This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Inflation Inches Higher; Danske Bank Prices $ AT1 at 7%

February 13, 2025

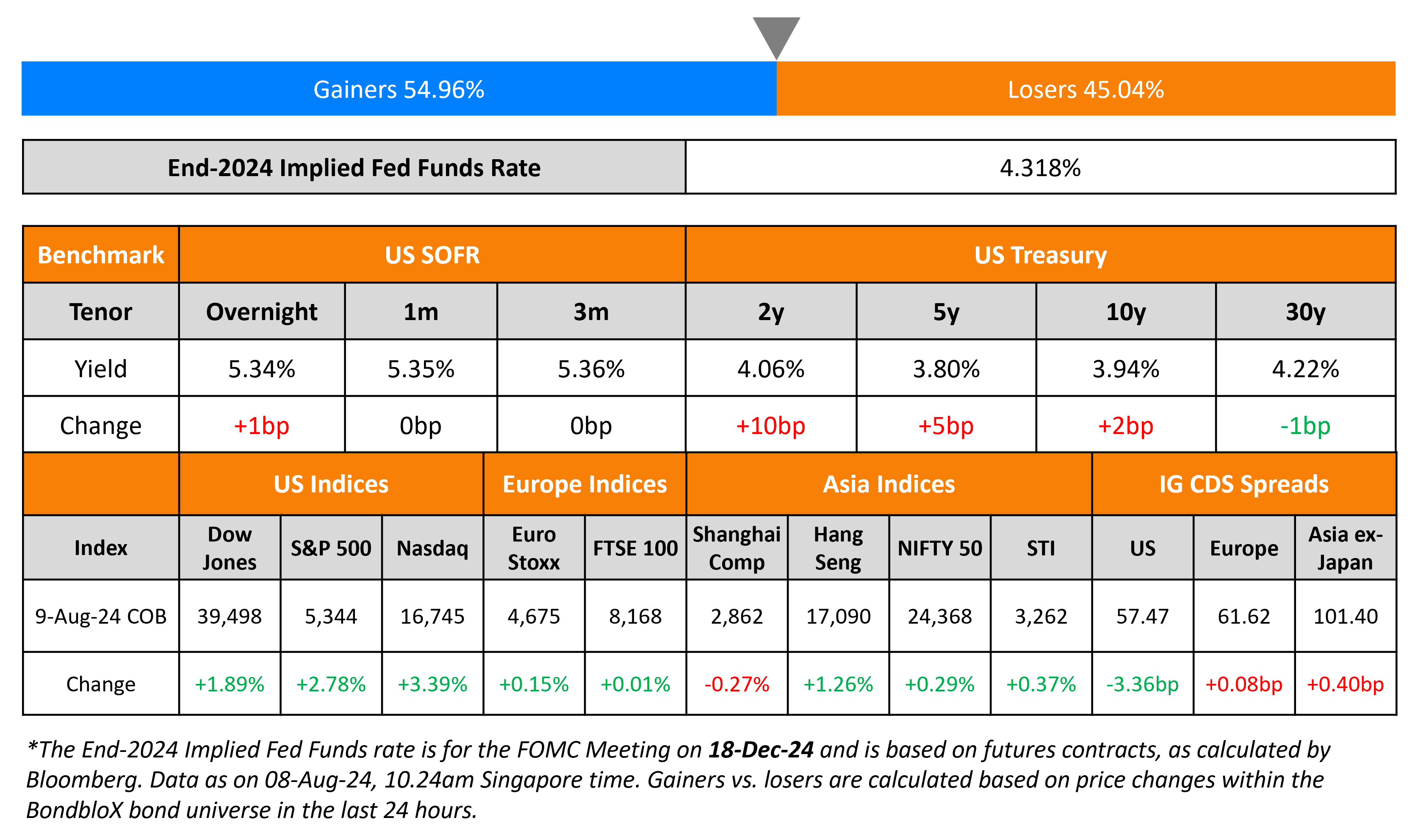

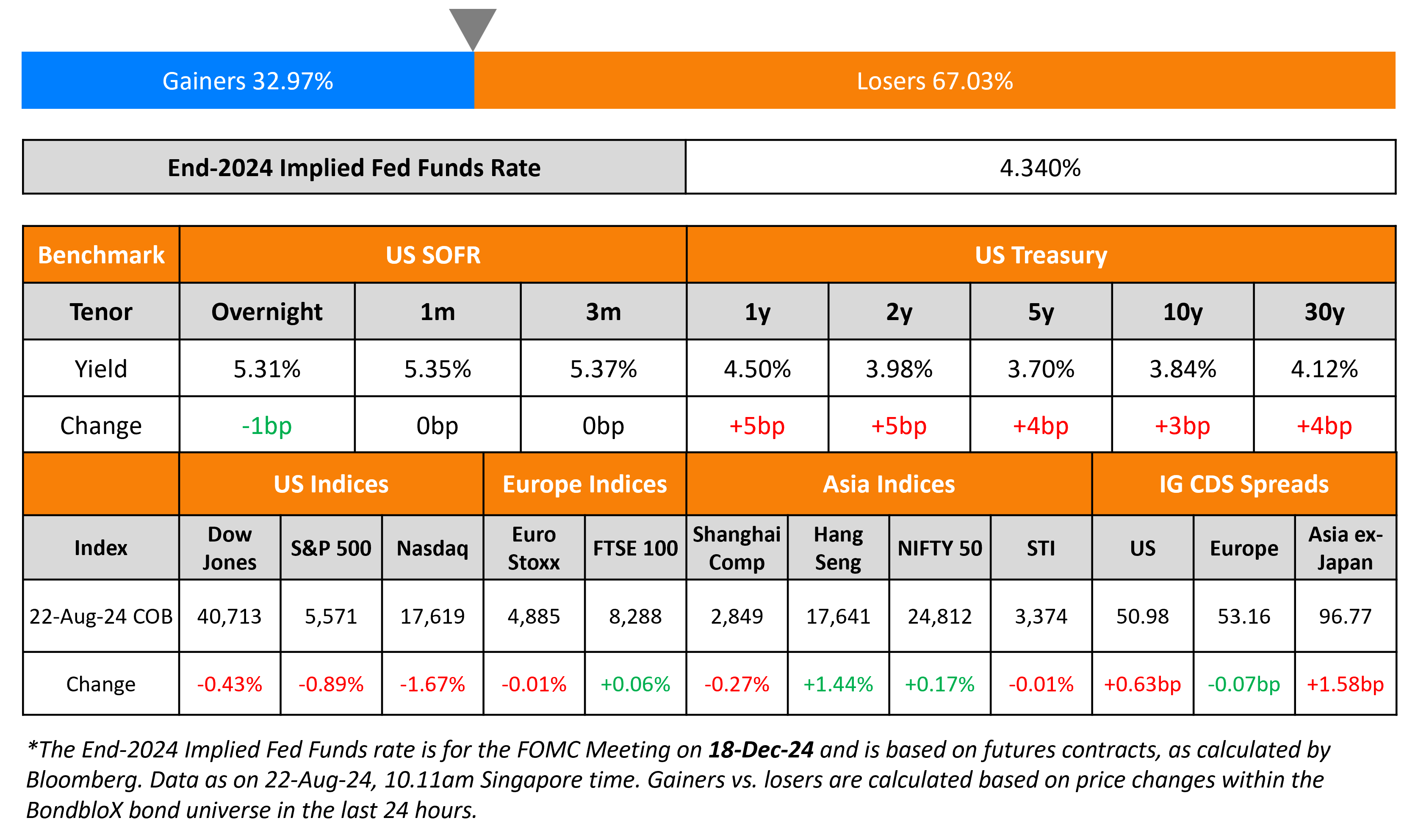

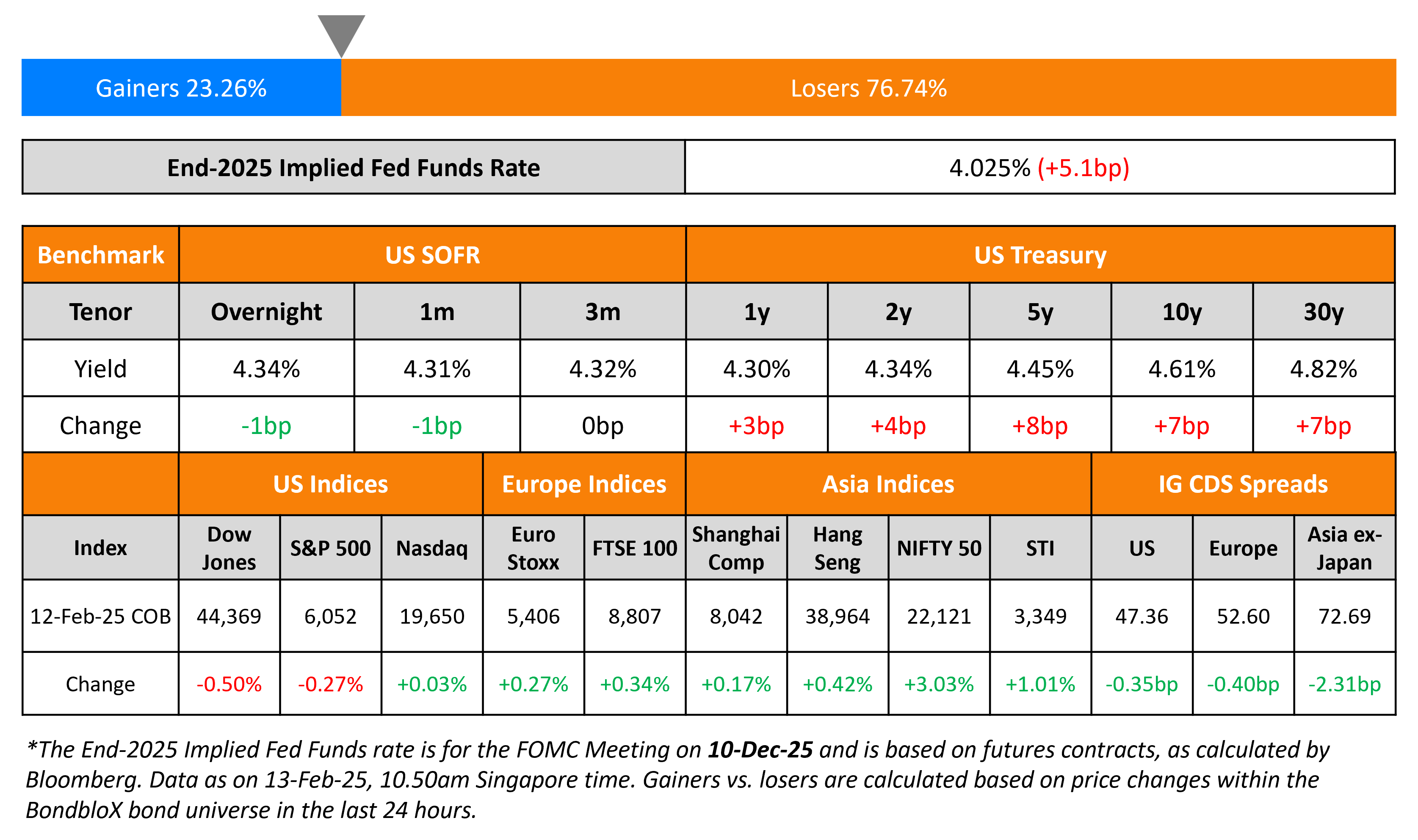

US Treasury yields rose across the curve, with the 10Y moving higher by 7bp. US CPI for the month of January came-in higher than expected at 3.0% YoY, higher than both expectations and the prior reading of 2.9%. The Core CPI reading also inched higher to 3.3% YoY, higher than expectations of 3.1% and the prior reading of 3.2%. Fed Chairman Jerome Powell said that the CPI numbers were above most forecasts, but cautioned against overreacting to one or two readings.

US equity markets saw the S&P end lower by 0.3% while Nasdaq was flat. Looking at credit markets, US IG CDS spreads were 0.4bp tighter while HY CDS spreads tightened by 3.3bp respectively. European equity markets moved higher. The iTraxx Main and and Crossover CDS spreads tightened by 0.4bp and 1.5bp respectively. Asian equity markets have opened higher. Asia ex-Japan CDS spreads were tighter by 2.3bp.

New Bond Issues

-

Greentown China $ 3NC2 8.85% area

-

Saudi Electricity $ Green Sukuk 5Y/10Y at T+120/130bp area

Danske Bank raised $500mn via a PerpNC5.5 AT1 bond at a yield of 7%, 62.5bp inside initial guidance of 7.625% area. The subordinated notes are rated BBB/BBB- (S&P/Fitch), and received orders of over $4.4bn, 8.8x issue size. If not called by 19 August 2030, the coupon will reset to the 5Y UST plus 259.9bp. A trigger event would occur if the CET1 Ratio the group is less than 7%.

New Bonds Pipeline

- Mongolia hires for $ bond

Rating Changes

-

CommScope Holding Co. Upgraded To ‘CCC+’ On Improved Maturity Profile And Metrics, Ratings Off Watch; Outlook Stable

-

Moody’s Ratings downgrades West China Cement’s ratings to B3/Caa1; outlook negative

-

Fitch Downgrades Sprint BidCo’s (Accell) IDR to ‘RD’ on DDE; Upgrades to ‘CCC’

-

Bally’s Corp. Secured Debt Rating Lowered To ‘B’ From ‘B+’ On Merger Closing; Off CreditWatch; ‘B-‘ Issuer

-

Credit Rating Affirmed; Outlook Stable

-

Fitch Revises Samarco’s Outlook to Positive; Affirms IDR at ‘B-‘

Term of the Day: Trigger Event

Triggers, or trigger events are an important feature of contingent convertible (CoCo) or additional tier 1 (AT1) bonds and define when the loss absorption mechanism is activated. Triggers can either be mechanical or discretionary. Mechanical triggers are numerically defined and most commonly refer to the bank’s capital ratio level. Discretionary triggers, also known as point of non-viability (PONV) triggers are based on supervisors’ judgement of the bank’s solvency position. On occurrence of a trigger event, an AT1’s loss absorption mechanism kicks in, which may include a conversion to equity and/or a principal write-down, both of which boost the bank’s capital position.

Talking Heads

On the future of Federal Reserve rates and USTs after the January CPI report

Simon White, Bloomberg

“Expected rate cuts this year are diminishing…Still, the likelihood of a hike this year is still small at ~15%, and has not yet materially risen since the data (of the January CPI report)”

Aditya Bhave, BofA

“Hikes (in rates) seem less inconceivable now”

James Athey, Marlborough Investment Management

“Uncertainty is too high to take a significant position in Treasuries…unless something much more inflationary emerges”

On the necessity of cautious BoE rate cuts

Megan Greene, Bank of England

“I believe it is appropriate to maintain a cautious and gradual approach to removing monetary restrictiveness…less likely inflation persistence will fade on its own accord”

On the future of inflation and rates by the European Central Bank, as rates purportedly near neutral

Joachim Nagel, Deutsche Bundesbank, European Central Bank

“[The ECB is] not at our target (inflation), but I’m really very convinced that we will come to our target by the midst of this year”

“The closer we get to the neutral rate, the more appropriate it becomes to take a gradual approach…There is no reason to act hastily in the present uncertain environment”

Top Gainers and Losers- 13-February-25*

Go back to Latest bond Market News

Related Posts: