This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US GDP Unchanged; Turkey Holds Rates at 50%

June 28, 2024

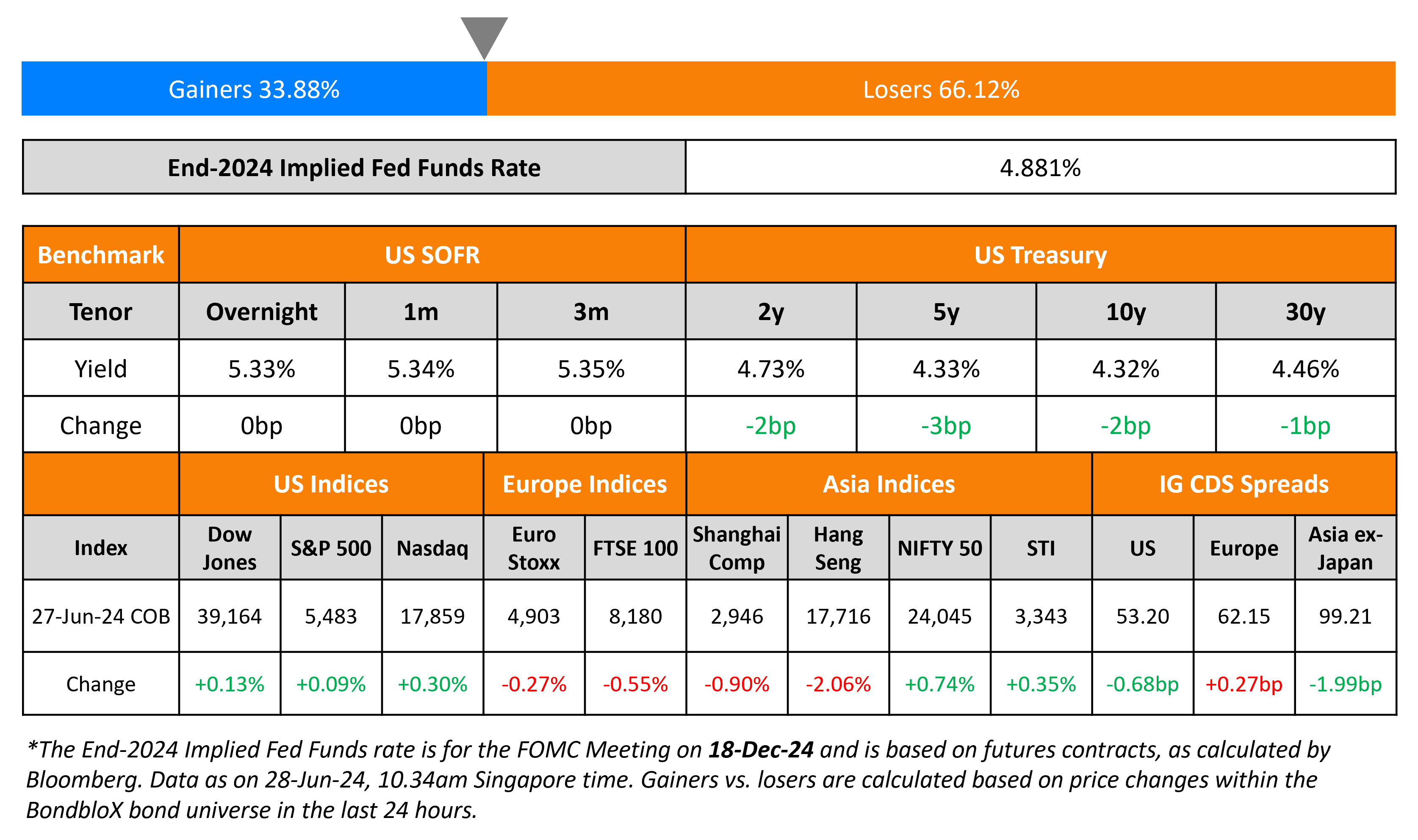

US Treasury yields edged lower by 2-3bp. The third and final reading for US Q1 GDP came at 1.4%, in-line with expectations but higher than the second estimate of 1.3%. While personal consumption was revised downwards to 1.5% from 2.0%, the price and core price indices were revised upwards to 3.1% and 3.7%, respectively. The preliminary Durable Goods Orders rose 0.1% MoM in May, higher than the surveyed -0.5%, while the prior month’s print was revised higher to 0.2% from 0.1%. However, the Capital Goods Orders fell 0.6% in May vs. expectations of a 0.1% pick-up. Separately, Fed Governor, Michelle Bowman reiterated her views earlier this week, saying that she is still not ready to support a rate cut until inflation moves sustainably towards 2%. Looking at equity markets, S&P and Nasdaq were up 0.1% and 0.3%, respectively. US IG spreads were 0.7bp tighter while HY CDS spreads tightened by 1.7bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were wider by 0.3bp and 2.9bp respectively. Turkey’s central bank kept rates steady at 50%, with a hawkish stance despite the surge in the latest inflation reading to over 75%. Asian equity indices have opened stronger this morning. Asia ex-Japan CDS spreads were 2bp tighter.

New Bond Issues

Sharjah Islamic Bank raised $500mn via a 5Y sukuk at a yield of 5.386%, 35bp inside initial guidance of T+140bp area. The senior unsecured notes are rated A-. The issuer is SIB Sukuk Co III Ltd.

Swire Pacific raised $500mn via a 5Y bond at a yield of 5.268%, 25bp inside initial guidance of T+205bp area. The senior unsecured notes are rated A3. Proceeds will be on-lent within Swire Pacific Group for working capital and for general corporate purposes.

Mizuho raised $1.5bn via a two-tranche deal. It raised $800mn via a 6NC5 bond at a yield of 5.382%, 27bp inside initial guidance of T+135bp area. It also raised $700mn via a 11NC10 bond at a yield of 5.594%, 25bp inside initial guidance of T+155bp area. The senior unsecured bonds are rated A1/A-. Net proceeds will be used to make a loan intended to qualify as Internal TLAC under and for general corporate purposes. The new 6NC5 bonds were priced roughly in-line with its existing 5.376% 2030s callable in 2029, that yield 5.36%.

Korea Gas raised $500mn via a 5Y bond at a yield of 5.07%, 28bp inside initial guidance of T+105bp area. The senior unsecured notes are rated Aa2/AA/AA-. Proceeds will be used for general corporate purposes. The bonds have a change of control put at 100 if the central and local government of Korea cease to own and control (directly or indirectly or in combination) at least 50.1% of the company. The new bonds were priced at a new issue premium of 8bp over its existing 2.875% 2029s that yield 4.98%.

New Bonds Pipeline

- NongHyup Bank hires for $ 3Y/5Y bond

- Ho Bee Land hires for S$ 5Y Green bond

Rating Changes

-

Fitch Upgrades Ulker to ‘BB-‘; Outlook Positive; Rates Planned Notes ‘BB-(EXP)’

- Turkish Confectionary Manufacturer Ulker Biskuvi Upgraded To ‘BB’ On Profitable Business Expansion; Outlook Stable

- Moody’s Ratings upgrades Alpha Bank S.A.’s long- and short-term deposit ratings to Baa3/P-3 from Ba1/NP, outlook on the long-term deposit ratings remains positive

- Fitch Downgrades Hudson Pacific Properties’ IDR to ‘BB-‘ from ‘BBB-‘; Outlook Negative

-

Moody’s Ratings changes Colombia’s outlook to negative from stable; affirms Baa2 ratings

Term of the Day

Yield-to-Call (YTC)

Yield to Call (YTC) is a return metric applicable to callable bonds and refers to the total return that a bondholder would receive if the bond is held till the call date, provided that the issuer does not default. YTC is an important metric from an investor’s standpoint as it gives them an indication of the expected return, if the bond is called on the call date. It is important because the call option lies with the issuer, not the investor. And hence, investors must review both the yield to maturity (YTM) and the YTC when analyzing their bond investments.

YTC calculation is similar to the YTM calculation except that the maturity date is replaced by the call date and the redemption value (stated as a percentage) is replaced by the call price.

Talking Heads

On US Economy Showing Further Signs of Slowing Under High Rates

Bill Adams, chief economist at Comerica Bank

“The economy is operating in low gear in the first half of 2024 after above-trend growth in the second half of 2023… second quarter has seen continued softness in retail sales and housing activity.”

On ECB May Only Cut Rates Once More This Year – GC member, Peter Kazimir

“I think we could expect one more interest-rate cut this year… see a significant risk of rising inflation, which may not fully align with our expectations… appropriate to wait for the September forecast”

On Germany Possibly Objecting If ECB Moves to Lower French Bond Yields

German Finance Minister Christian Lindner

“A strong intervention by the ECB would raise some economic and constitutional questions.”

Top Gainers & Losers- 28-June-24*

Go back to Latest bond Market News

Related Posts: