This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 2Y Treasury Auction Sees Strong Demand

July 24, 2024

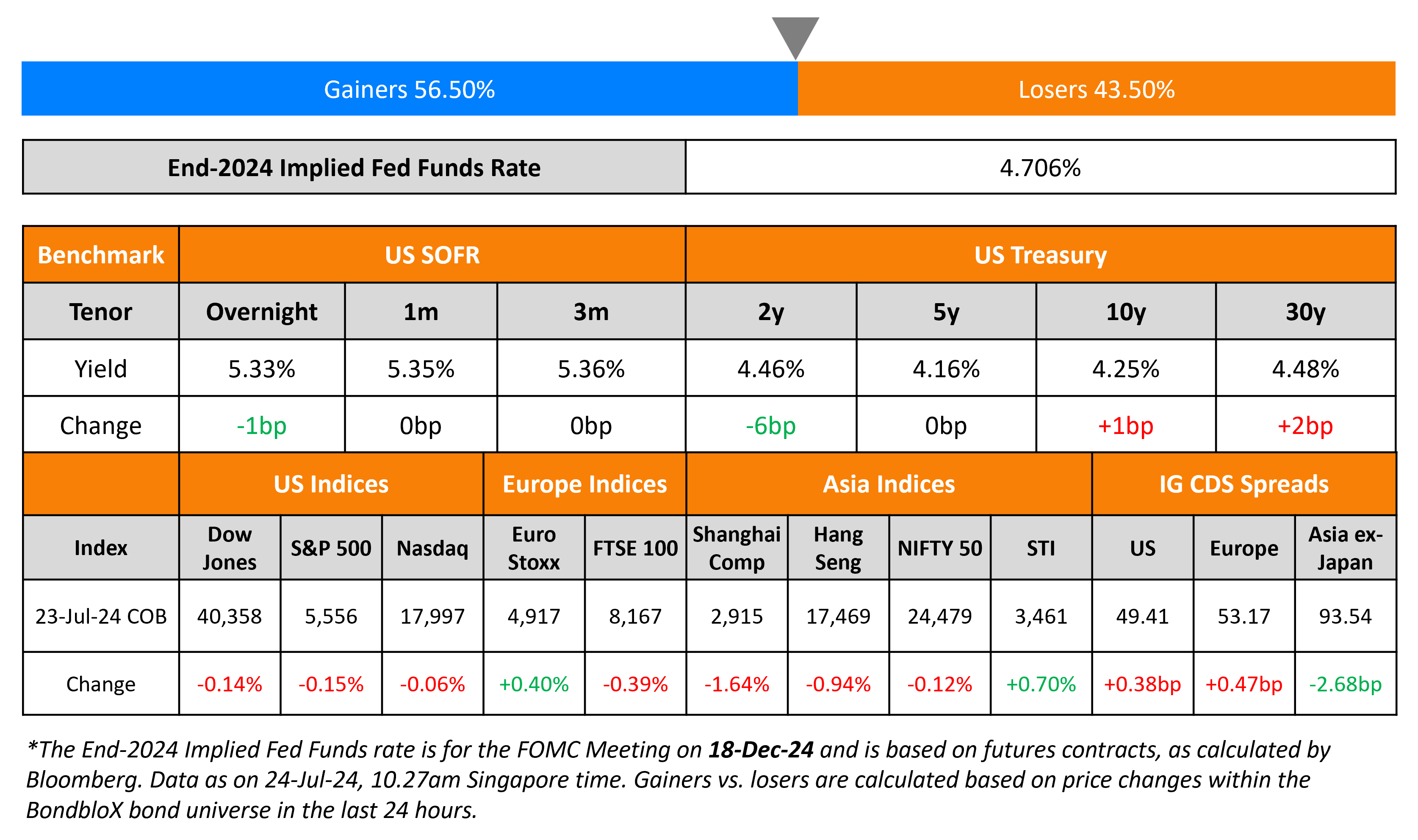

Treasury yields were stable with no major data points emerging from the US. The US 2Y Treasury auction saw strong demand yesterday, with a bid-to-cover ratio of 2.81x vs. 2.75x last month and an indirect take-up of 76.6% vs. the prior 65.6%. The notes stopped through by 2.3bp at a yield of 4.434% with dealers taking up only 9%. Analysts note that the results indicate robust investor confidence in US Treasuries. US equities saw the S&P and Nasdaq end slightly lower, by 0.2% and 0.1% respectively. US IG and HY CDS spreads widened by 0.4bp and 0.8bp respectively.

European equity markets had a mixed session. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.5bp and 1.2bp respectively. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were tighter by over 2.7bp.

New Bond Issues

Rating Changes

- Moody’s Ratings upgrades Istanbul and Izmir’s ratings to B1; maintains positive outlook

- Moody’s Ratings upgrades 17 Turkish banks, outlooks remain positive

- Moody’s Ratings upgrades EQM Midstream to Ba2; outlook stable

- Moody’s Ratings downgrades Accell’s CFR to Caa3; outlook negative

- Moody’s Ratings downgrades Intrum’s Corporate Family Rating to Caa2 and senior unsecured rating to Caa3, outlook changed to developing

Term of the Day

Auction Tail/Stop Through

Auction tails and stop throughs are metrics that can help in understanding whether the auction was well bid or not and is to be seen with the bid-cover ratios and other metrics. These are particularly observed in Treasury securities auctions. An auction tail occurs when the final yield of the bond auctioned is higher than the when-issued yield (WI yield) and can indicate that demand was not strong enough even though bid-cover might have been strong. On the other hand, a stop through occurs when the final yield is lower than the when-issued yield (WI yield) and can indicate that demand was particularly strong for that bond.

Talking Heads

On US High-Grade Bond Sales Post Biggest July in Six Years

Winifred Cisar, CreditSights

“There’s still strong funding conditions with IG spreads holding near the tight end of the recent range… supply follows demand and demand has been nothing short of stellar”

Collin Martin, fixed-income strategist at Charles Schwab & Co.

“I don’t see anybody holding off issuing if they need to because spreads are so low… So maybe we see kind of a slower end to the summer before it picks up a little bit in the fall”

On Most BOJ Watchers See July Rate Hike Risk With Bond-Buying Cut

Marcel Thieliant, Capital Economics

“The sharp weakening of the yen, the spreading of large pay hikes to small firms as well as the stickiness of underlying inflation all suggest that there’s a strong case for a rate hike”

Naomi Muguruma, Mitsubishi UFJ Morgan Stanley Securities

“Chances are slim for the rate hike and the bond cut plan coming in one go… It’s hard to imagine the BOJ suddenly taking bold action after it spent 1.5 months finalizing the bond plan “

On focus should be on policies – Richard Madigan, the JPMorgan Private Bank CIO

“There is a Republican Party trade and there is a Democratic Party trade. But it’s anchored on themes… very different policy positions, but both seem to lead on a road that is going to have rising Treasury issuance and fiscal deficits”

Top Gainers & Losers- 24-July-24*

Go back to Latest bond Market News

Related Posts: