This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

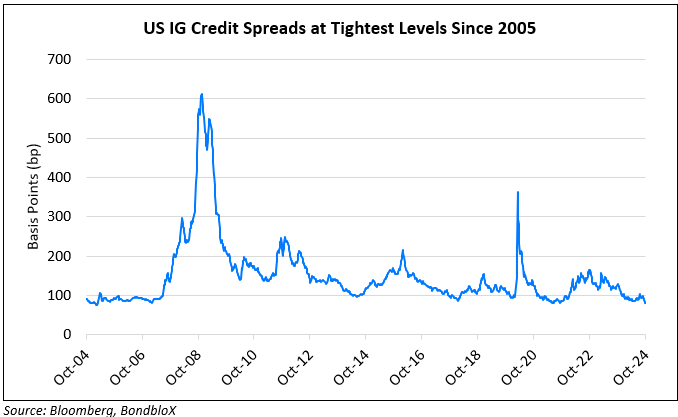

US Investment Grade Credit Spreads at Tightest Since 2005

October 18, 2024

US Treasury yields were higher across the curve on the back of continued resilience in economic data. US Retail Sales for September rose by 0.4%, better than estimates of 0.3% and the prior month’s 0.1% print. Core Retail Sales grew 0.7%, again better than estimates and the prior print of 0.3%. The Philadelphia Fed Business Outlook print came in at 10.3 vs. expectations of 0.3. Also, initial jobless claims for the previous week rose by 241k as compared to expectations of 259k. Looking at US equity markets, S&P and Nasdaq both closed flat. US IG and HY CDS spreads widened by 0.2bp and 2.8bp respectively. US IG credit spreads are as measured by the option adjusted spread (Term of the Day, explained below), are currently at 79bp, their tightest levels since 2005.

The ECB lowered their benchmark deposit rate by 25bp to 3.25% at their latest meeting. This comes following the latest inflation figures in key Eurozone economies such as Spain and Germany coming-in below the ECB’s 2% target. Moving forward, Christine Lagarde mentioned that the ECB will continue to keep interest rates restrictive to ensure inflation returns to the mid-term 2% target. Following this decision, German, France and Spain saw their 10Y bond yields largely stable. Separately, European equities closed higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.9bp and 3.9bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan IG CDS spreads were 0.4bp tighter.

New Bond Issues

Turkiye Wealth Fund raised $750mn via a 5.25Y bond at a yield of 6.95%, ~61.25bp inside initial guidance of 7.5-7.625%. The senior unsecured notes are rated BB- (Fitch), and received orders of over $5.1bn, 6.8x issue size. Proceeds will be used for general corporate purposes. The notes are rated at the same level as the Turkish sovereign. The new bonds by Turkiye Wealth Fund offer a yield pick-up of 68bp over Turkey’s 5.25% 2030s that yield 6.27%.

Zorlu Enerji raised $800mn via a 5.5NC2 sustainability-linked bond (SLB) at a yield of 11%, ~12.5bp inside initial guidance of 11-11.25%. The senior guaranteed notes are rated B3/B+ (Moody’s/Fitch). Proceeds will be used to redeem its $263mn 9% 2026s and to refinance other OpCo debt.

New Bonds Pipeline

- China Huadian hires for $ PerpNC3 bond

Rating Changes

- Piedmont Office Realty Trust Inc. Downgraded To ‘BB+’ On Modestly Elevated Credit Metrics, Notes ‘BBB-‘; Outlook Stable

- Fitch Downgrades Wizz Air to ‘BB+’; Outlook Stable

- Moody’s Ratings downgrades FORVIA’s CFR to Ba3 and notes ratings to B1; outlook stable

- Nike Inc. Outlook Revised To Negative On Revenue And Profitability Declines; ‘AA-‘ Rating Affirmed

- Moody’s Ratings changes AMD’s outlook to positive

Term of the Day

Option Adjusted Spread (OAS)

Option Adjusted Spread (OAS) refers to a measure of the credit spread of a bond with embedded options relative to a benchmark, similar to the z-spread. The key difference between OAS and z-spread lay in the optionality. When comparing two bonds – one with an embedded option and one without – OAS is a better measure compared to z-spread as the former adjusts for/removes the impact of optionality for a like-to-like comparison. Put simply, OAS ≈ Z-Spread + Option cost.

On a technical note, the above formula is not an exact equation as the z-spread is calculated from the spot curve while the OAS is calculated from the forward curve. The OAS is less than the z-spread for callable bonds and greater than z-spread for puttable bond.

Talking Heads

On Market Being Wrong About Synchronized ECB, Fed Cuts – Fmr PIMCO CEO, Mohammed El-Erian

“The market is pricing in the same amount of cuts from the ECB and the Fed. I don’t think that’s what’s going to happen. I think you are going to see the ECB cut more than the Fed… In July, we didn’t need a rate cut (Fed). Mid-September, we needed a 50bp rate cut. Now, we are talking about caution”

On Goldman and Amundi Liking UK Bonds

Daniel Loughney, Mediolanum International

“She will want to maintain some kind of perception of fiscal discipline”

John O’Toole, Amundi

“The UK should benefit from slowing inflation and fiscal discipline”

On expecting lukewarm growth in medium term, urging reforms – IMF’s Kristalina Georgieva

“I’m not super pessimistic, because if you look at the trajectory of the world economy, yeah, we can do better, but we can also do much worse”

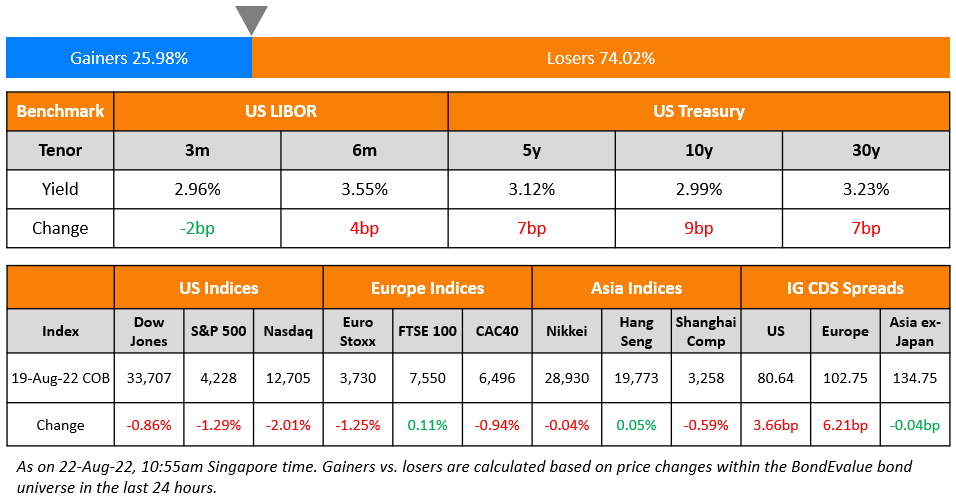

Top Gainers and Losers- 18-October-24*

Go back to Latest bond Market News

Related Posts: