This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CapitaLand India Trust Prices S$ bond at 3.7%

August 23, 2024

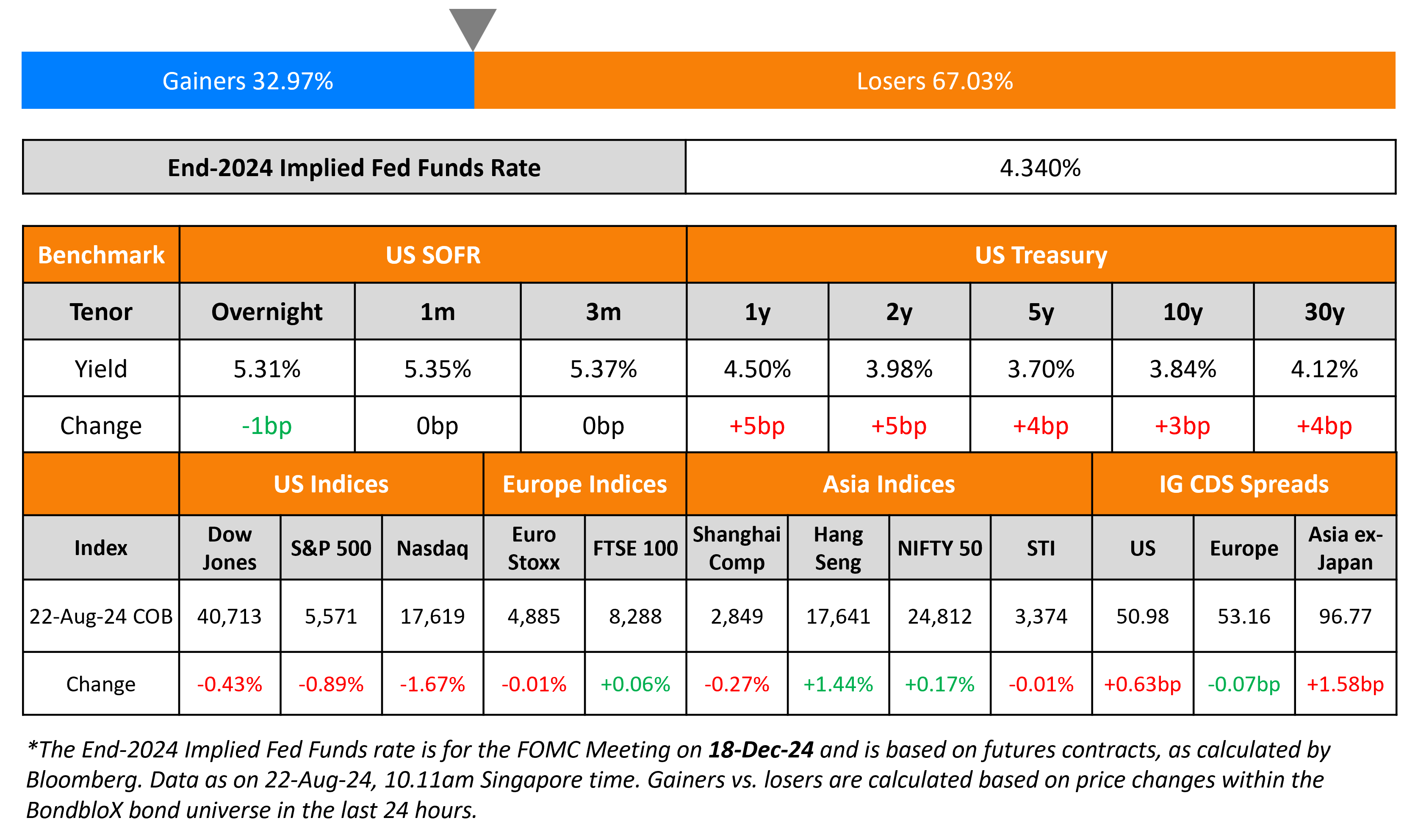

US Treasury yields moved higher by 3-5bp across the curve. Initial jobless claims for the previous week were in-line with expectations at 232k. The preliminary S&P PMIs were mixed with the Manufacturing and Services PMIs at 48.0 (vs. expectations of 49.5) and 55.2 (vs. expectations of 54.0). Markets now await Fed Chairman Jerome Powell’s speech at the Jackson Hole symposium later today. US IG CDS spreads widened by 0.6bp while HY CDS spreads widened by 2.7bp. Looking at US equity indices, the S&P and Nasdaq were down by 0.9% and 1.7% respectively.

European equity markets ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main spreads tightened 0.1bp while Crossover spreads were tighter by 0.2bp. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 1.6bp wider.

New Bond Issues

CapitaLand India Trust raised S$150mn via a 3Y bond at a yield of 3.7%, 20bp inside initial guidance of 3.9% area. The senior unsecured bonds are rated BBB-. Proceeds will be used to refinance existing borrowings or repay loans and for financing business activities, acquisitions and working capital needs.

Rating Changes

- Latam Airlines Group S.A. Upgraded To ‘BB-‘ From ‘B+’ On Solid Performance Sustaining Stronger Metrics; Outlook Positive

- Fitch Upgrades AstraZeneca to ‘A’; Outlook Positive

- CVS Health Corp. Outlook Revised To Negative On Lower Full-Year Guidance; ‘BBB’ Ratings Affirmed

- Moody’s Ratings affirms Delhi Airport’s B1 ratings, changes outlook to positive

Term of the Day

PMI

PMIs or Purchasing Managers’ Index are an index composed of a monthly survey of purchasing managers/supply chain managers across industries. This is a diffusion index, a statistical measure of summarizing the common tendency of a series – if there are more number of values rising than falling, the index is above 50 and the index goes below 50 if the falling values exceed those rising. For PMIs, a value below 50 indicates contraction and a value above 50 shows expansion. These surveys are taken over different areas of the supply chain business: New Orders, Employment, Inventories, Supplier Deliveries and Production covering imports, exports, prices and backlogs. In most countries, Markit publishes the PMI numbers while other organizations publish them too. Markit generally publishes the month’s PMIs in last week of the month.

Talking Heads

On Market Pricing In Too Many Fed Rate Cuts – El-Erian

“It is problematic in my mind that the market is pricing in so many rate cuts right now. The market is overdoing it. There’s this notion of a hard landing policy response to achieve a soft landing, that has got to be reconciled one way or another”

On Fed Officials Arguing for Gradual Pace of Cuts Starting Soon

Boston Fed President Susan Collins

Focused on “preserving that healthy labor market while we continue to bring inflation down… That’s the context in which I do see it soon being appropriate to begin easing policy”

Philadelphia Fed President Patrick Harker

“In September we need to start a process of moving rates down.. need to start bringing them down methodically”

Kansas City Fed President Jeffrey Schmid

“It makes sense for me to really look at some of the data that comes in the next few weeks”

On Seeing Low Duration Limiting Junk Bonds Amid Credit Rally – Marty Fridson

“High-yield investors who hope for a boost from Fed interest rate cuts over the next several months.. will have to adjust their expectations regarding the size of the boost… The number of fallen angels has risen in recessions. All else being equal, that could push duration back up”

Top Gainers & Losers-23-August-24*

Go back to Latest bond Market News

Related Posts: