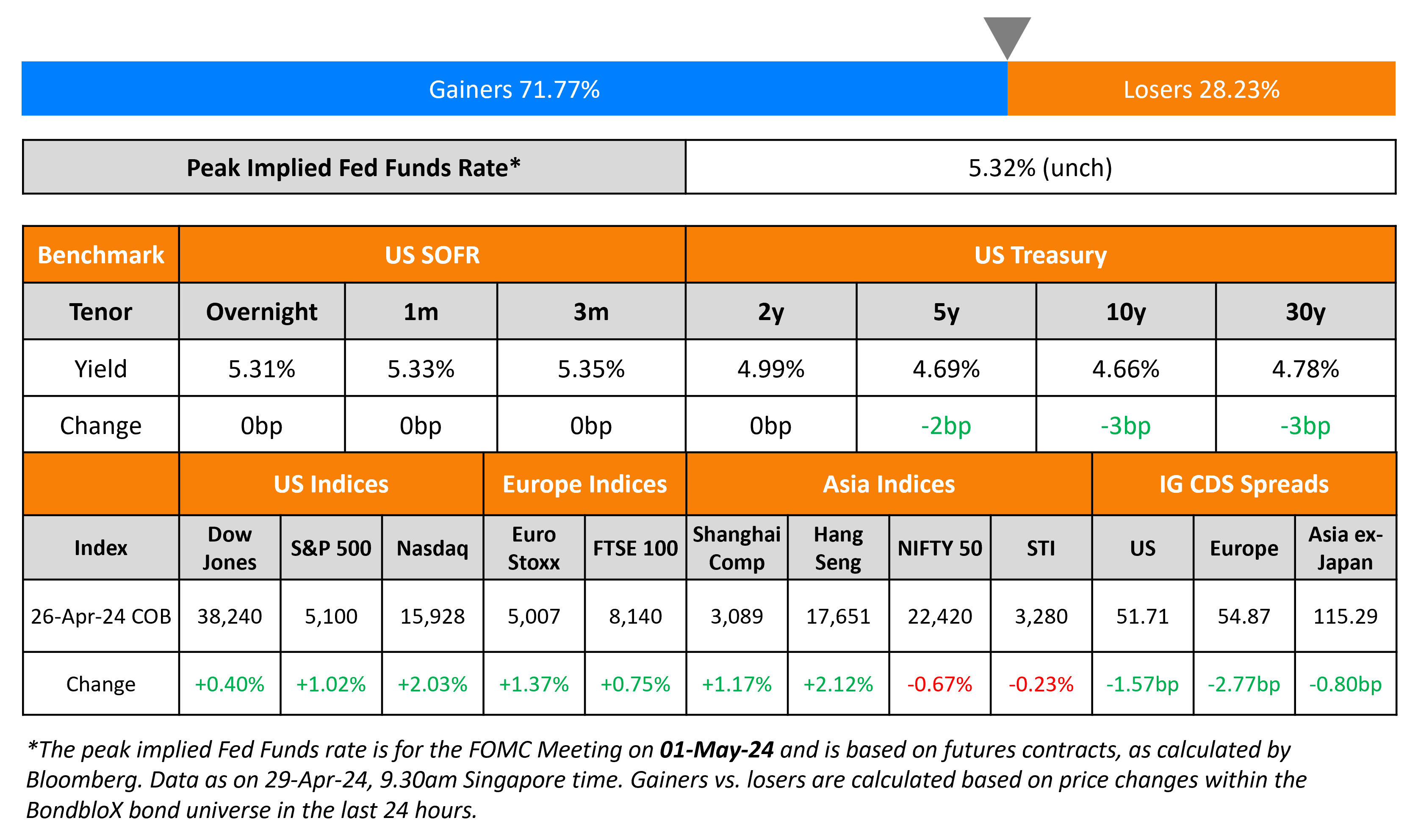

US Treasury yields eased slightly on Friday, by ~3bp across the curve. The headline Personal Consumption Expenditures (PCE) Index rose 2.7% YoY in March, above expectations of 2.6% and the prior month’s 2.5% reading. The Core PCE Index rose 2.8% YoY, higher than expectations of 2.7% and in-line with prior month’s 2.8% reading. The Michigan Consumer Sentiment Index for April came at 77.2, marginally lower than the expected 77.9 print. US IG CDS spreads tightened 1.6bp and HY spreads were 11bp tighter. S&P and Nasdaq soared higher, up by 1% an 2% respectively.

European equity indices ended higher too. European IG CDS spreads tightened 2.8bp while crossover spreads were 9bp tighter. Asian equity markets have opened in the green today. Asia ex-Japan IG CDS spreads were 0.8bp tighter. The BOJ kept its interest rate target unchanged at 0-0.1%, but indicated readiness to hike later this year. BOJ governor Kazuo Ueda said, “If underlying inflation moves in line with our forecasts, we could adjust the degree of monetary easing. If the economy and prices overshoot, that could also be a reason to change policy”.

New Bond Issue

- Jiujiang Municipal Development $ 3Y at 7.1% area

- Kookmin Bank $ 3Y/5Y at T+85/95bp area

Hotel Properties raised S$190mn via a 5Y bond at a yield of 5.1%, inline with guidance. The unsecured notes are unrated. Net proceeds will be used for refinancing existing borrowings and financing working capital requirements, including redeeming its S$160mn 4.40% Perps. Private banks receive a 25-cent concession.

New Bonds Pipeline

- Korea Expressway hires for $ 3Y/5Y bond

Rating Changes

- Fitch Upgrades China Energy Engineering to ‘A-‘; Removes UCO; Outlook Negative

- Moody’s Ratings downgrades China Vanke’s ratings to Ba3/B1; outlook negative

- Canacol Energy Downgraded To ‘B-‘ On Weaker 1P Reserves And Liquidity, And Limited Growth; Outlook Negative

- Moody’s Ratings downgrades Bolivia’s ratings to Caa3 from Caa1; changes outlook to stable

- Fitch Revises Boeing’s Outlook to Negative

Term of the Day

Significant Risk Transfers (SRT)

A Significant Risk Transfer (SRT) is a transaction where banks can deleverage their balance sheet by buying protection on diversified loan portfolios, so that they can release regulatory capital or manage risk. This is typically achieved by selling notes linked to a pool of loans that also include a credit derivative. Selling SRTs may help avoid using less investor friendly measures like dividend cuts, stopping share repurchases or raising new equity to boost regulatory capital levels.

In 2023, as per Pemberton Asset Management, banks globally sold $25bn of SRTs, partially offloading the risk of $300bn of loans.

Talking Heads

On Bond Rout Easing as Traders Find Relief in Key Inflation Readings

Michael Contopoulos, head of fixed income at Richard Bernstein

“It’s a little relief rally. Investors need to wake up to the idea that inflation is sticky and the Fed won’t be cutting anytime soon”

Charles Ripley, senior investment strategist at Allianz Investment

“We can expect volatility, but the narrative stays the same — the Fed is on hold”

On Fed Repricing Giving Rise to New Equities Playbook in Asia

Gary Tan, PM at Allspring Global Investments

“Higher rates for longer do pose headwinds to capital flow into Asia… some domestic-focus sectors could be safe havens” like Indian infrastructure stocks, Korean reform beneficiaries

George Efstathopoulos, Fidelity International

“Japan equities are set to benefit.. through a combination of a weaker yen and improving global demand”

Jin Yuejue, specialist at JPMorgan Asset Management

“India stands out as a strong domestic consumption story, supported by strong demographics and macro stability”

On global fund managers building ‘significant exposure’ to Chinese stocks in sentiment shift – HSBC

“GEM [global emerging markets] funds have rolled back on their underweight [position] on mainland China and turned neutral, while Asia’s funds exposure on the market is now at a seven-month high”

Top Gainers & Losers- 29-April-24*

Go back to Latest bond Market News

Related Posts: