This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US GDP Rises 3.1% in Q3

December 20, 2024

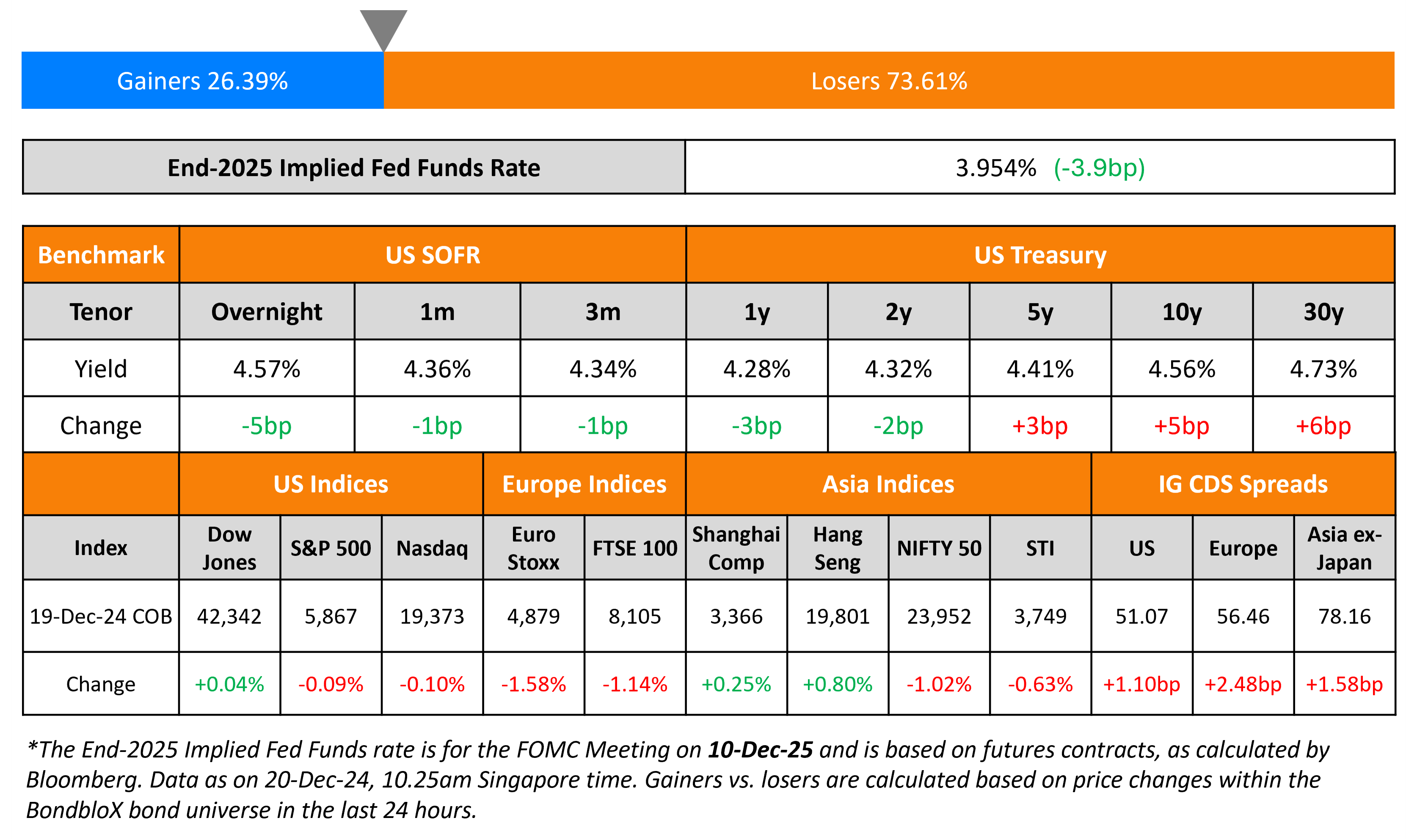

The US Treasury curve steepened to its highest level in two years, with the 2s10s curve currently at 24bp. As compared to the beginning of the year where the 2s10s curve was inverted at -37bp, it has steepened by 61bp. The final reading of US Q3 GDP saw a 3.1% rise, much higher than expectations of 2.8%. This was led by strong consumer spending, that rose by 3.7% during this period, its fastest pace since early 2023. Separately, the US House of Representatives failed to support the spending deal backed by Donald Trump and Elon Musk, with renewed concerns of a potential US government shutdown.

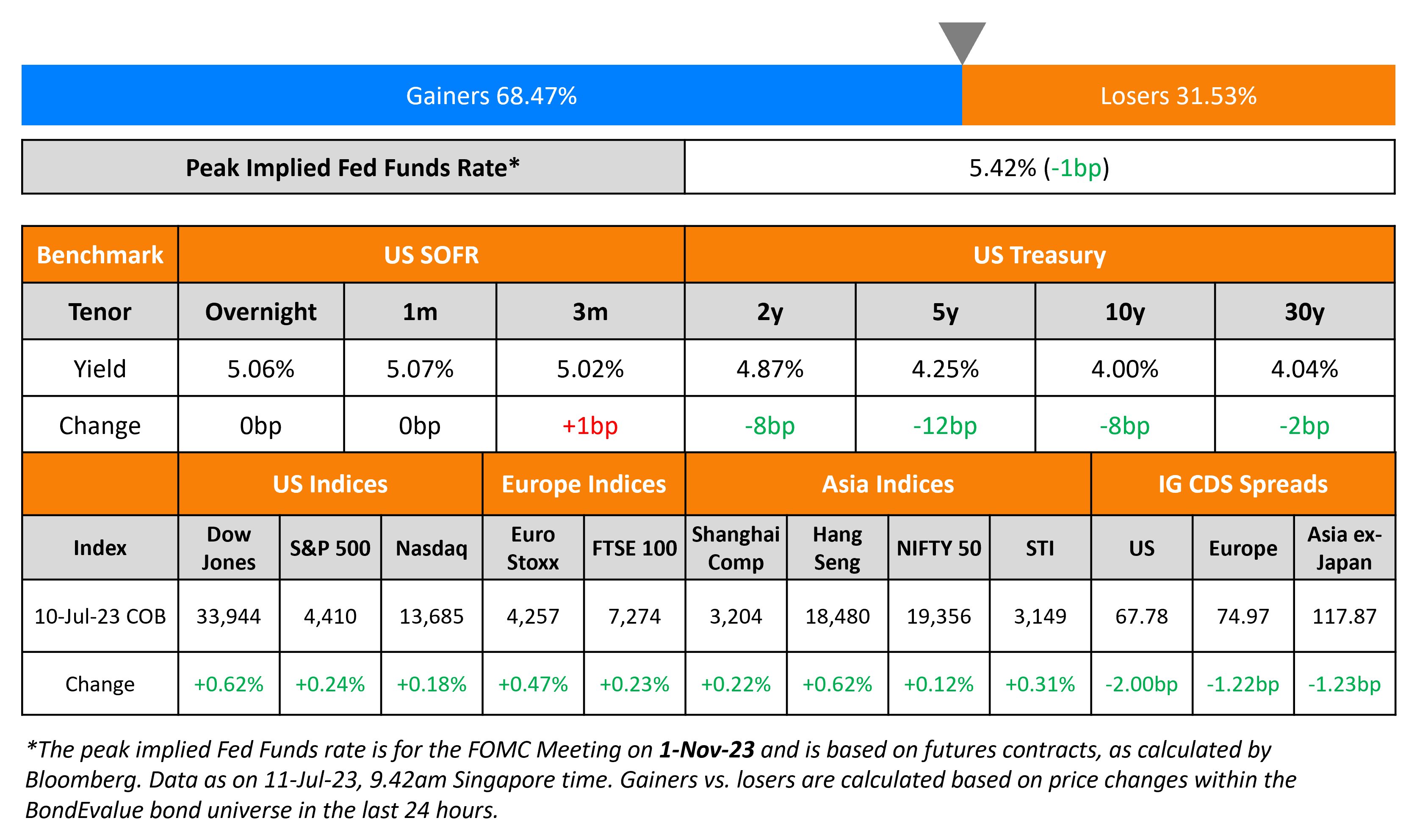

US IG and HY CDS spreads widened by 1.1bp and 4.3bp respectively. Looking at US equity markets, both the S&P and Nasdaq closed 0.1% lower. European equities ended lower. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 2.5bp and 12.5bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan CDS spreads were 1.6bp wider.

New Bond Issues

Rating Changes

-

Autopista del Sol Concesionaria Española S.A. Debt Upgraded To ‘A-‘ On Increasing Coverage; Outlook Stable

-

U.K.-Based TalkTalk Telecom Group Ltd. Upgraded To ‘CCC+’ From ‘D’ On Completed Debt Restructuring; Outlook Stable

-

Kohl’s Corp. Downgraded To ‘BB-‘ From ‘BB’ On Persistent Performance Pressures And Elevated Leverage; Outlook Negative

-

Fitch Downgrades Azul’s IDRs to ‘C’ on Announcement of Exchange Offer

-

Italy-Based Reno De Medici SpA Downgraded To ‘B-‘ On Weaker EBITDA Prospects And Cash Generation; Outlook Stable

-

Moody’s Ratings upgrades Hapag-Lloyd’s corporate family rating to Ba1 from Ba2; outlook stable

-

Fitch Affirms Hertz at ‘B-‘; Rating Watch Removed; Negative Outlook Assigned

-

Fitch Revises KIPCO’s Outlook to Negative; Affirms IDR at ‘BB-‘

Term of the Day: Flat Bond Trading

Flat trading in bond parlance refers to the trading of the bond without accrued interest. Bonds have a clean price in the market and a dirty price (the clean price plus accrued interest) which a buyer must pay to the seller for settlement of the bond. When a bond is trading ‘flat’, there is no scope of dispute between the bond buyer and seller over unpaid coupons as the bonds trade without accrued interest, i.e. trade flat. Bonds can trade flat due to a few reasons – when the settlement date is the same as coupon date, or if no interest is due, or when an issuer is in default, or if there are concerns over the issuer’s ability to pay coupons.

Following Sri Lanka’s debt restructuring completion, its new dollar bonds have come out, swapping its older notes which were ‘flat trading’ since its default in 2022.

Talking Heads

On ECB Must Stay Agile Cutting Rates in Uncertain World – ECB Chief Economist , Philip Lane

“In the current environment of elevated uncertainty, it is prudent to maintain agility on a meeting-by-meeting basis and not pre-commit to any particular rate path… In the event of downside shocks to the inflation outlook and/or to economic momentum, monetary easing can proceed more quickly… We are determined to ensure that inflation stabilizes sustainably at our 2% medium-term target”

On Macro a must-have for hedge fund investors betting on 2025 market swings

Craig Bergstrom, Corbin Capital

“Macro seems interesting now given a more turbulent political backdrop and what it means for both fiscal and monetary policy”

Jordan Brooks, Macro Strategies

“Inflation is now more balanced. From here, we think things are less certain across the board”

Top Gainers and Losers- 20-December-24*

Go back to Latest bond Market News

Related Posts: